- Federal Reserve Chair Powell’s much-anticipated Jackson Hole speech today may trigger market shifts.

- Market expectations align with a potential rate cut signal in September.

- Trump’s push for interest rate reductions adds to existing economic pressures.

Jerome Powell, Chair of the Federal Reserve, will speak on economic policy at the Kansas City Fed’s Jackson Hole Symposium today, drawing intense market focus amid policy uncertainty.

This address is crucial as it could influence the impending monetary policy direction, impacting cryptocurrency and financial markets already under scrutiny due to inflation and labor trends.

Powell’s Speech Sparks Crypto Volatility Amid Rate Speculations

Jerome Powell’s keynote address at the Jackson Hole symposium captures market attention as the Federal Reserve Chair outlines the economic outlook. The speech holds particular significance due to persistent pressures from President Donald Trump to implement interest rate cuts, with potential implications for Powell’s tenure, set to end in May 2026.

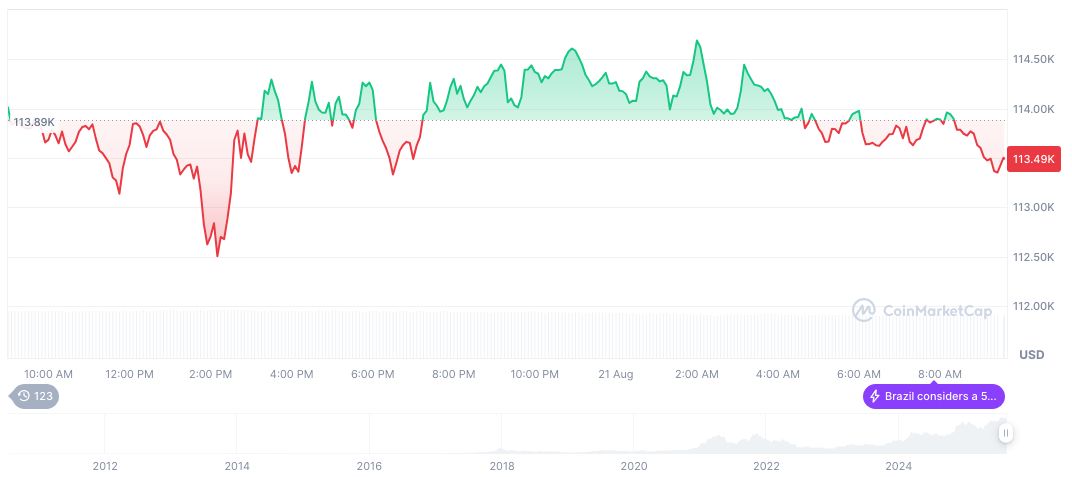

With high anticipation of a possible 25-basis-point rate cut in September, crypto markets are experiencing volatility, particularly among key assets such as Bitcoin and Ethereum. This follows trends where Powell’s past comments have markedly shifted crypto market dynamics, showcasing the dependency on central bank signals.

Arthur Hayes, Former CEO, BitMEX, “Jackson Hole is when crypto traders realize how tied we are to macro. Rate signals here move everything.”

Bitcoin Price Movement and Potential Regulatory Changes Post-Speech

Did you know? Historically, Powell’s speeches at Jackson Hole have prompted significant intraday volatility in the crypto markets, with double-digit swings witnessed in Bitcoin prices following his 2020 address.

Bitcoin (BTC) currently trades at $113,060.26, with a market cap of $2.25 trillion and a market dominance of 58.70%, according to CoinMarketCap as of August 22, 2025. BTC’s price dropped 0.56% over 24 hours and showed a 5.06% decrease in the past week.

Coincu’s research team suggests potential regulatory adjustments post-Powell’s address, considering rate cut implications on liquidity and institutional crypto adoption. The analysis underscores the importance of blockchain scalability and microeconomic adjustments required to manage these anticipated monetary policy outcomes effectively.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/powell-jackson-hole-crypto-impact/