- Fed Chair Powell announces potential easing of crypto bank regulations.

- Bitcoin price surges past $84,000 following the announcement.

- Stablecoins like USDT and USDC to see regulatory clarity.

Jerome Powell, Chairman of the Federal Reserve, announced potential easing of cryptocurrency-related bank regulations during a speech in Chicago on April 16, 2025. This move could facilitate greater institutional involvement in the digital asset sector.

The potential easing of regulations comes as a significant development for the crypto industry, promising greater integration between traditional banking and digital assets. Market reactions were swift, with Bitcoin, Ethereum, and Solana seeing price increases.

Fed’s Strategy to Integrate Crypto with Traditional Banking

Powell’s announcement of a “partial easing” of regulations aims to foster better integration between banks and cryptocurrency services, specifically targeting stablecoins. The speech emphasized the need for consumer protections while promoting innovations in fintech. Powell mentioned Congress’s efforts on a legal framework for stablecoins.

Regulatory shifts are expected to enhance institutional involvement in crypto markets, potentially easing bottlenecks related to crypto custody and stablecoin processing. Powell’s remarks highlighted a shift in the Fed’s approach, suggesting future regulations might offer clearer pathways for traditional banks entering this space.

“We will try to do it in a way that preserves the safety and soundness of the financial system.” – Jerome Powell, Chairman, Federal Reserve

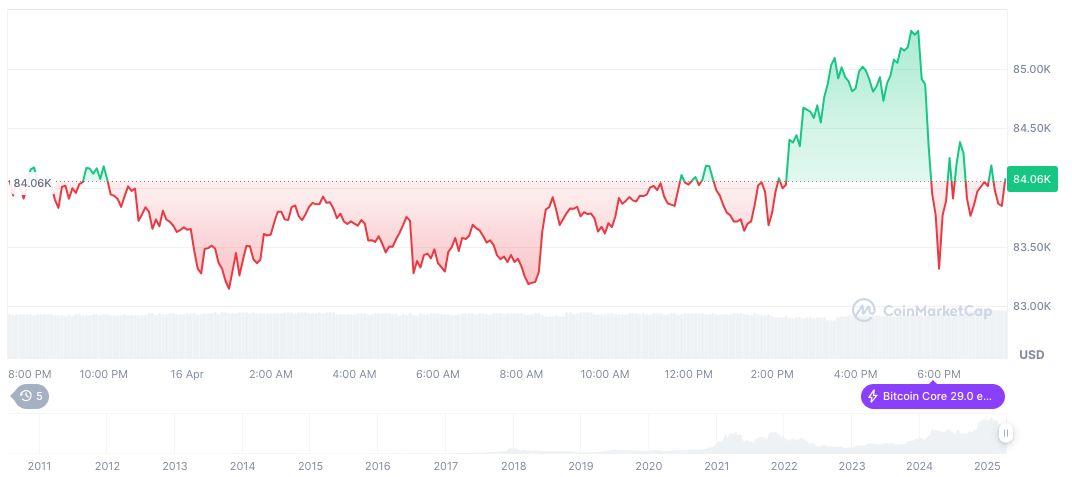

The market reacted positively, with Bitcoin surpassing $84,000 soon after Powell’s comments. Jerome Powell stressed the importance of maintaining financial stability while allowing progressive changes. Sid Powell, CEO of Maple Finance, remarked on the maturity of the crypto sector reflected in Powell’s speech.

Crypto Market Gains Momentum with Bitcoin Surging Past $84,000

Did you know? Historical shifts in U.S. regulatory stances have frequently led to short-term rallies in crypto markets, with significant impacts observed after major announcements like the 2022 White House Executive Order.

According to CoinMarketCap, Bitcoin (BTC) currently trades at $84,713.76 with a market cap of $1.68 trillion, reflecting a 1.80% rise in the past 24 hours. The circulating supply stands at 19,852,496 BTC, with a total potential supply of 21 million. Recent months have shown a 16.67% decline over 90 days.

Coincu research predicts that if Powell’s proposals lead to concrete regulatory frameworks, U.S. banks can expect enhanced engagement in crypto activities, potentially impacting liquidity and technology partnerships in the coming months. These adjustments could pave the way for increased adoption and a robust regulatory structure for the cryptocurrency business landscape.

Source: https://coincu.com/332680-powell-ease-crypto-bank-rules/