- OSL Group to acquire 90% of Evergreen Crest for $15M, securing Indonesian crypto license.

- The acquisition will use new shares, creating an indirect subsidiary.

- Compliant entry into the Indonesian market boosts OSL’s digital asset reach.

OSL Group (HK: 00863) plans to acquire 90% of Evergreen Crest Holdings Ltd for $15 million through new shares, aiming at Indonesia’s crypto market. OSL Group’s acquisition aims to secure a compliant pathway to Indonesia’s booming cryptocurrency scene.

By expanding into Indonesia, OSL aligns strategically with regional market growth. OSL’s CEO, Patrick Pan, emphasized the move’s innovative potential and industry positioning. “With a committed vision for OSL, we’re not just charting a new path in the digital asset domain – we will be pioneering it,” he said. Anticipated market effects include enhanced liquidity and heightened institutional interest.

OSL Group Embarks on $15M Indonesian Market Entry

OSL Group’s decision to acquire Evergreen Crest involves obtaining 90% of the company for $15 million. This strategic move focuses on acquiring a cryptocurrency and futures trading license in Indonesia. The intention is to utilize Evergreen Crest’s Indonesian license to expand into emerging sectors like real-world assets (RWA) and payment finance (PayFi). OSL aims to leverage its new subsidiary status in Indonesia to access the extensive local digital asset market. Upon completion, Evergreen Crest will become an indirect subsidiary, further integrating into OSL’s operations.

Indonesia’s market stands to gain from increased access to licensed digital trading platforms. OSL’s new position could bolster Indonesia’s economic stature in digital finance, potentially attracting increased foreign investment and interest in its regulatory frameworks.

OSL CEO Patrick Pan remarked on the industry-leading aspirations, underlining the company’s ongoing commitment to innovation. The local market has reacted cautiously, with stakeholders observing OSL’s compliance-focused approach.

Historical Context, Price Data, and Expert Analysis

Did you know? The acquisition reflects a trend where crypto firms pursue Southeast Asian markets via compliant channels. Indonesia, with its digital growth potential, ranks as a prime target for such strategic market entries.

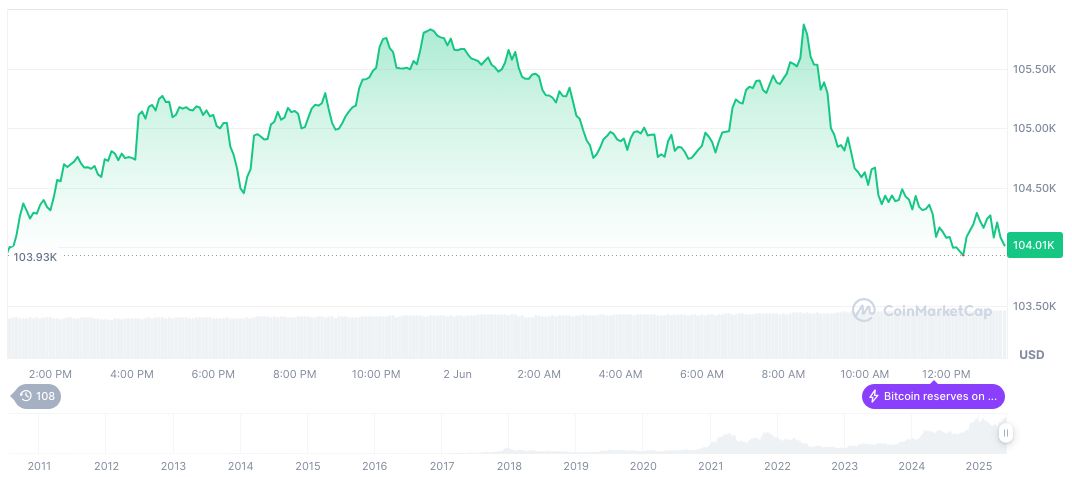

Bitcoin (BTC), trading at $105,066.67 with a market cap over $2.08 trillion, faces a 0.28% decline in 24 hours, according to CoinMarketCap. BTC’s 24-hour trading volume reached $47.63 billion, while its market dominance stands at 63.19%. Despite short-term price dips, BTC has shown notable gains over longer durations, including a 24.38% rise in 60 days and a 19.60% increase in 90 days.

Coincu analysts foresee OSL’s move as a stepping stone for other digital asset firms targeting compliant expansion in regulated environments. The focus on local regulatory partnerships reaffirms a long-term commitment to sustainable market integration.

Source: https://coincu.com/341362-osl-acquires-indonesia-crypto-license/