- Senate passes Trump-backed bill with deep tax cuts amid sharp bipartisan division.

- Crypto tax relief was excluded, leaving miners and stakers in regulatory uncertainty.

In a deeply divided Senate, Republicans managed to push through a controversial budget reconciliation bill, dubbed the “One Big Beautiful Bill Act”, with Vice President JD Vance casting the decisive vote in a 50-50 deadlock.

‘One Big Beautiful Bill’ gets a green light

The legislation sparked fierce debate across party lines.

It drew criticism over proposed healthcare cuts, lack of safeguards around artificial intelligence, and tax policies widely seen as favoring the wealthy.

However, despite widespread calls for amendments, including from within the GOP, the bill passed after a 24-hour marathon session last night.

The sweeping budget reconciliation bill now heads to the House of Representatives, where internal Republican friction would complicate its path to final approval.

What’s in the bill?

Backed by Donald Trump, who hopes to sign it into law by the 4th July Independence Day holiday, the bill seeks to extend Trump’s 2017 tax cuts.

It will introduce new exemptions for tipped and overtime income, and significantly boost funding for military operations and immigration enforcement.

At the same time, it outlines steep cuts, nearly $930 billion, from key social safety net programs like Medicaid and SNAP, while dismantling many of President Biden’s hallmark green energy initiatives.

The bill also includes a controversial $5 trillion increase in the national debt ceiling, intensifying GOP infighting over how to manage the ballooning $36.2 trillion federal debt.

With the risk of default looming, the bill has become a flashpoint in debates over economic priorities, social welfare, and climate policy.

Crypto miners see no reprieve

Even with its extensive policy changes, the bill failed to acknowledge the growing challenges within the cryptocurrency sector, particularly those affecting miners.

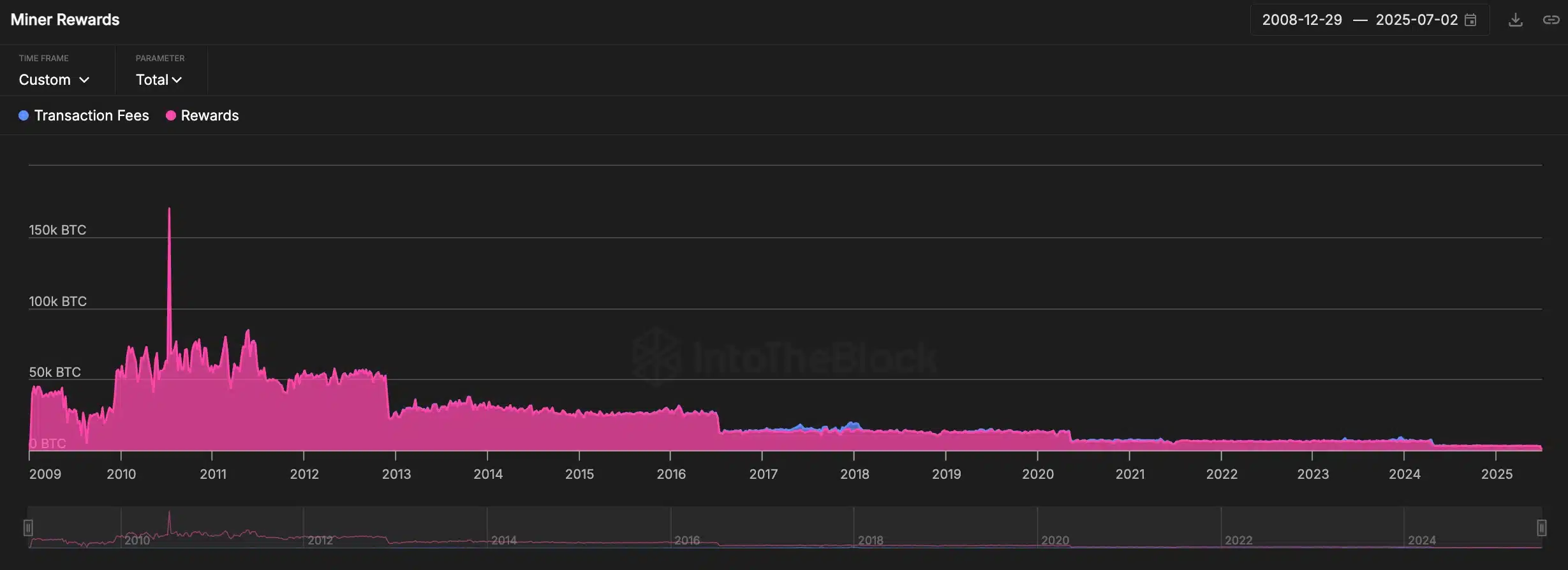

As block rewards for Bitcoin and other cryptocurrencies continue to decline over time due to halving events, many miners are already operating on thin margins.

Source: IntoTheBlock

Thus, the absence of clear tax relief or regulatory guidance in this legislation adds to the burden faced by miners, potentially making mining operations in the U.S. less sustainable.

Senator Cynthia Lummis was vocal in championing for less taxes for miners, advocating,

“For years, miners and stakers have been taxed TWICE. Once when they receive block rewards, and again when they sell it.”

However, such a reform was not noted in the final bill.

Without supportive policies, the industry may struggle to remain competitive, weakening America’s position in the global digital asset landscape.

The way forward

While Republicans were able to get the bill through the Senate, even staunch Trump supporters like Marjorie Taylor Greene are voicing concerns over the proposed policy changes.

Notably, former DOGE head, Elon Musk has even announced plans to create a new political party and oppose it, asserting,

“Our country needs an alternative to the Democrat-Republican uniparty so that the people actually have a VOICE.”

Thus, as crypto advocates weigh new strategies amid political rifts and mounting industry challenges, the way forward remains uncertain for now.

Source: https://ambcrypto.com/one-big-beautiful-bill-passed-but-is-crypto-being-pushed-to-the-side/