- The Nasdaq Composite fell over 2%; largest drop since April.

- No direct crypto market data available from the event.

- Potential spillover into cryptocurrency remains undetermined.

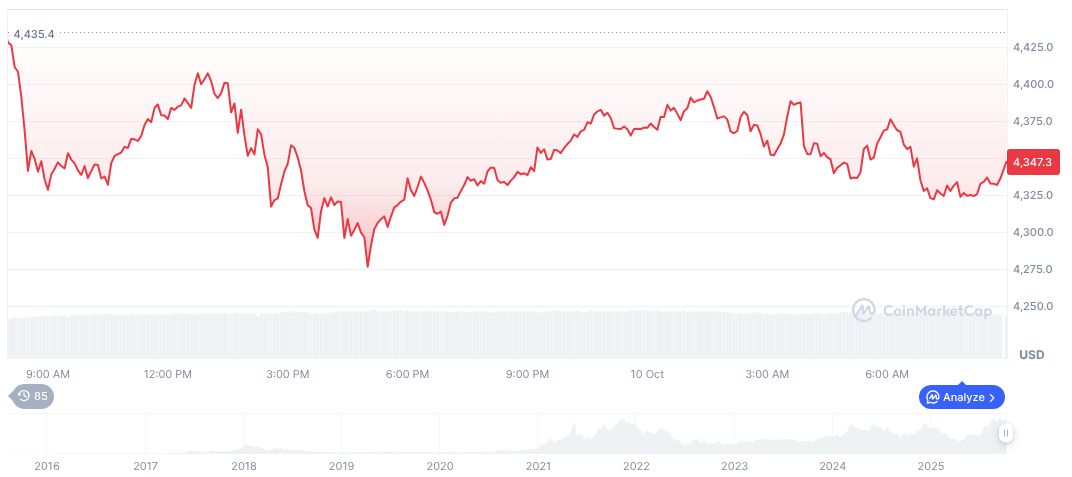

On October 10, US stocks witnessed significant losses, with the Nasdaq Composite Index dropping over 2% and the Nasdaq 100 Index registering its largest decline since April.

This downturn raises concerns about potential spillover into cryptocurrency markets, although no immediate on-chain data or leadership reactions were observed from notable industry figures or regulators.

Nasdaq Plummets Over 2% Amid Tech and Semiconductor Losses

The Nasdaq Composite’s decline exceeded 2% on October 10, driven by losses in tech and semiconductor sectors. Analyzing market dynamics shows widespread concern over potential recessionary triggers and inflationary pressures. Historically, such traditional equity downturns have correlated with heightened volatility across financial markets, necessitating cautious investor sentiment.

Immediate market conditions are turbulent, with analysts suggesting the potential for cryptocurrency markets to react similarly to past events. However, data on specific crypto asset shifts is scarce. No visible responses from leading industry figures or institutions surfaced, leaving market participants awaiting further clarity.

Market reactions remain speculative as specific statements from government or industry leaders were absent. Observers expect possible alignment of cryptocurrency movements with historical patterns of risk aversion seen in such equity declines. Investors and analysts are closely monitoring both stock and digital asset markets for correlated impacts.

Crypto Markets on Edge: Lack of Data Fuels Speculation

Did you know? The Nasdaq Composite’s October 2025 fall continues a trend seen during the 2020 pandemic’s onset, where similar equity declines coincided with a temporary drop in Bitcoin prices before crypto resurged dramatically.

Ethereum’s current metrics indicate a price of $4,008.70 with a market cap of $483.86 billion and dominance of 12.23%, according to CoinMarketCap. The 24-hour trading volume saw an 11.59% change, recording $51.22 billion. Ethereum’s price faced a notable decrease of 7.46% in the past day, further embedding a downward trend over the last week at -11.48%. Despite short-term declines, Ethereum still marks a significant 90-day growth of 36.30%. The circulating supply stands at 120.70 million ETH.

Research insights suggest potential implications for both cryptocurrency and traditional markets. The lack of direct data linking the Nasdaq’s decline with Ethereum’s market movement indicates a decoupling not immediately noticeable. Investors are encouraged to track ongoing sentiments and regulatory developments to gauge technological adaptation post-market fluctuations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/nasdaq-decline-crypto-impact/