- U.S. stocks saw mixed reactions; crypto-related shares, slight gains.

- Crypto stocks include COIN and MSTR; modest rises.

- Market sentiment reflects broader economic conditions and crypto trends.

On September 3, 2025, U.S. stock indices showed mixed results as crypto-related stocks experienced modest rallies, reflecting broader market dynamics.

Market reactions highlight investors’ cautious sentiment amid September volatility, notably impacting Bitcoin and Ethereum prices, correlating with broader equity trends.

Stock and Crypto Index Fluctuations on September 3

On September 3, major U.S. stock indices experienced varied performances. While the Dow Jones registered a slight decline, both the S&P 500 and Nasdaq showed gains. A similar pattern was observed in crypto-related stocks, such as Coinbase (COIN), recording a rise of 0.86%. Yet, no official statements from key executives like Coinbase CEO Brian Armstrong specifically addressed this session.

The modest gains in crypto stocks align with the current mixed sentiment in broader equity markets. Cryptocurrency giants Coinbase, MicroStrategy, and Robinhood all experienced marginal stock moves. Market activity remains predominantly stock-focused, with limited insight into any new institutional allocations affecting these entities.

“Coinbase will list support for Awe (AWE) on the Base network. Do not send this asset via other networks, or your funds may be lost.” — Brian Armstrong, CEO, Coinbase

Community and expert reactions to the changes were minimal. Key figures in the cryptocurrency space—such as Arthur Hayes and Vitalik Buterin—did not offer public commentary on the day’s movements, as reflected in their official platforms. Regulatory agencies echoed no statements directly tied to these stock actions.

Historical Trends Indicate September Market Volatility

Did you know? Historically, September has been marked by heightened volatility for BTC. This pattern often corresponds with noticeable equity market fluctuations, typically resulting in cautious trading strategies from investors.

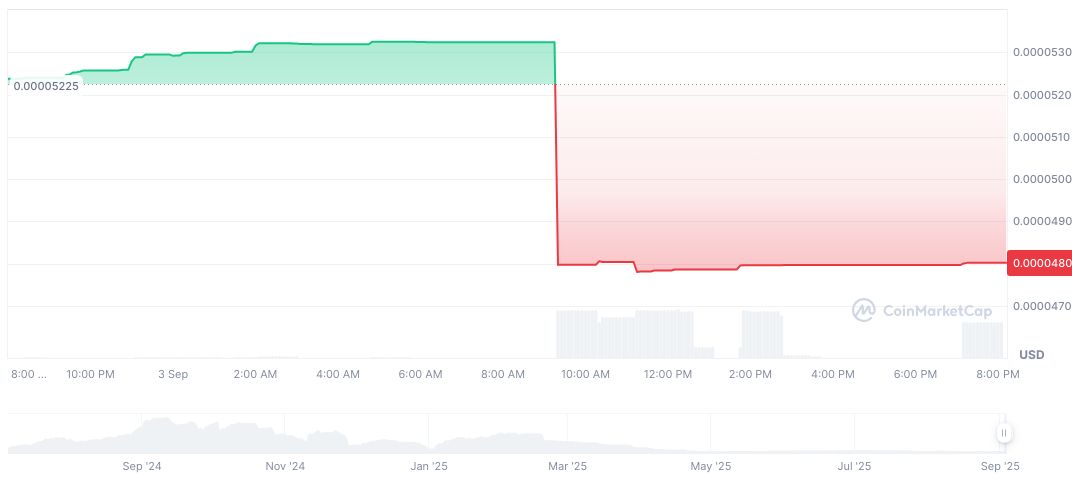

This trading period reflects patterns within both equity and crypto markets. 8-Bit Coin currently trades at $0.00, with a modest 24-hour trading volume surge of 4957.45%, as analyzed by CoinMarketCap. Over the past 90 days, it has seen a decrease of 19.73%, highlighting prevailing market volatility.

The Coincu research team predicts that ongoing regulatory scrutiny may affect the long-term performance of these stocks. Historical data signals increased volatility in September, heavily impacting investor sentiment across markets. Both institutional and retail traders remain observant of further regulatory developments impacting the crypto sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/mixed-us-stocks-crypto-gains/