- Shift in U.S. non-farm employment benchmarks draws crypto market interest.

- Bitcoin transactions and regulatory discussions lead market focus.

- SEC discusses clearer regulations for crypto entrepreneurs.

U.S. non-farm employment data for 2025 shows an unexpected drop of -910,000 against an expected -700,000, impacting cryptocurrency and financial markets, as reported by ChainCatcher.

This stark deviation may lead to volatility in Bitcoin and other crypto assets amid ongoing regulatory and market changes.

Major Shift in U.S. Non-Farm Employment Sparks Crypto Market Discussions

The U.S. 2025 non-farm employment benchmark reported a change of -910,000 against an expectation of -700,000. ChainCatcher highlighted this discrepancy based on industry reports. Advanced planning stages emerged, with on-chain actions like Cumberland’s transfer of 473 BTC to Coinbase Institutional, signaling potential market adjustments.

Market shifts could result from these employment figures, introducing uncertainty and volatility within both traditional and crypto sectors. Analysts emphasize on-chain liquidity changes, as seen with Cumberland’s transfer, reflecting preparation for potential economic impacts.

Paul S. Atkins, Chairman, SEC, “We will ensure that entrepreneurs can raise funds on-chain, and the U.S. will become the world’s cryptocurrency capital. Most crypto tokens are not securities, and we will clearly define these boundaries. We must ensure that entrepreneurs can raise funds on-chain without facing endless legal uncertainty. We must also allow ‘super app’ trading platforms to innovate, increasing choices for market participants. Platforms should be able to offer trading, lending, and staking services under a single regulatory framework. Investors, advisors, and broker-dealers should also have the freedom to choose among various custody solutions.”

Bitcoin Trading Volume Climbs Amid Economic Indicators

Did you know? Non-farm payroll data has often influenced crypto prices, with historical shifts leading to increased Bitcoin volatility and liquidity adaptation amid macroeconomic events.

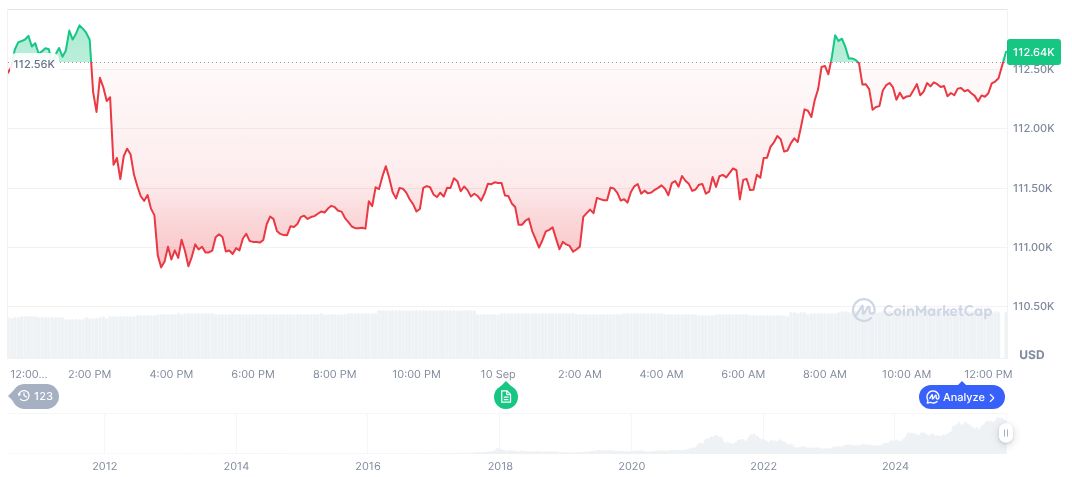

As of the latest data from CoinMarketCap, Bitcoin (BTC) trades at $113,645.75 with a market cap of $2.26 trillion. A 24-hour trading volume report of $53.39 billion marks a 26.04% change, revealing heightened activity. The price demonstrates a 0.88% and 2.06% gain over the last 24 hours and 7 days, respectively, despite drops of 4.91% and 3.25% over 30 and 60 days.

Coincu’s research suggests this employment benchmark shift may prompt broader crypto adoption and technological integration, catalyzed by regulatory adaptations. Historically, such economic indicators prompt shifts towards stablecoin liquidity and position adjustments within on-chain finance platforms, reflecting market resilience and adaptation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/us-non-farm-crypto-impact/