- Spencer Hallarn anticipates a bullish year-end crypto market due to low leverage.

- Skepticism remains after prior liquidation events.

- Market structure favors a potential Santa rally in major cryptos.

Spencer Hallarn, Global Head of OTC at GSR, predicts a favorable year-end for the crypto market amid low leverage, hinting at a potential ‘Santa rally.’

The market outlook seems optimistic as low leverage suggests reduced speculative activity, potentially setting the stage for a rise in cryptocurrency prices, particularly for Bitcoin and Ethereum.

Hallarn Predicts Santa Rally with Market Stabilization

Spencer Hallarn’s analysis suggests optimism as the crypto market enters the year-end phase. Lower leverage levels and a base of skepticism are seen as catalysts for positive market change. With previous long positions liquidated, market participants are cautiously optimistic about reversal trends.

The reduction in leverage presents opportunities for market stabilization. Hallarn mentions that a “favorable environment” exists for potential gains. This setup could lead to a Santa rally, as positive conditions align with historical year-end patterns.

“Most long positions have been liquidated, creating a base of skepticism. Perpetual funding rates are very low or negative, which suggests that there isn’t much leverage in the market. This makes the setup pretty bullish for a Santa rally and that the end of the year is looking positive for further upside.” — Spencer Hallarn, Global Head of OTC, GSR

Historical Insights: Leverage Reduction and Price Patterns

Did you know? Despite previous liquidations, historically, the crypto market often sees an uptick toward year-end, termed a “Santa rally,” where bullish sentiment reshapes investment strategies.

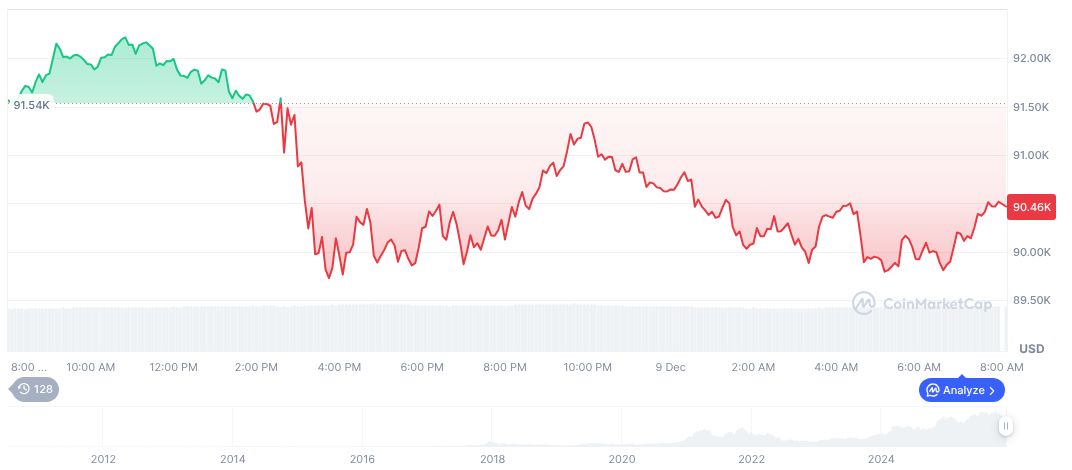

Bitcoin (BTC) currently trades at $92,585.14, setting its market cap at $1,848,000,815,512 with a 58.48% dominance. Key metrics from CoinMarketCap reveal a 15.68% trading volume change in 24 hours, reflecting market dynamics. Recent 24-hour price movement saw a 2.95% rise, although BTC maintains a declining trend over 90 days, dropping by 18.90%.

Coincu research team notes that current leverage conditions align with previous recovery phases. Historically, crypto bulls rally during these times, spurred by positive market structures. If trends align, price stabilization strategies could reinstate confidence in future transactions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-market-santa-rally-hopes/