- The KOSPI and Nikkei indices fell over 3% on November 18, 2025.

- Technology and chip stocks led the decline in Asian markets.

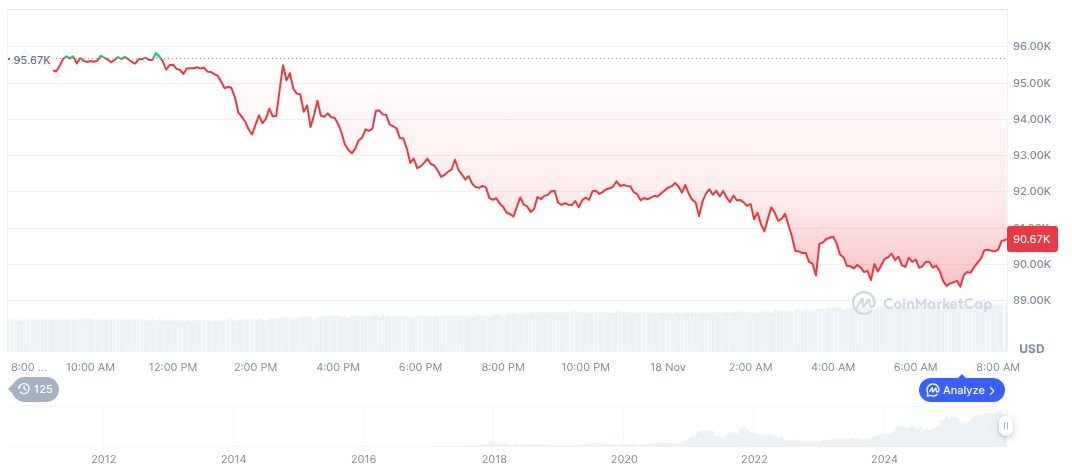

- Cryptocurrency markets experienced volatility due to institutional risk-off sentiment.

On November 18, 2025, South Korea’s KOSPI and Japan’s Nikkei 225 indices each dropped over 3%, driven by declines in technology and chip stocks.

This market activity suggests institutional deleveraging, impacting risk assets like cryptocurrencies, especially BTC and ETH, reflecting increased volatility in Asian-linked digital assets.

KOSPI and Nikkei Drop Over 3% from Tech Sell-Off

On November 18, 2025, the KOSPI and Nikkei indices in South Korea and Japan fell by over 3%, led by technology and chip stocks. Major chip manufacturers, like Tokyo Electron, contributed significantly to the downturn. The sell-off primarily involved institutional investors, with no direct statements from regulatory entities or key industry leaders.

The decline demonstrates a shift in investor sentiment, causing reduced allocations to risk assets, including cryptocurrencies. This emphasizes the broader impact of traditional market dynamics on the crypto sector. The immediate implications point to potential short-term outflows from regional stablecoins and risk assets. For investors seeking to navigate these shifts, platforms like Explore Crypto Markets on Phemex can provide valuable insights into current market trends.

Market reactions included increased caution in investor sentiment, though without widespread panic. No official responses from major exchange leaders or regulatory authorities were observed. The absence of emergency measures or public addresses highlights reliance on existing market mechanisms to counter such fluctuations. According to a source from Phemex, “This market contraction mirrors broader institutional risk-off sentiments.”

Crypto Volatility Linked to Institutional Risk-Off Strategy

Did you know? The 2025 crash follows similar patterns seen in past Asian market crises, like China’s sell-off in 2021, which also pressured cryptocurrencies like Bitcoin and Ethereum to temporarily dip.

As per CoinMarketCap data, Bitcoin (BTC) currently trades at $92,787.47, with a market cap of approximately 1851150805960. Recent changes show a 0.89% rise in the last 24 hours, offset by a 9.69% drop over the past week. Market dominance stands at 58.30%, with its maximum supply still capped at 21 million.

The Coincu research team notes shifts in institutional risk appetite, potentially affecting crypto allocations. Historical parallels with previous Asian market downturns suggest that volatility is likely to persist in the near term, pressing investors to monitor such events closely. If you are considering trading in this volatile environment, explore Trade Bitcoin Futures (BTC-USDT) on Phemex for potential opportunities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/asia-market-impact-crypto/