- Kazakhstan’s central bank plans to invest in crypto assets, seeking higher returns.

- Strategy inspired by Norway and Middle Eastern funds.

- No detailed allocation figures or timelines given yet.

Kazakhstan’s central bank, led by Governor Timur Suleimenov, announced plans on July 14, 2025, to invest national reserves in cryptocurrency. The move aligns Kazakhstan with global practices in seeking higher investment returns through crypto assets. This exploration into crypto investments is part of a broader strategy to emulate successful sovereign fund models in Norway, the U.S., and the Middle East.

Kazakhstan is set to invest its gold and foreign exchange reserves in crypto assets, employing aggressive strategies to enhance investment returns. Following the lead of countries like Norway and the Middle East, Kazakhstan aims to integrate crypto into its national financial strategy. The initiative is spearheaded by Timur Suleimenov, who is examining practices from other sovereign funds that involve small crypto allocations. The potential investments may include Bitcoin (BTC), Ethereum (ETH), ETFs, and equities in crypto-related firms. However, no official allocation figures or investment timelines have been released by the government or central bank officials. Kazakhstan is committed to following global best practices, intending for regulated and cautious asset management rather than large-scale direct crypto holdings. This approach prioritizes risk management over market disruption.

Historical Context, Price Data, and Expert Insights

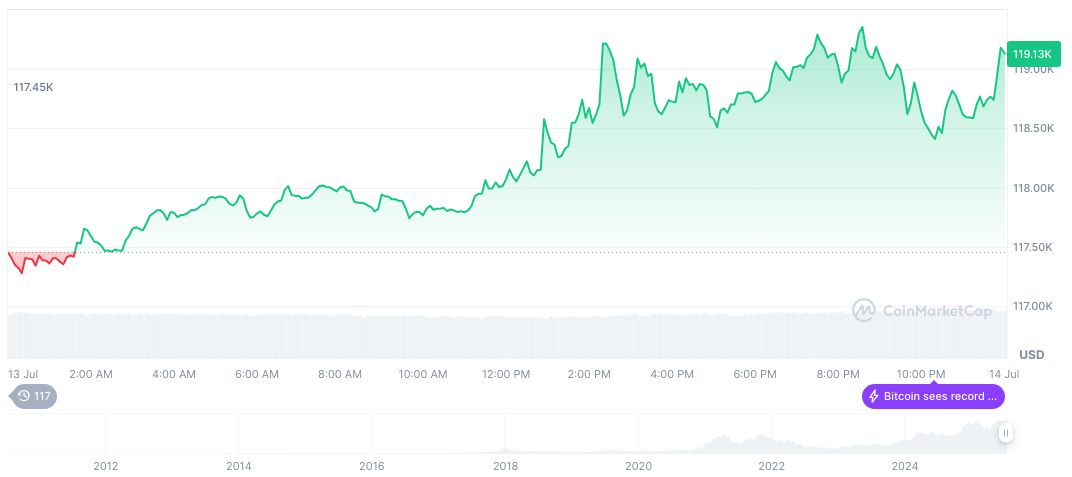

As of July 14, 2025, Bitcoin (BTC) is priced at $120,746.44 with a market cap of $2.40 trillion, dominating 63.50% of the market, as detailed by CoinMarketCap. Over 24 hours, BTC’s trading volume surged 302.97% to $173.76 billion with 1.58% price growth. The Coincu research attributes potential technological advancements and regulatory adaptability as key factors influencing Kazakhstan’s plan. By integrating crypto, Kazakhstan might enhance its financial landscape while diversifying its reserves, though the approach necessitates cautious legislative implementation.

Such assets can yield high returns, but they’re also highly volatile, said Timur Suleimenov, emphasizing the complexity and need for caution in such ventures.

“Such assets can yield high returns, but they’re also highly volatile,” said Timur Suleimenov, emphasizing the complexity and need for caution in such ventures.

Market Data and Insights

Did you know? The initiative mirrors El Salvador’s bolder national Bitcoin reserve strategy but opts for a more conservative risk-managed approach, aligning with some Middle Eastern SWFs.

As of July 14, 2025, Bitcoin (BTC) is priced at $120,746.44 with a market cap of $2.40 trillion, dominating 63.50% of the market, as detailed by CoinMarketCap.

The initiative is spearheaded by Timur Suleimenov, who is examining practices from other sovereign funds that involve small crypto allocations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348642-kazakhstan-invests-crypto-reserves/