- The market saw significant declines in the past week.

- There is still time in the year for the market to push for one last rally.

The Santa Claus rally, a seasonal market trend where prices historically rise in the last week of December, has become a hot topic in the crypto world.

As we approach the end of 2024, crypto investors are questioning whether this rally has already fizzled out or if it still has the potential to drive markets higher.

Current market overview

Bitcoin [BTC], the market leader, is currently trading at approximately $95,00, reflecting a less than 1% increase in the past 24 hours.

Ethereum [ETH] follows suit with a less than 1% increase, priced around $3,291. Solana [SOL] and Binance Coin [BNB] are also showing slight gains, with the overall crypto market capitalization hovering near $3.5 trillion.

Despite the minor pullback, trading volumes remain strong. Bitcoin’s dominance, now at 55.08%, underscores its pivotal role during this seasonal period.

Source: Coinglass

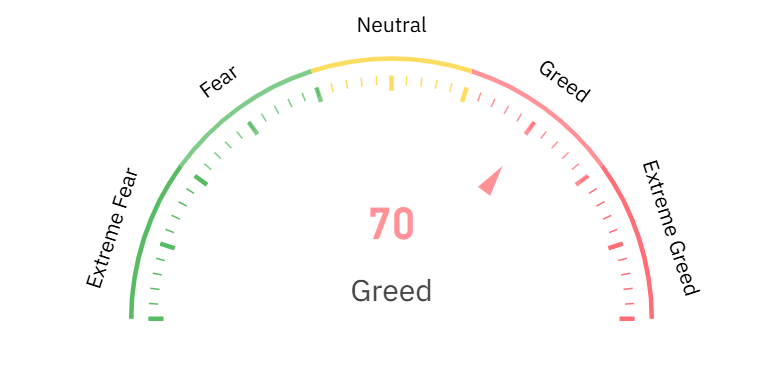

Furthermore, the Fear & Greed Index, currently at 70 (Greed), suggests market sentiment remains bullish, albeit cautiously.

Has the Santa Claus rally lost steam?

The Santa Claus rally has historically been linked to bullish sentiment, tax-driven buying, and increased retail participation. However, recent events have introduced volatility, including the expiration of over $2.6 billion in Bitcoin and Ethereum options.

This options expiry often creates price swings as traders adjust their positions.

On-chain data reveals mixed signals. Whale activity has slowed, with fewer large transactions recorded, while retail investors continue accumulating.

Meanwhile, technical indicators like the Relative Strength Index (RSI) for BTC and ETH hover near neutral levels, suggesting a lack of clear directional momentum.

What this means for investors

The rally’s performance in the coming days will largely depend on key resistance levels. Bitcoin faces a psychological barrier at $100,000, while Ethereum needs to reclaim $3,500 to regain bullish momentum.

Bollinger Bands indicate reduced volatility, but any breakout could be significant.

For those navigating the current market, risk management is crucial. Investors should watch for momentum shifts, particularly in the MACD and RSI, while monitoring macroeconomic trends and regulatory updates that may impact sentiment.

While the Santa Claus rally hasn’t delivered explosive gains, its potential isn’t entirely diminished. The next week will be pivotal as the market transitions into 2025.

Staying informed and adapting to market conditions will be key for crypto investors looking to capitalize on year-end opportunities.

Source: https://ambcrypto.com/is-the-santa-claus-rally-already-over-heres-what-it-means-for-your-crypto-investments/