- Franklin Templeton predicts institutional crypto adoption surge by 2025.

- Stablecoins drive innovation in payment systems.

- GENIUS Act boosts institutional confidence.

Christopher Jensen of Franklin Templeton revealed in a Binance interview that institutional crypto adoption is accelerating, projecting significant strides by 2025 driven by stablecoin adoption and regulatory clarity.

This shift could reshape financial landscapes, integrating traditional finance with blockchain, marked by rising institutional interest in stablecoins and tokenized assets.

Stablecoins Redefining Payment Systems by 2025

Jensen’s commentary emphasizes that stablecoins are pivotal, becoming the primary currency for tokenized assets. Stablecoins’ large-scale implementation is reconfiguring payment systems, signaling a broader institutional entry into crypto. With 2025 anticipated as a turning point, traditional finance integration into blockchain becomes more probable. Regulatory improvements, notably the GENIUS Act, further solidify institutional confidence and encourage crypto engagement.

According to Jensen, the shift towards stablecoins indicates wider changes. Tokenization is reshaping financial landscapes, with future investors’ portfolios potentially including diverse assets like U.S. Treasuries and NFTs. Institutional entities now appear less hesitant, indicating a progression to a structural adoption phase.

“Institutions are actually coming now … Stablecoins were the first ‘killer app’ in crypto, not just for payments but as a base currency for tokenized assets. The regulatory climate—particularly the GENIUS Act—is a catalyst for institutional confidence.” — Christopher Jensen, Head of Digital Asset Research, Franklin Templeton

Stablecoin Growth Fuels Institutional Crypto Shift

Did you know? Stablecoins like USDC have continuously maintained price stability, paralleling the evolution of Eurodollar markets in traditional finance, thereby providing a foundation for ongoing financial innovations.

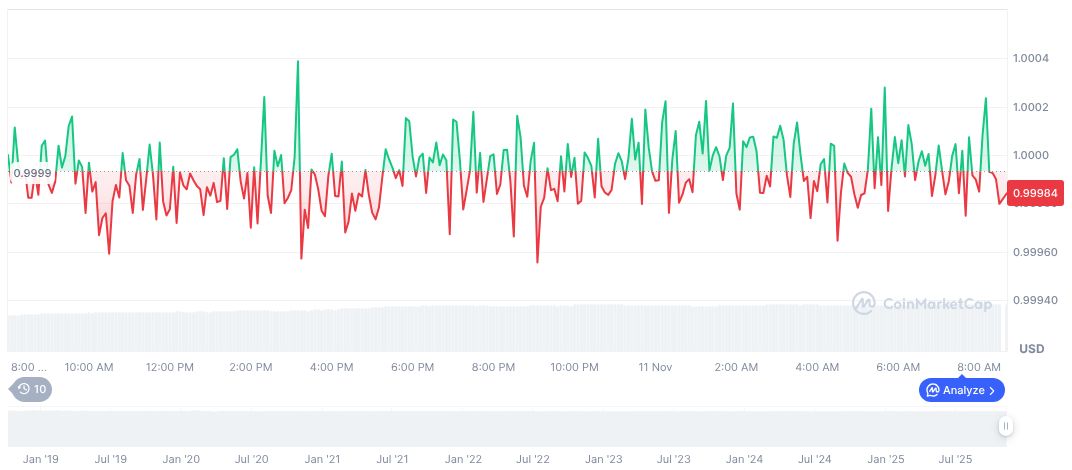

According to CoinMarketCap data, USDC currently holds a market cap of $76.10 billion, maintaining a consistent price of $1.00. The stablecoin has a 24-hour trading volume of $16.15 billion, a 24.98% increase, with its market dominance at 2.15%. The data indicates minimal price fluctuation, typical of USDC’s stability standards.

Coincu research posits that regulatory clarity from acts like GENIUS could lead to widespread stablecoin adoption as secure transactional units. The emergence of diversified on-chain portfolios—banking on tokenized assets—might redefine asset management paradigms, allowing further integration of traditional finance systems with blockchain innovations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/institutional-crypto-adoption-2025/