Indonesia’s financial services watchdog has published a list of 29 digital asset exchanges licensed to operate in the country, with local platforms dominating, while renowned global exchanges missed out.

The list will serve as an official public reference, enabling investors to verify the status of any trading platform, thereby enhancing consumer protection and safeguarding the integrity of the broader financial sector, according to the Financial Services Authority, locally known as the Otoritas Jasa Keuangan (OJK).

The list includes Indodax, one of the country’s largest exchanges, as well as smaller players such as Bitwewe, Ajaib, Coinvest, Naga Exchange, Reku, and Pluang. Also on the list is Tokocrypto, a local exchange acquired by Binance in 2022; following the acquisition, Binance laid off nearly 60% of Tokocrypto’s workforce, sparking public outrage in the Indonesian digital currency circles.

The only notable global platforms on the list are South Korean giant Upbit and Luno, a London-based exchange with a focus on Africa and Asia.

In addition to the 29 exchanges, OJK also listed four market infrastructure institutions licensed to offer digital asset services.

“Companies that are not included in this list are not licensed or supervised crypto asset trading entities or platforms,” commented OJK’s head of financial inclusion, Ismail Riyadi.

He further urged investors to work with the government to foster the growth of a safe and vibrant digital currency market, which “can be done by transacting only through legal entities and actively reporting any indications of illegal activities that harm the public.”

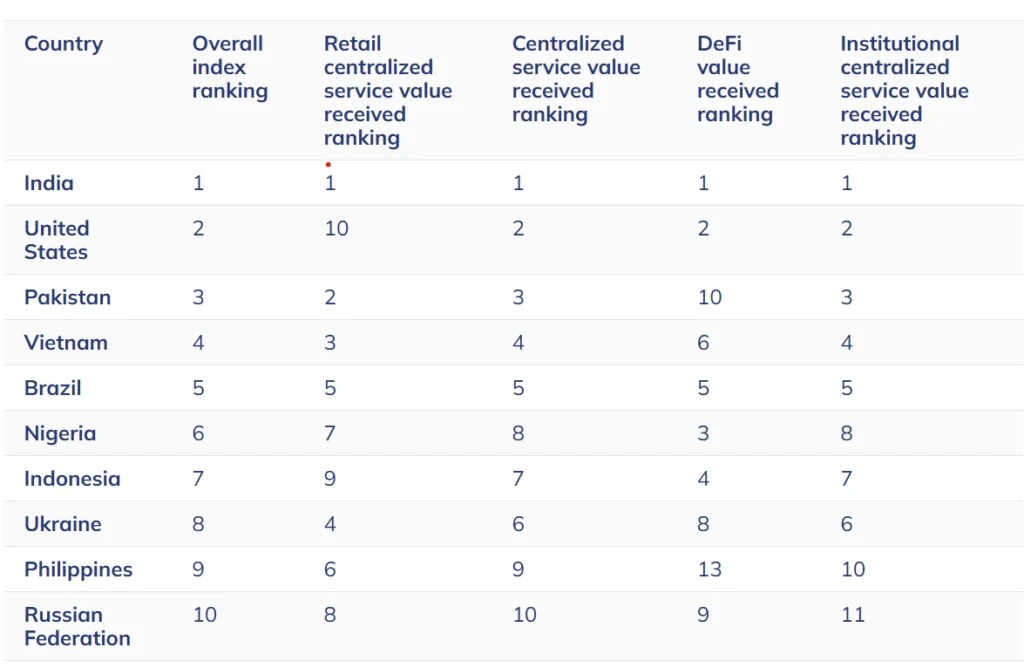

Indonesia is one of the world’s most active digital asset markets, with some studies reporting over 20 million digital currency holders. According to Chainalysis, it was the 7th largest market last year, ranking fourth in terms of DeFi value received.

This rapidly growing market is attracting some industry heavyweights. Last month, Robinhood (NASDAQ: HOOD) completed the acquisition of PT Pedagang Aset Kripto, a licensed digital asset trader, marking its entry into what it described as a “compelling market for equities and crypto trading.”

“Indonesia represents a fast-growing market for trading, making it an exciting place to further Robinhood’s mission to democratize finance for all,” commented Robinhood’s Head of Asia Patrick Chan.

OSL Group, one of the few exchanges licensed in Hong Kong, also ventured into Indonesia last year with the acquisition of Koinsayang, a licensed exchange.

“Indonesia offers both scale and structure, and has a huge potential to integrate TradFi and Web3 and access regulated crypto payments,” commented OSL’s CFO Ivan Wong.

Watch: Bitcoin’s Ultimate Use Case Explained

Source: https://coingeek.com/indonesia-lists-29-licensed-crypto-exchanges/