- Major cryptocurrency thefts affect individual investors; losses up to $6.5 million.

- Incidents involve wallet compromises and social engineering methods.

- Focus shifts from contracts to centralized services and personal wallets.

Individual cryptocurrency investors have encountered multiple significant thefts, including a $6.5 million loss, during the past week.

These thefts underscore rising cybersecurity challenges facing digital asset holders, emphasizing vulnerability in personal wallet security.

$6.5 Million Crypto Heist Sparks Security Concerns

According to Yu Xian, Slow Fog’s founder, cryptocurrency investors faced large-scale theft incidents, with significant cases exceeding $1 million. The highest single loss reached $6.5 million. These developments highlight the vulnerability of individual investors to cyberattacks, emphasizing a shift in targeting methods from institutional treasuries to personal wallets. Most incidents involved phishing and social engineering, marking an increase in sophisticated tactics targeting private keys.

The impact remains significant, affecting market sentiment as investors become more cautious about security protocols. Despite no assets being specifically named, experts highlight the usual involvement of major cryptocurrencies like BTC and ETH, considering their prevalence in personal portfolios. The market response included increased attention to wallet security and private key management, as reflected in recent communications from industry experts like:

“In the past week, there have been several significant thefts impacting individual cryptocurrency investors, including losses exceeding $1 million, $2 million, and a single incident with a loss as high as $6.5 million.” — Yu Xian, Founder of Slow Mist

Bitcoin Surges Amid Rising Theft Threats

Did you know? Regulatory bodies continue to stress private key security, as individual wallet compromises affect more personal assets compared to institutional holdings.

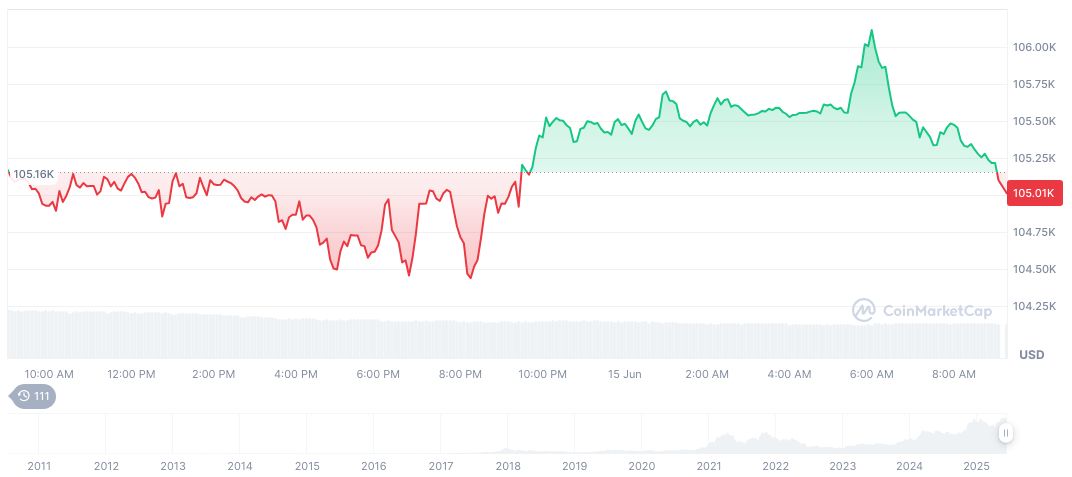

Bitcoin (BTC) is currently valued at $105,508.93, with a market cap of $2.10 trillion and a dominance of 63.81%. According to CoinMarketCap, its 24-hour trading volume decreased by 0.94% to $37 billion. Recent price changes over 90 days reflect a 25.94% increase.

The Coincu research team highlights growing concerns over rising wallet-based attacks, urging enhanced user education on phishing risks and private key protection. Historical data reveals a pivot in attack trends, further emphasizing the crucial need for robust cybersecurity measures for individual cryptocurrency investors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343496-individual-investors-crypto-theft/