- SEC’s incoming chair to review over 70 crypto-related ETF applications as of April 2025.

- Applications cover a range of assets, including Solana and XRP.

- Potential delay on XRP ETF decision until mid-October.

Paul Atkins, the incoming chairman of the SEC, is reviewing over 70 cryptocurrency ETF applications, including assets like Solana and XRP. The SEC’s decision, especially regarding the XRP ETF, is anticipated by mid-October.

This development indicates an increased regulatory focus on cryptocurrency markets, which may influence institutional involvement and market behavior.

SEC to Deliberate on Over 70 Crypto ETFs

Paul Atkins, previously an SEC Commissioner from 2002 to 2008, returns as chairman to oversee over 70 cryptocurrency-related ETF applications. These applications encompass a range of assets, including Solana, XRP, Dogecoin, and others, underlining the expanding interest in cryptocurrency ETFs.

Immediate implications involve a potential delay in the decision regarding the XRP ETF until October. Industry analysts anticipate that this period will provide regulators with more time to assess the impact on market dynamics and investor protections.

“The review of ETF applications marks a critical juncture for integrating cryptocurrencies into traditional market frameworks.”

Solana and XRP: Market Reactions Await Decisions

Did you know? The SEC’s previous approval of spot ETFs for Bitcoin and Ethereum served as a pivotal moment, marking one of the first successful integrations of cryptocurrency into traditional financial markets.

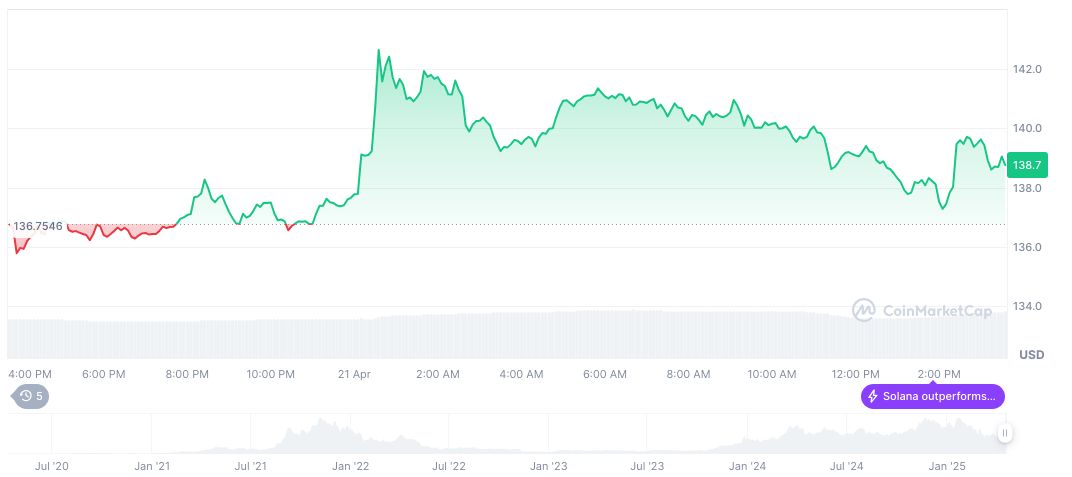

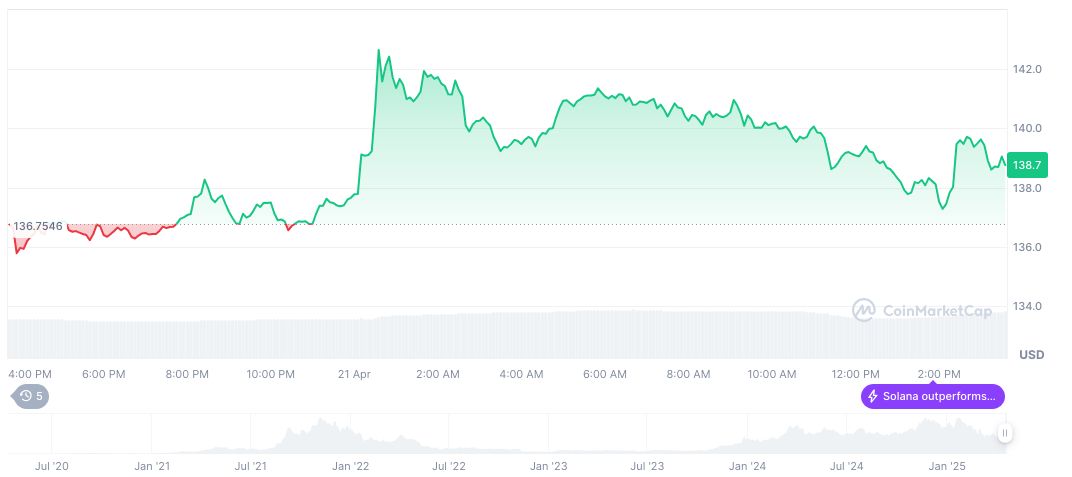

Solana (SOL) shows a current price of $140.37, with a market cap of $72.60 billion and dominance of 2.62%. Recent price fluctuations include a 45.11% decline over the past 90 days, according to CoinMarketCap data as of April 22, 2025.

Insights from the Coincu research team suggest that ongoing regulatory reviews could leverage historical trends, possibly shaping future financial products. This regulatory evolution could enhance the credibility of crypto investments in traditional portfolios.

Source: https://coincu.com/333613-sec-crypto-etf-review-atkins/