- Huaxing Capital plans $100M Web3 and crypto investment over two years.

- Investment focuses include stablecoins and cryptocurrency assets.

- Market expects liquidity and infrastructure enhancements.

Huaxing Capital Holdings announced plans to invest $100 million in Web3.0 and cryptocurrency assets over the next two years. This declaration was made via the Hong Kong Stock Exchange.

The decision underscores a robust involvement in digital assets and could enhance cryptocurrency market liquidity and infrastructure.

Huaxing’s $100M Investment Strategy for Stablecoin Growth

Huaxing Capital Holdings aims to enhance its Web3 and cryptocurrency portfolio, directing $100 million for diversified investments. The board’s decision builds on prior successes with companies like Circle Internet Group. Stablecoins will be a key focus as Huaxing plans to capitalize on its RWA and broader crypto ecosystem.

Investment objectives target stablecoin growth and application of new business licenses. This substantial financial commitment signals increased institutional support for cryptocurrency expansion and technological adoption.

[Name], [Title], Huaxing Capital Holdings, ‘We are excited to allocate $100 million toward pioneering initiatives within Web3.0 and cryptocurrency, as we believe these sectors hold significant potential for innovation and growth.’ – *[Citation URL]*

Market participants anticipate heightened interest and liquidity increases, potentially affecting Total Value Locked in DeFi protocols. Although major statements from executives remain unavailable, crypto enthusiasts are optimistic about the asset class’s reinforced legitimacy.

Institutional Moves Drive Crypto Regulatory and Market Growth

Did you know? This move by Huaxing Capital mirrors past strategic institutional efforts, contributing to over $1 billion combined in crypto-focused funds in the past five years, demonstrating increasing faith in digital asset integration.

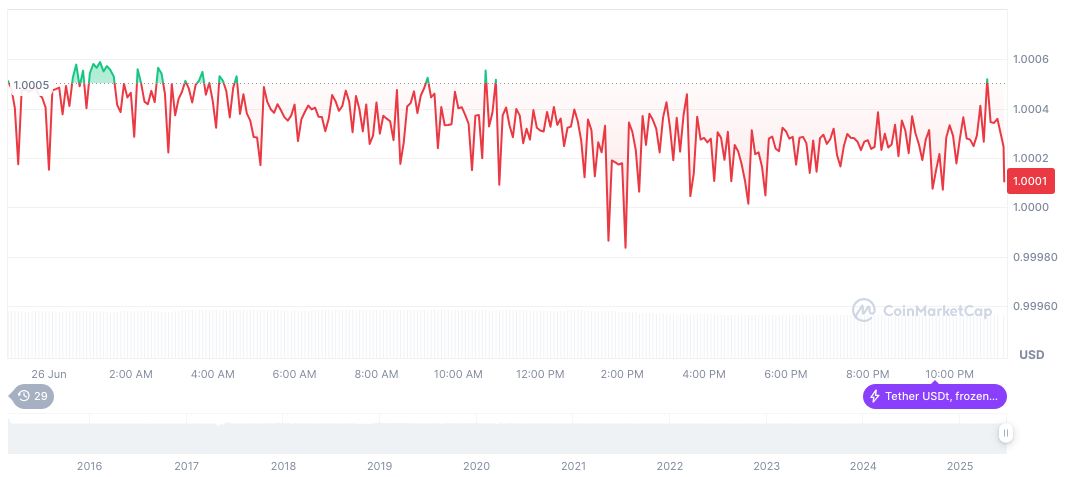

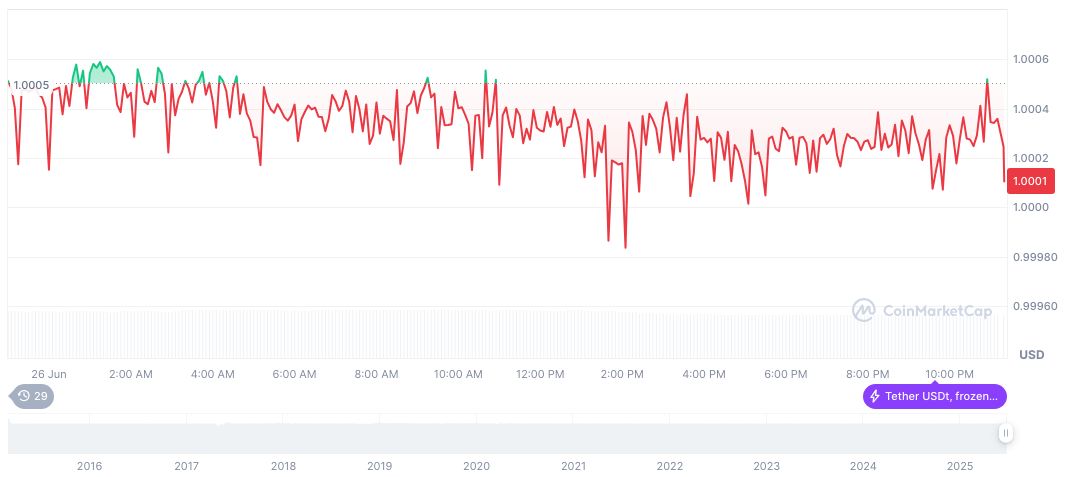

According to CoinMarketCap, the Tether USDt (USDT) holds a price of $1.00 with a market cap of $157.24 billion. It accounts for a 4.81% market dominance, with a 24-hour trading volume of approximately $64.24 billion, marking a -7.11% change. The past 90 days showed a price adjustment of +0.07%.

Analysts from Coincu highlight that institutional investments can drive technological advancements and regulatory frameworks in the cryptocurrency sphere. Such moves could enhance regulatory compliance, fostering the ecosystem’s growth and innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345381-huaxing-capital-web3-crypto-investment-2/