- Hong Kong outlines new crypto regulations set for 2026 implementation.

- Significant classification of crypto assets impacts the banking sector.

- Industry feedback is open until October 10, 2025.

The Hong Kong Monetary Authority has announced new rules for crypto asset classification under Basel Capital Rules, set to be effective from January 1, 2026.

The policy impacts how banks manage digital assets, influencing market practices and aligning Hong Kong’s regulatory standards with global Basel norms.

Hong Kong’s 2026 Crypto Rules: Basel Impact on Banking

The Hong Kong Monetary Authority will implement a new regulatory manual beginning January 2026, classifying crypto assets under Basel rules. Stablecoins and tokenized assets backed by real-world assets will receive favorable regulatory treatment. Unsecured tokens such as Bitcoin and Ethereum will face stricter capitalization rules.

Banks must adjust risk assessments and capital allocations for investments in different crypto asset categories. This framework may promote licensed stablecoins, seen as lower risk, while strict regulations for unsecured tokens might affect their attractiveness to institutional investors.

“The consultation draft ‘CRP-1 Classification of Crypto Assets’ formalizes the approach to how crypto assets will be regulated, ensuring banks are equipped to manage their risks effectively under Basel capital rules.” — Hong Kong Monetary Authority (HKMA), Lead Regulatory Authority.

Crypto Regulatory Moves by Hong Kong Echo Global Trends

Did you know? Crypto regulations akin to Hong Kong’s Basel-based framework were pioneered in the EU and Switzerland, influencing similar risk-weighted capital policies worldwide for digital assets.

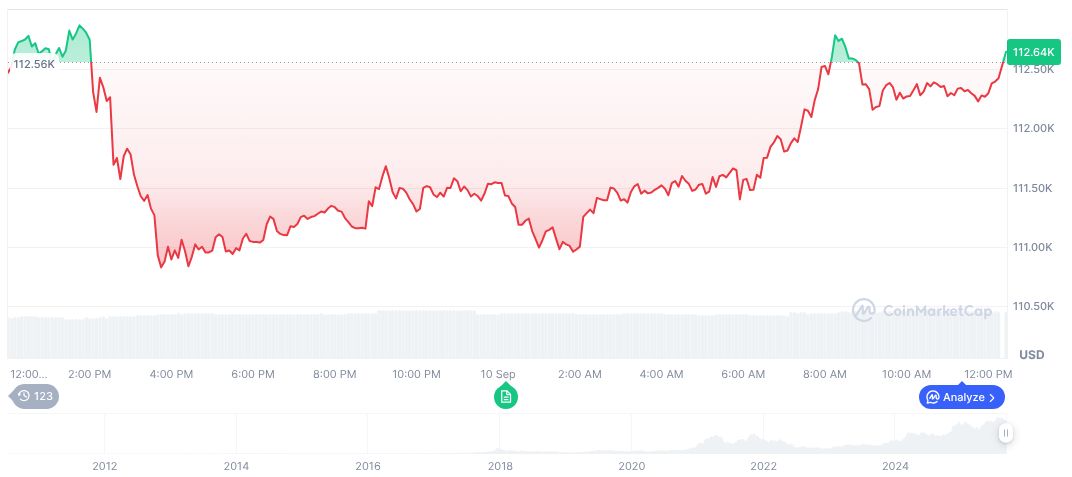

Bitcoin (BTC) trades at $114,191.67 with a market cap of $2.27 trillion, holding a market dominance of 57.46%, according to CoinMarketCap. In the past week, Bitcoin’s price has risen by 3.08%, although it decreased by 3.92% over the last 30 days. The asset’s trading volume reached $56.09 billion in the last 24 hours, gaining 2.39%.

The Coincu research team notes that Hong Kong’s regulatory update could align its digital finance ecosystem with global standards, particularly favoring stablecoins. This approach may bolster investor confidence and market stability, drawing in more institutional players.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-crypto-regulations-basel/