- Hong Kong to implement Basel crypto regulations on Jan 1, 2026.

- Banks may change approach to stablecoins and RWAs.

- Market reactions appear measured amidst substantial regulation.

The Hong Kong Monetary Authority will enact banking capital regulations aligning with Basel standards for cryptocurrency on January 1, 2026, impacting Bitcoin, Ethereum, stablecoins, and RWAs.

These regulations may influence Hong Kong banks’ willingness to hold digital assets, affecting market strategies and potentially altering the landscape for stablecoins and RWAs globally.

Hong Kong’s Major Basel Regulatory Shift for Cryptocurrencies

Hong Kong’s alignment with Basel standards will see the introduction of new banking capital regulations starting January 2026. The regulations include cryptocurrencies, stablecoins, and RWAs. The Hong Kong Monetary Authority (HKMA) leads this initiative based on long-standing Basel Committee standards.

Ethereum is prominently highlighted within the new regulatory framework, which addresses public blockchain-issued stablecoins and RWAs. Industry insiders suggest changes in banking appetites for such digital holdings may emerge due to these standards. The Basel Committee on Banking Supervision has noted, “The Basel crypto regulatory standards generally will not impose credit risk or market risk capital requirements for assets held by banks in ‘custody for clients,’ provided those assets are segregated from bank capital.” – Source: Caixin

Community response remains measured as no major statements from Hong Kong’s banking sector accompany the release. However, key figures in the industry have yet to weigh in publicly on these developments.

Market Trends and Historical Comparisons Amid Regulation

Did you know? Similar regulatory updates in Singapore, Switzerland, and the EU have historically led to an initial outflow from affected assets before stabilizing, highlighting the importance of clear custodial risk provisions in banking frameworks.

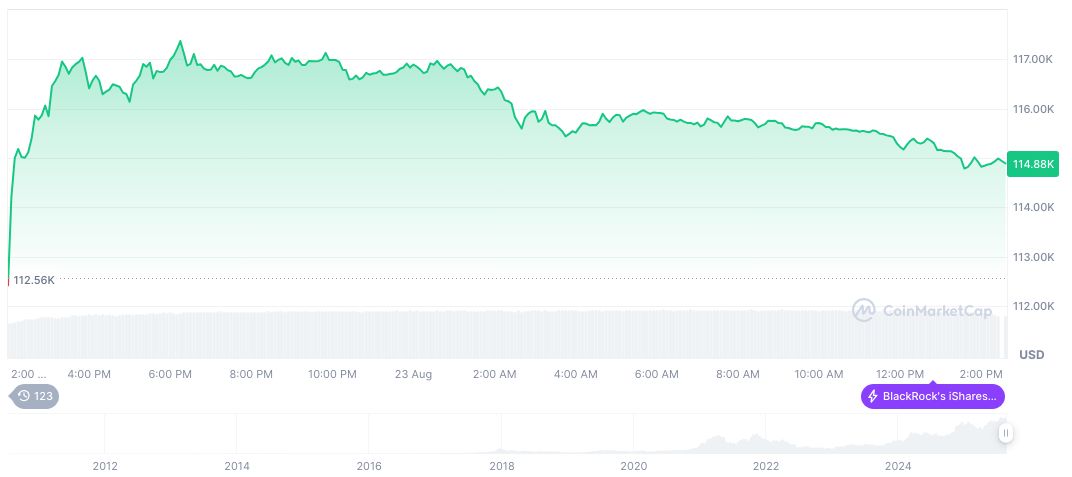

Bitcoin (BTC), priced at $114,846.39, holds a market cap of $2.29 trillion, dominating 57.47% of the market. Its fully diluted market cap is $2.41 trillion. Recent 24-hour trading volume reached $67.73 billion, though registering an 8.61% decline. Over the past 24 hours, Bitcoin’s price fell by 1.70%.

Experts from the Coincu research team suggest this regulatory move could enhance institutional confidence in cryptocurrencies. Historical precedents indicate gradual acceptance once risk provisions clarify, stabilizing market conditions and fostering a regulatory-driven evolution of banking practices.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-bank-crypto-regulations/