The U.S. SEC has exhibited significant inconsistencies in classifying crypto tokens in various court sessions, particularly evident during hearings involving Binance and Coinbase.

Prominent attorney James Murphy, also known as MetaLawMan, recently brought public attention to these inconsistencies through a recent post on X.

Crypto is and Not Security

The first instance Murphy cited was a January proceeding in the suit against American exchange Coinbase.

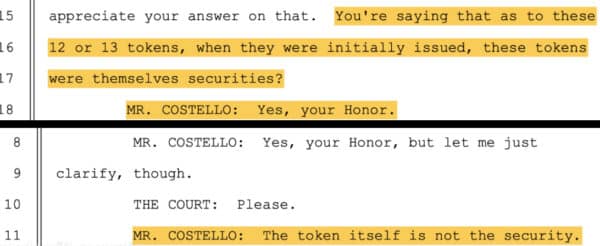

During the hearing, the court asked the SEC legal counsels to affirm whether some 13 cryptocurrencies were considered securities when the project teams first issued them.

In reply, the SEC attorneys affirmed, “Yes, your Honor,” indicating that the tokens were classified as securities. Interestingly, during the same court proceeding, the lawyer remarked, “The token itself is not the security.”

Crypto Asset is and Not Investment Contact

Furthermore, Murphy referenced a second instance during the hearing on the lawsuit against prominent crypto exchange Binance.

Likewise, the court queried the SEC solicitors whether it concurred that there existed a distinction between the tokens in dispute, which were the subject of the investment contracts, and the contracts themselves.

– Advertisement –

The SEC lawyers agreed that cryptocurrencies are “simply a line of code.” Yet, they negated their positions once more during the same court session, saying:

“The token itself represents the investment contract.”

At this point, the inconsistencies were becoming increasingly evident as the court pointed out that it had not previously heard from the SEC that crypto assets define investment contracts.

In justifying its stance, the SEC representatives emphasized that the assets themselves represent the investment contract.

Furthermore, the lawyers stated that they uphold a consistent position on the matter and disagreed that the SEC has contradicted itself.

Essentially, attorney James Murphy underscored that the SEC sees cryptocurrencies as both security and non-security and that these two assertions are not seen as contradictory.

“The SEC seems to have a hard time keeping its story straight on crypto,” the lawyer submitted. These cases further point to the lack of regulatory clarity plaguing the U.S. crypto scene. Coinbase has taken the agency to court to secure a proper rulemaking policy for the industry.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Source: https://thecryptobasic.com/2024/02/09/here-are-instances-sec-contradicted-itself-in-court-on-security-status-of-crypto-tokens/?utm_source=rss&utm_medium=rss&utm_campaign=here-are-instances-sec-contradicted-itself-in-court-on-security-status-of-crypto-tokens