- HBAR crypto has gained by over 34% in 24 hours to a five-month high.

- The rising Open Interest and DeFi TVL suggested that the rally could continue.

Hedera [HBAR] has gained by more than 30% in 24 hours, outperforming all the top 30 largest cryptocurrencies by market capitalization.

At press time, the altcoin traded at a five-month high of $0.118, with a market cap of $4.22 billion.

Will HBAR crypto continue rising?

HBAR’s recent gains follow an uptick in buying activity, as seen in the green volume histogram bars in the last five consecutive days.

At the same time, the Relative Strength Index has been rising and has reached a value of 88 at press time, showing that HBAR is overbought.

Typically, whenever the RSI hits overbought levels, it hints at an upcoming short-term correction.

However, traders might choose to hold and not sell, as other technical indicators suggested that the bullish momentum is gaining strength.

The Directional Movement Index (DMI) showed that the upward trend is strong. The positive DI (blue) was higher than the negative DI (orange), as the gap between them has widened, showing bullish momentum.

Additionally, the Average Directional Index (ADX) was tipping north, an indication that the press time trend was positive. The ADX value at 42 also suggested that the uptrend was strengthening.

Source: TradingView

If the bullish momentum continues, HBAR will rally to resistance at the 1.618 Fibonacci level ($0.13). The last time that HBAR flipped this resistance, it surged to $0.18.

Therefore, if buyers continue accumulating, a similar rally could occur.

On the other hand, traders should watch out for support at $0.0546 as failing to hold this support level could trigger a trend reversal.

Rising speculative activity

The derivatives market showed rising speculative activity around HBAR. At press time, trading volumes for the altcoin in this market stood at $1.37 billion, an over 104% increase within 24 hours.

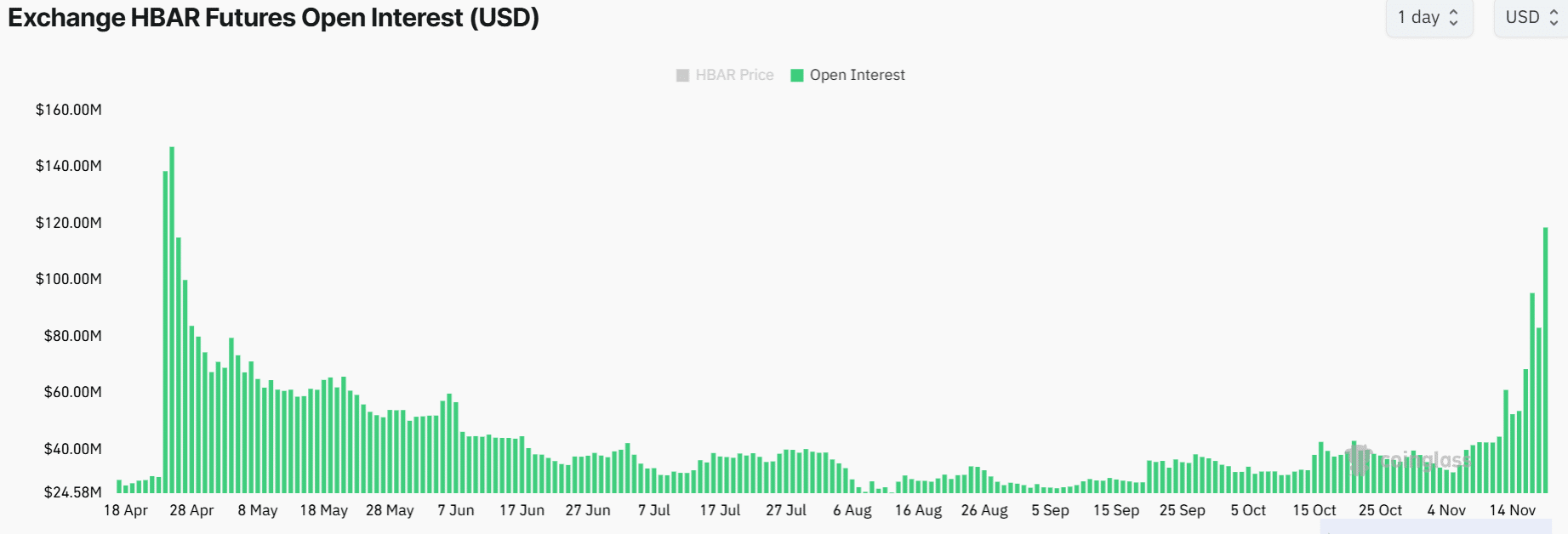

Open Interest had also soared to $118M, its highest level since late April, indicating that traders are opening new positions.

Source: Coinglass

When the Open Interest rises alongside the price, it shows bullish momentum and conviction in the uptrend. Moreover, Funding Rates remained positive, showing there is a higher demand for long positions.

If the market maintains this bullish outlook, HBAR could extend its gains. However, a spike in Open Interest also shows rising leverage, which could in turn cause volatile price movements.

Rising DeFi activity could fuel the rally

The Hedera blockchain was also recording a surge in decentralized finance (DeFi) activity, which could fuel HBAR’s rally.

Data from DeFiLlama showed that in just one week, Hedera’s DeFi TVL has increased by 82% to $93M at press time.

Read Hedera’s [HBAR] Price Prediction 2024–2025

A similar increase has also been seen in the DeFi volumes, which have surged significantly over the past week.

Rising DeFi activity is usually a catalyst for price growth. Therefore, if this TVL continues to rise, it could support the bullish momentum and drive more gains for HBAR.

Source: https://ambcrypto.com/hbar-coin-jumps-30-but-heres-why-the-rally-isnt-over-yet/