- Germany’s DZ Bank to begin offering crypto trading services legally via its meinKrypto platform.

- The bank will initially offer crypto trading services to institutions, with retail planned for later.

- DZ Bank launches meinKrypto with Atruvia, enabling BTC, ETH, ADA, and LTC trading.

DZ Bank has officially entered the crypto industry. The second largest bank in Germany, with more than €660 billion in assets under management (AUM), will begin to offer crypto-related services to corporate clients before rolling out to retail traders in the near future.

DZ Bank Obtains EU MiCA License

According to the announcement, DZ Bank received the proper authorization to operate crypto trading services in Europe through the Markets in Crypto Assets (MiCA) regulatory framework.

The DZ Bank stated that Germany’s top financial regulator BaFin, authorized its crypto trading platform meinKrypto at the end of 2025. As such, DZ Bank can seamlessly offer crypto trading services to about 700 financial institutions.

To start with, DZ Bank will offer crypto trading services for Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Litecoin (LTC). The meinKrypto platform was launched with the bank’s IT partner Atruvia to enable DZ Bank app users to access crypto directly.

Meanwhile, DZ Bank will leverage Boerse Stuttgart Digital for crypto custody services, and EUWAX AG for trade execution.

What Does it Mean for Crypto Traders in Germany?

The entrance of DZ Bank into the crypto space in 2026 will have a major impact on the wider Web3 industry. Furthermore, the crypto industry in Germany has grown exponentially in the past years, catalyzed by clear crypto regulations.

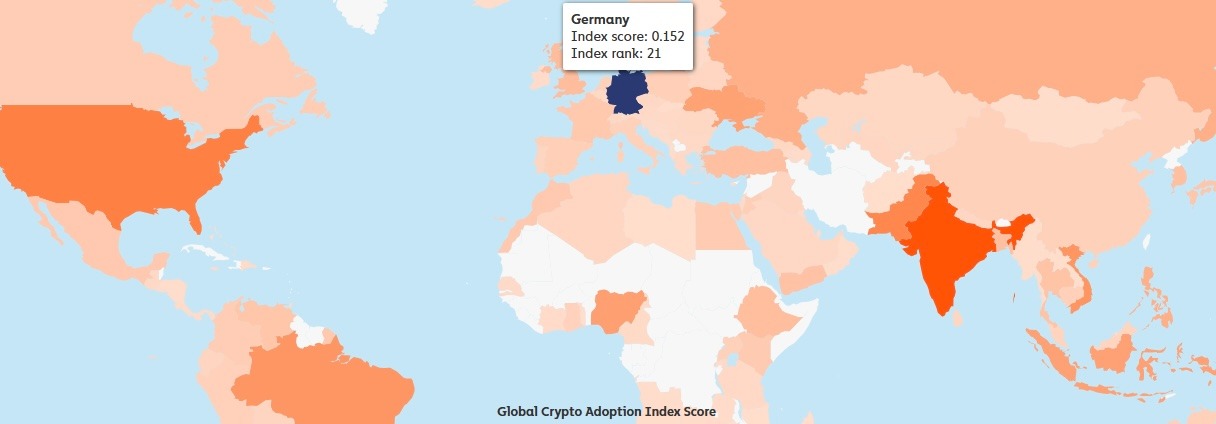

According to the Chainalysis 2025 report on the global adoption index, Germany ranked 21st in crypto adoption. With many crypto traders in Germany holding crypto for at least one year to optimize gains under the new crypto tax regime, the entry of DZ Bank will play a crucial role in providing sustainable liquidity.

Notably, Germany offers 100% tax-free spending on crypto if traders hodl for at least one year. On the other hand, short-term Crypto holders in Germany, less than 1 year, are taxed as ordinary income.

What’s Next?

The approval of DZ Bank to enter the crypto industry will heavily influence other financial institutions. Already, several other institutions in Germany have received proper licensing to venture into the crypto industry.

Some of the institutions licensed to offer crypto-related services in Germany include Commerzbank AG, DekaBank, BitGo Europe, and Bullish DE Custody. Meanwhile, the Deutsche Bank AG and the Volksbanken group are in the process of obtaining proper licensing to offer crypto-related services.

Related: Top Countries with Zero Bitcoin Tax Enter a New Era of Global Reporting

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/germanys-2nd-largest-bank-dz-bank-gets-approval-for-crypto-trading/