- Gemini and Coinbase near EU licenses under MiCA regulations.

- Regulatory clarity could enhance market participation.

- Potential financial growth for both companies in the EU.

Gemini and Coinbase are reportedly nearing the acquisition of EU-wide operational licenses under MiCA, with Gemini’s approval from Malta and Coinbase’s from Luxembourg expected soon.

These anticipated licenses underline the ongoing regulatory conversations and their potential effects on the European cryptocurrency ecosystem.

Gemini and Coinbase Poised for EU Market Expansion

Gemini and Coinbase are on the verge of obtaining licenses to operate across the 27 EU member states under the recent Markets in Crypto-Assets Regulation (MiCA). Gemini is expected to secure approval from Malta, while Coinbase awaits a decision from Luxembourg. The Malta Financial Services Authority had previously sanctioned licenses for notable entities like OKX and Crypto.com following MiCA’s enactment.

Regulatory developments will allow these companies to tap into a unified market, fostering growth and institutional engagement. For Gemini, the license also permits the offering of regulated derivatives, a burgeoning market segment in Europe. Meanwhile, concerns persist over Luxembourg’s regulatory approach, given the relatively small scale of Coinbase’s planned operations there.

Reactions from industry stakeholders have been closely followed, especially regarding potential discrepancies in regulatory applications across EU countries. Although neither Gemini’s founders, the Winklevoss twins, nor Coinbase’s Brian Armstrong have made public statements, their historical advocacy for clarification in regulatory practices remains relevant. Brian Armstrong has emphasized, “Our commitment to operational security and regulatory clarity is unwavering as we expand our services across Europe.”

MiCA Adoption Reflects on U.S. Regulatory Precedents

Did you know? The application of MiCA regulations aligns with the historical precedent set by the approval of Bitcoin futures by the CFTC in the U.S., which bolstered market confidence significantly.

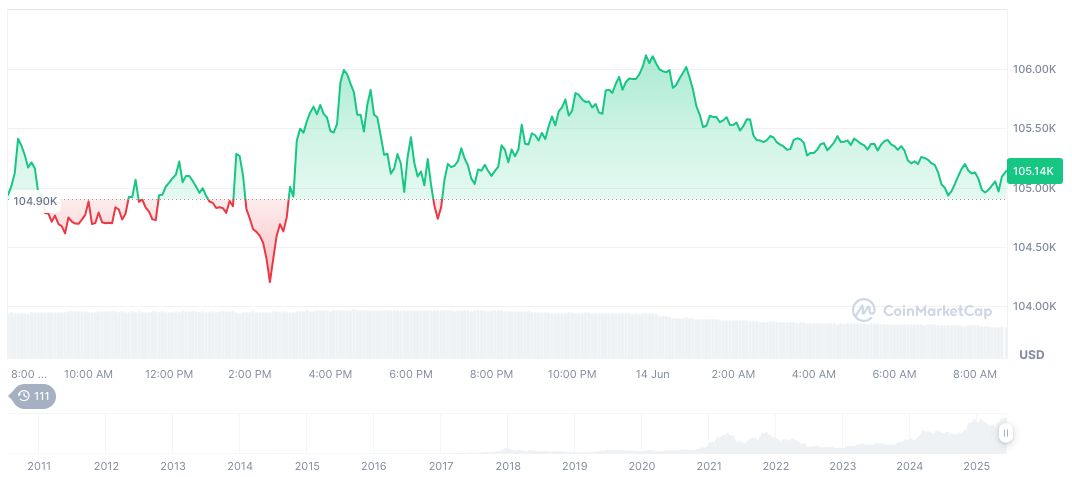

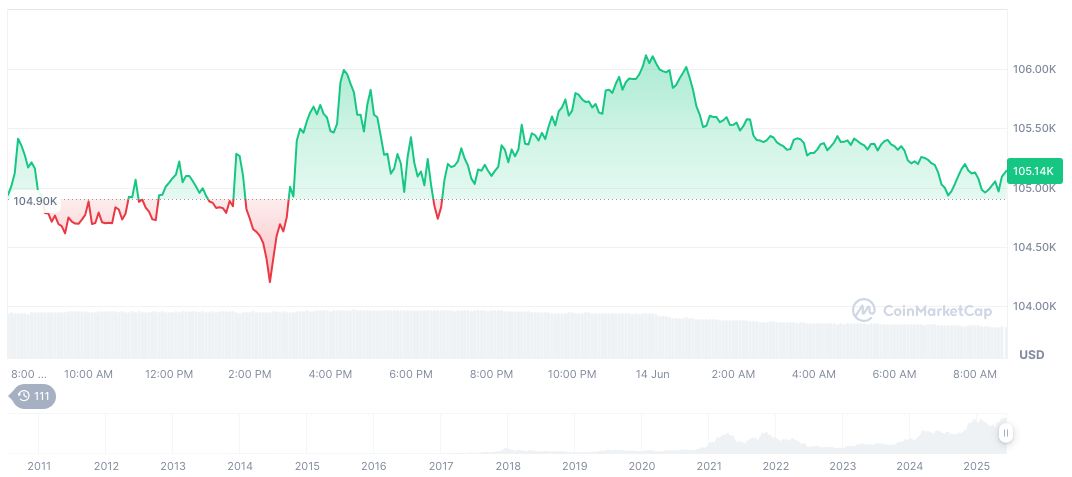

As of June 14, 2025, CoinMarketCap reports Bitcoin (BTC) at $105,016.44, with a market cap of $2.09 trillion and a 63.81% dominance. The past 90 days have seen Bitcoin’s price increase by 25.28%, despite a recent 0.35% rise in the last 24 hours.

Insights from the Coincu research team suggest that these license approvals may positively affect financial and regulatory balances, facilitating expanded operations within the European market. Historical analyses underline potential technological innovations and broader cross-border collaborations as more jurisdictions adopt standard compliance frameworks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343238-gemini-coinbase-eu-crypto-licenses/