- U.S. FinCEN warns of illicit use of crypto ATMs by criminals.

- Crypto ATMs exploited for money laundering by cartels.

- Emphasis on regulatory compliance to prevent financial crime.

The U.S. Financial Crimes Enforcement Network (FinCEN) issued a warning on August 4, 2025, regarding the rising misuse of cryptocurrency ATMs by criminals, including drug cartels.

This notice underscores growing concerns about cryptocurrency security and compliance, with potential regulatory impacts on ATM operators, possibly affecting their operational costs and compliance measures.

FinCEN Highlights Crypto ATM Misuse by Cartels

The U.S. Financial Crimes Enforcement Network (FinCEN) issued an alert warning of increasing misuse of cryptocurrency ATMs for activities such as laundering drug proceeds. Specific mention was made of the Jalisco New Generation drug cartel leveraging these technologies. Andrea Gacki, Director of FinCEN, stated, “Criminals are relentless in their efforts to steal money from victims. They’ve learned to exploit innovative technologies like CVC kiosks,” emphasizing the critical role of financial institutions as partners in protecting the digital asset ecosystem.

FinCEN identified failures among some operators in complying with regulations, which include verifying customer information and maintaining appropriate compliance controls. This increases pressure on ATM operators to evaluate and enhance their internal procedures. Failure to adapt may lead to stringent law enforcement actions and direct impact on operational costs. Explore more about Intelligize platform for regulatory compliance and research to ensure effective adherence to guidelines.

Reactions from authorities and industry leaders vary. While some have yet to comment, U.S. Senator Dick Durbin has already introduced a bill proposing transaction limits and mandatory consumer warnings for crypto ATMs. The community is monitoring potential changes and awaiting further industry responses.

Regulatory Pressures on Crypto ATM Operators Surge

Did you know? Previous regulatory actions by FinCEN have consistently led to an increase in compliance measures among crypto ATM operators, following substantial rises in losses or detected cartel activities.

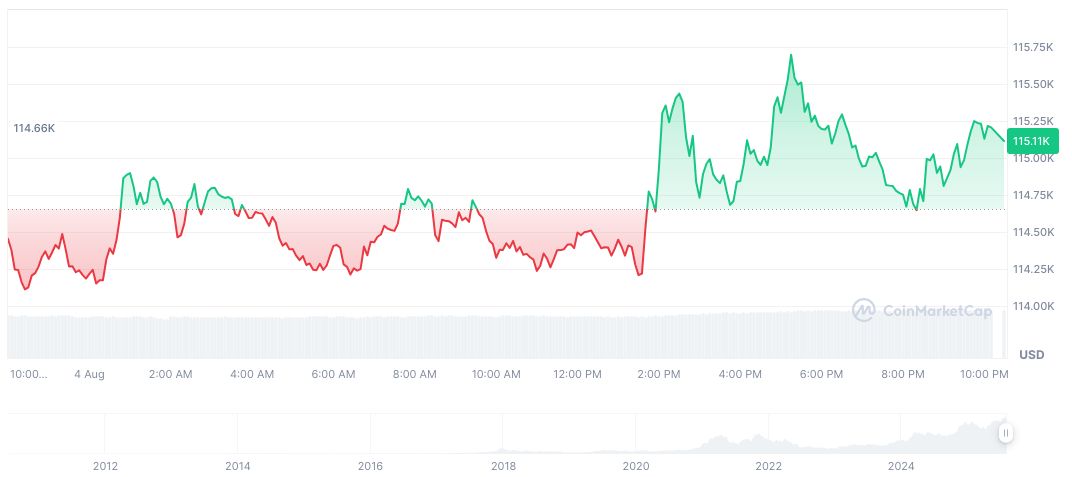

Bitcoin (BTC) currently trades at $115,072.18, standing strong with a market cap of $2.29 trillion and a market dominance of 60.64%, according to CoinMarketCap. The recent 24-hour trading volume has seen a decline of 25.61%, reflecting market volatility. BTC’s price has varied over the past 90 days, with an 18.84% increase, highlighting its ongoing market resilience.

The Coincu research team suggests that tightening regulations on crypto ATMs could lead to substantial changes in operation and investment strategies. Historical trends show that regulatory pressures often prompt increased compliance costs and heightened scrutiny, especially within financial sectors closely monitoring digital asset management.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/fincen-crypto-atm-warning/