- FET’s breakout from a descending channel and a potential breakout above $1.67 could push prices to $2.56.

- On-chain signals and rising open interest point to a sustained bullish outlook, supporting further price gains.

The Artificial Superintelligence Alliance [FET] recently announced plans to launch an Earn-and-Burn mechanism in December, which will involve burning up to 100 million tokens to reduce supply and potentially boost price.

Following this news, FET saw a 9.19% jump, trading at $1.62 at press time. The question on everyone’s mind: can this rally continue, and what does the technical outlook suggest for FET’s future?

Is FET breaking out of Its downtrend?

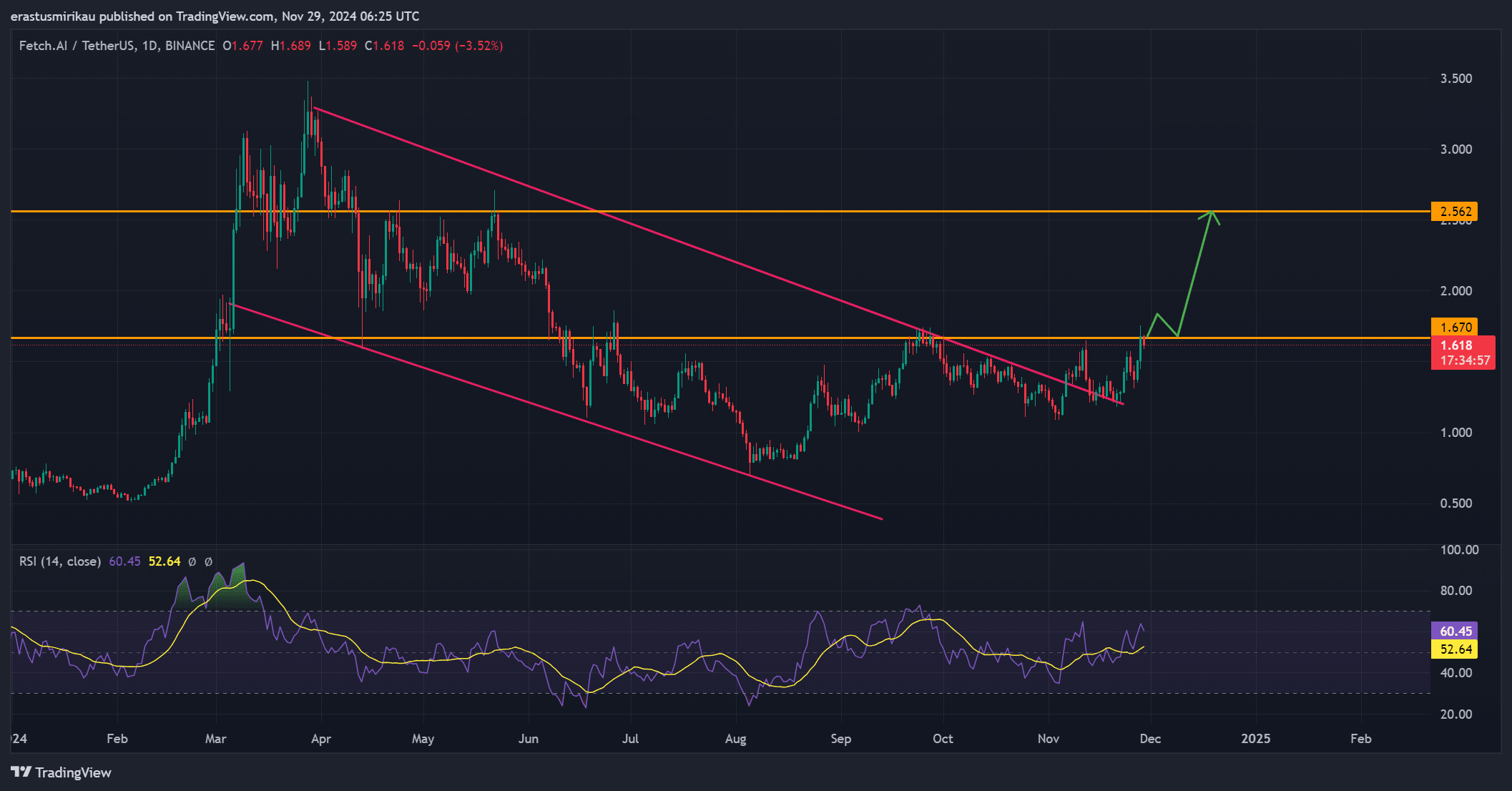

FET has recently broken free from a descending channel, a move that typically signals a change in market momentum. This breakout is promising, suggesting that the token may be entering a more bullish phase.

FET is currently testing a key resistance at $1.67. If the token can break through this level, a push towards $2.56 becomes a realistic target. With the RSI at 60.45, FET is not yet in overbought territory, which leaves room for further price movement.

Source: TradingView

What does the MVRV ratio indicate about investor behavior?

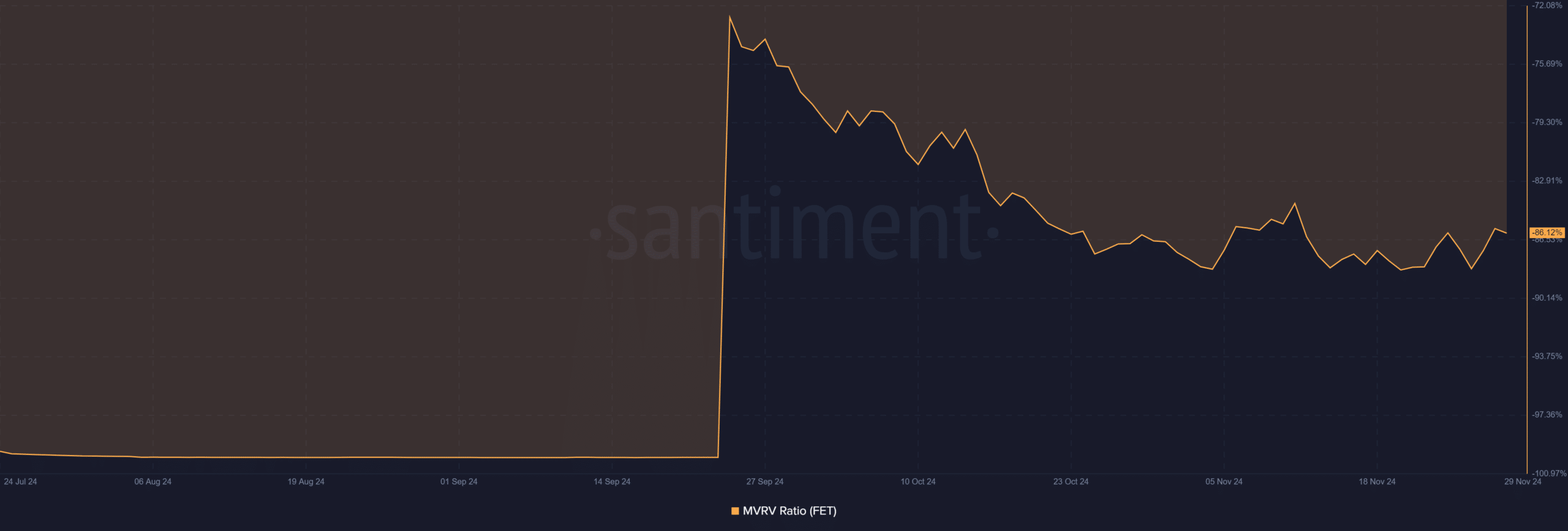

The MVRV ratio for FET is at -86.12%, signaling that many holders are at a loss. While this might seem concerning, it can also point to an undervalued asset, potentially setting the stage for a price rebound.

Therefore, the current negative MVRV ratio could represent an opportunity for long-term investors looking for a price recovery.

Source: Santiment

How are on-chain signals supporting the bullish outlook?

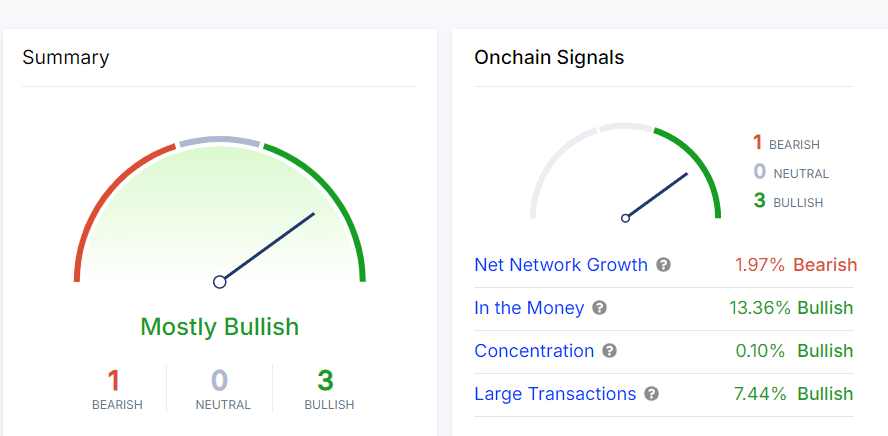

The on-chain metrics provide a generally bullish picture. Net Network Growth has decreased slightly by 1.97%, but this is not a major concern given the overall market sentiment.

More importantly, other key signals are strongly bullish: Into the Money stands at 13.36%, meaning a large portion of FET holders are in profit.

Additionally, large Transactions have risen by 7.44%, indicating growing institutional interest. Additionally, Concentration is at 0.10%, signaling that investors are accumulating tokens. These factors collectively suggest strong support for FET’s price momentum.

Source: IntoTheBlock

Is market sentiment shifting in FET’s favor?

Market sentiment is increasingly bullish. The open interest has surged by 10.38%, reaching $156.26M, a clear indicator that traders expect further price gains. This uptick in open interest suggests that the market anticipates more upside for FET, especially with the upcoming token burn.

Source: Coinglass

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024 – 2025

Given the strong technical breakout, positive market sentiment, and bullish on-chain signals, FET is well-positioned for continued price appreciation.

The recent surge in open interest reflects growing investor confidence, and if FET can break through the $1.67 resistance, a move toward $2.56 is highly probable. Therefore, the rally seems likely to continue, but investors should keep an eye on key resistance levels for confirmation.

Source: https://ambcrypto.com/fet-cryptos-new-burn-mechanism-could-this-fuel-a-price-surge/