- The FedWatch tool predicts low chance of a July rate cut.

- 81.4% probability: rates remain unchanged into July.

- Potential impact on crypto markets observed, volatility expected.

Based on ChainCatcher news and CME’s FedWatch data, there is a significant probability that the Federal Reserve will maintain the current interest rates in July and September of 2025. The FedWatch tool outlines an 18.6% chance of a rate cut in July.

The implications of potential Federal Reserve decisions could reverberate through global markets, with interest rates being a critical factor for investor strategy. The overall probability mix suggests volatility in anticipation of central bank decisions.

FedWatch Signals 81.4% Probability of Stable July Rates

ChainCatcher, a prominent Chinese Web3 media outlet, has highlighted the latest data from CME’s FedWatch tool. The tool indicates an 81.4% chance of maintaining July’s rates and only an 18.6% chance of a rate cut. Predictions for the September meeting include an 8.6% chance of unchanged rates and a 74.8% likelihood for a 25bp rate cut.

Markets anticipate potential Fed actions, affecting global liquidity and risk preferences. Cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), alongside significant altcoins, typically experience price fluctuations around these monetary policy updates. Past rate stability has often triggered sideways trading or market contraction.

Expert opinions lack uniformity, with no explicit reports from major industry leaders linked to this data. However, market analyst Watters noted, “If this week’s inflation data is weak, the dollar may come under pressure and decline, which could drive up gold prices.”

Crypto Market Awaits Fed Decision Amid Volatility Concerns

Did you know? During past periods when Fed interest rates remained stable, cryptocurrency markets often saw increased institutional interest, leading to higher market capitalization and greater market participation.

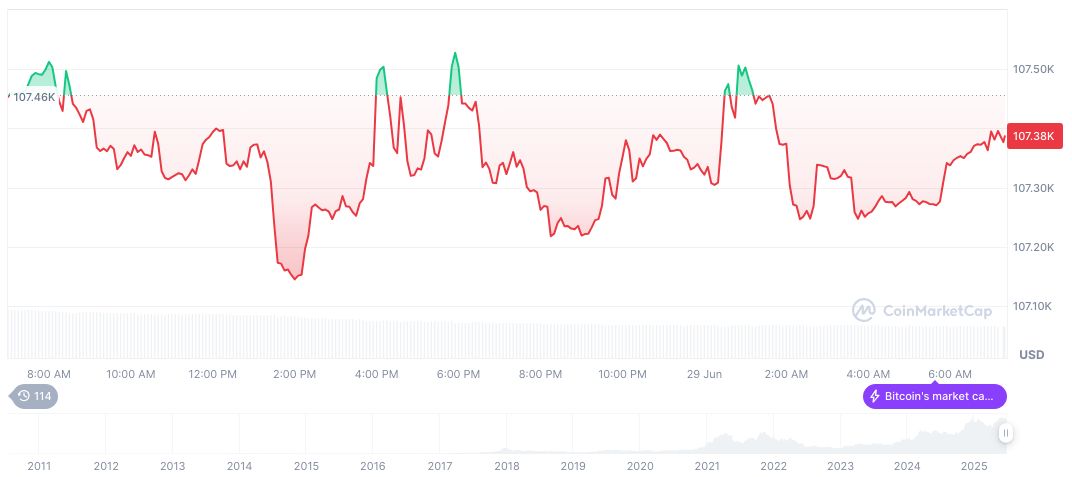

CoinMarketCap reports Bitcoin (BTC) at a current price of $108,714.87 and a market cap of $2.16 trillion. Recent figures show a 1.24% increase over 24 hours and a 7.68% rise weekly. BTC’s dominance stands at 64.57%, highlighting its influence on the wider crypto ecosystem.

Experts project continuing volatility in the crypto space as Fed decisions approach. ChainCatcher’s analysis advises caution, underscoring the need for rational market engagement. The Coincu research team notes that long-term crypto adoption may rely increasingly on macroeconomic factors, with regulatory and technology trends possibly influencing future valuations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345936-fedwatch-rate-stability-effect/