- Federal Reserve hints at significant rate cuts, initiating a market rally.

- Digital assets, especially Bitcoin, benefit from improved liquidity.

- Market participants show a positive reaction with renewed interest in financial sectors.

Federal Reserve Chair Jerome Powell signaled a dovish policy shift at an August conference, suggesting potential rate cuts, leading to a substantial multi-asset rally in traditional and crypto markets.

The Fed’s dovish pivot could increase liquidity, enhancing macro sentiment, benefiting digital assets like BTC, ETH, and altcoins, while supporting DeFi’s total value locked and speculative trading.

Fed’s Dovish Pivot Sparks Crypto and Market Rally

Jerome Powell’s remarks in his speech on Friday, set the stage for a significant market shift. FOMC Minutes from July 30, 2025 have been used to outline the expectations of a rate cut, which has stirred renewed interest in both traditional and crypto markets. This dovish move was anticipated by many traders, drawing comparisons with 2024’s similar pivot. According to Federal Reserve Chairman Jerome Powell, “The growth of economic activity had moderated…”

Market optimism has surged following Powell’s hints at a policy shift. This announcement has particularly benefited digital assets, such as Bitcoin and various altcoins, due to improved liquidity conditions and risk-on sentiment.

Reactions from market participants have been overwhelmingly positive, with major players in the financial sector showing renewed interest. Key figures like Governor Michelle Bowman expressed the need for a rate cut, reinforcing Powell’s indications. Michelle W. Bowman mentioned, “Taking action to begin moving the policy rate at a gradual pace toward its neutral level would have proactively hedged against a further weakening in the economy and the risk of damage to the labor market.” Meanwhile, on-chain activity in the crypto sector has yet to show any immediate exceptional shifts.

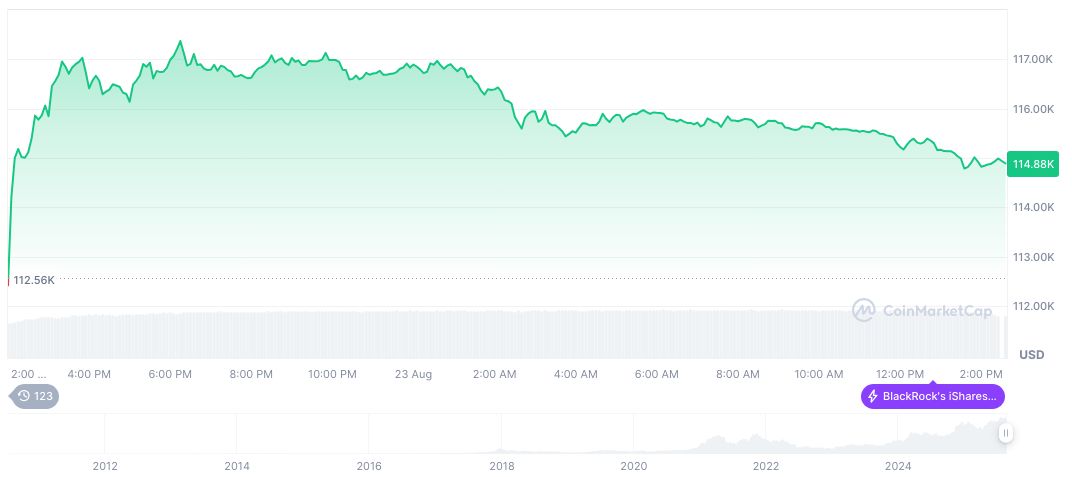

Crypto Markets Surge: Bitcoin Nears All-Time High

Did you know? Powell’s dovish approach recalls the March 2020 pivot, which led to a substantial spike in both traditional and crypto asset markets.

As of August 23, 2025, Bitcoin is trading at $115,018.68 with a market cap of FOMC Calendars and Meeting Schedules $2,290,067,558,126, according to CoinMarketCap. It maintains a 24-hour trading volume of $72.37 billion with a slight decline of 0.30% within that period. Bitcoin demonstrates a 57.46% dominance and currently circulates 19,910,396 coins, nearing its max supply of 21 million.

Coincu Research suggests that Powell’s dovish direction may enhance liquidity conditions in the cryptocurrency market, potentially spurring investment in DeFi and altcoins. Past behaviors indicate this could lead to increased staking flows and growing traction in layer 1 and layer 2 solutions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-dovish-pivot-crypto-rally/