- Federal Reserve Vice Chair Bowman supports crypto holdings for staff experience and effective regulation.

- Proposed policy could improve recruitment and retention of bank examiners.

- Bowman’s stance marks a shift towards pragmatic engagement with digital assets.

Michelle Bowman, Vice Chair for Supervision at the U.S. Federal Reserve, proposed allowing Fed staff to hold small amounts of cryptocurrency for hands-on learning at a conference in Wyoming.

The proposal highlights a shift towards innovation-friendly policies, aimed at effective regulation and talent retention, amid the growing influence of digital finance on global markets.

Bowman Proposes Crypto for Fed Staff to Boost Regulatory Skills

Federal Reserve Vice Chair Bowman proposed permitting Fed staff to hold small amounts of cryptocurrencies to gain hands-on experience. She believes this will enhance their understanding of digital finance, aiding regulatory effectiveness and attracting talent.

Her proposal underscores a shift in the regulatory perspective, potentially making the Federal Reserve’s approach more aligned with innovation-driven oversight. The initiative reflects the broader regulatory trend toward fintech modernization.

“Our approach should consider allowing Federal Reserve staff to hold de minimus amounts of crypto or other types of digital assets so they can develop practical understanding of new and evolving products and services.” – Michelle W. Bowman, Vice Chair for Supervision, Federal Reserve

Historical Ban Revisited Amid Bitcoin’s Price Surge

Did you know? In 2022, the Federal Reserve restricted its staff from holding cryptocurrencies due to conflict-of-interest concerns. Bowman’s suggestion marks a significant departure from past practices, highlighting the evolving perspectives in regulatory circles.

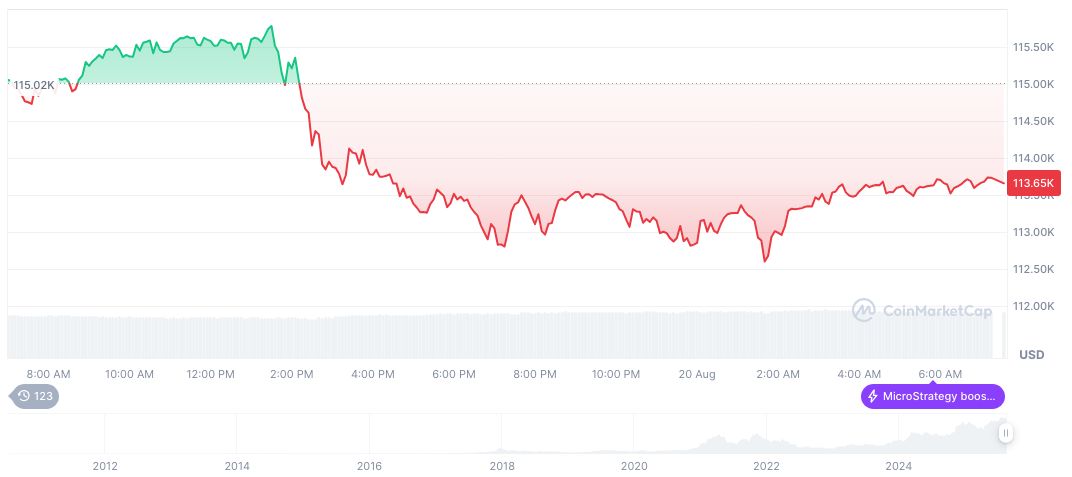

According to CoinMarketCap, Bitcoin (BTC) currently trades at $113,659.03, with a market cap of $2.26 trillion and a 24-hour trading volume of $71.65 billion—a 10.11% increase. The circulating supply is 19,908,896 with a max supply of 21 million. Price changes include a 0.90% decline over 24 hours and a 4.78% decrease in the last seven days.

The Coincu research team notes that Bowman’s call for practical crypto exposure reflects broader trends toward regulatory modernization to keep pace with fintech innovation. This could pave the way for future policy shifts, balancing regulatory oversight with technological advancements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/fed-bowman-crypto-holdings-proposal-2/