- Federal Reserve’s interest rate decision impacts crypto markets and trading strategies.

- Traders expect three rate cuts in 2025.

- Bitcoin volatility anticipated post-decision with maintained dollar strength.

Jerome Powell and the Federal Reserve decided to hold interest rates steady after their latest meeting according to BlockBeats News on May 8th.

Traders anticipate potential adjustments with expectations of future rate cuts before July influencing market strategies and positioning, suggesting shifts in liquidity and asset allocations.

Federal Reserve’s Decision Holds Steady Amid Crypto Speculation

The Federal Reserve’s latest decision to maintain current interest rates has impacted market sentiment, particularly within cryptocurrency sectors. Anticipation for forthcoming rate cuts is shaping trading strategies, suggesting a significant influence on liquidity and asset allocations. Jerome Powell’s leadership continues to play a pivotal role.

Market analysts highlight the interconnectedness between the Federal Reserve’s monetary policies and the cryptocurrency sector. The recent decision to hold rates adds to ongoing market speculation, with traders anticipating three rate cuts later this year, potentially commencing before July, echoing broader economic expectations.

Market consensus and expert forecasts indicate no interest rate cut is expected.

According to Mihir, the continued hold could maintain current levels of dollar strength, potentially affecting Bitcoin’s momentum in the near term.

Bitcoin’s Market Dynamics: A Close Watch on Interest Rates

Did you know? Bitcoin often experiences high volatility following Federal Reserve announcements, as traders adjust to new monetary policy cues affecting the dollar’s strength and risk asset appeals.

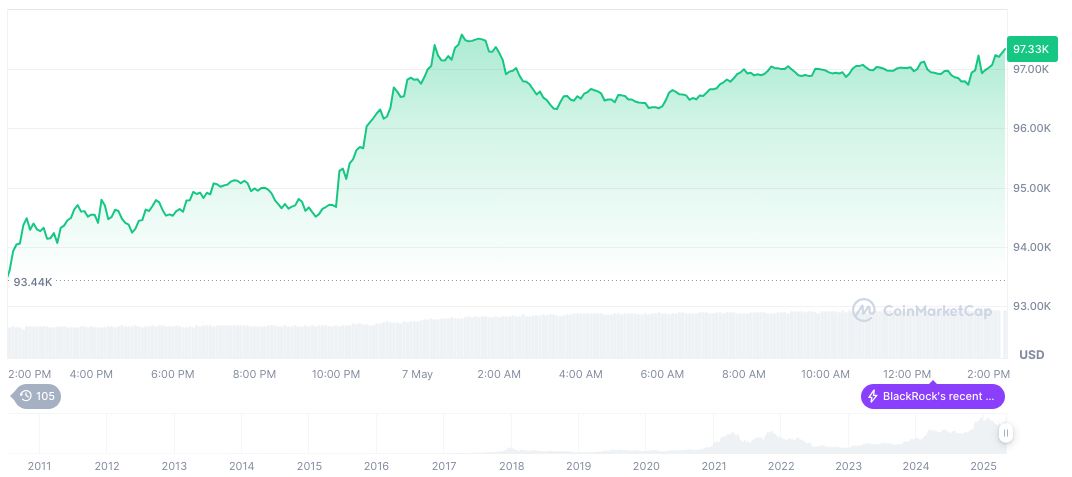

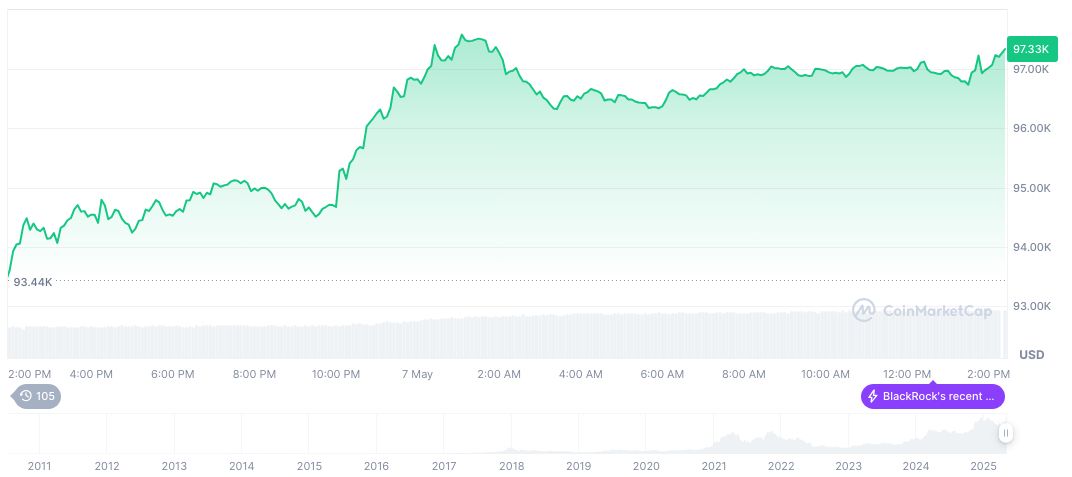

According to CoinMarketCap, Bitcoin currently trades at $97,095.97 with a market cap of 1,928,478,819,946.79 and a 24-hour trading volume of 77,815,657,995.76, reflecting a 1.76% price increase. This $2,039,015,295,558.51 fully diluted market cap and a slight 0.82% three-month gain suggest a stable market position amid broader economic shifts.

Coincu’s research team indicates that potential outcomes depend heavily on evolving global macroeconomic conditions. If the Federal Reserve continues this trajectory of potential easing, expect a positive adjustment in asset pricing sensitivity, directly influencing both BTC and ETH market behaviors.

Source: https://coincu.com/336242-fed-rate-decision-crypto-impact-2/