- Federal Reserve revokes 2022 crypto directive for banks.

- Shift towards regulatory ease promoting banking innovation.

- Analysts anticipate more bank-led crypto initiatives.

The Federal Reserve announced on April 24, 2025, in Washington that it has revoked the 2022 directive requiring banks to provide advance notice for crypto activities. This move signifies a shift aimed at easing regulatory compliance while promoting banking innovation.

The revocation aligns with broader efforts to integrate crypto within established frameworks. By moving towards ordinary supervision, banks may find it easier to navigate crypto activities without needing special approvals.

Fed Eases Crypto Compliance for U.S. Banks

Federal Reserve’s decision to rescind the crypto notification requirement has prompted significant changes. State member banks are no longer mandated to inform regulatory bodies in advance about crypto-related operations. Instead, these activities will be monitored through regular supervisory processes. This withdrawal also includes the non-objection procedure for USD token activities, and the joint withdrawal from crypto risk statements with the FDIC and OCC. Regulatory consistency concerns remain with the January 2023 guidance still active.

Reactions to the Federal Reserve’s actions have been generally positive, with industry insiders expressing optimism about streamlined regulations. Analysts anticipate more bank-led crypto initiatives as obstacles lessen. However, concerns persist regarding outstanding regulatory guidance, leaving some uncertainty about the overall regulatory landscape.

“The Board is rescinding its 2022 supervisory letter establishing an expectation that state member banks provide advance notification of planned or current crypto-asset activities. … [We will] instead monitor banks’ crypto-asset activities through the normal supervisory process.” — Federal Reserve, Official Spokesperson, Federal Reserve Press Release

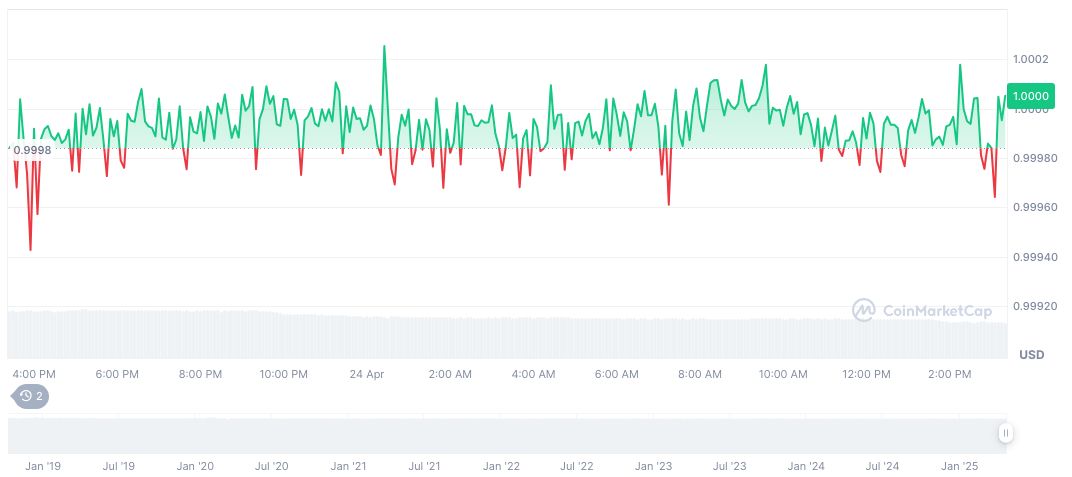

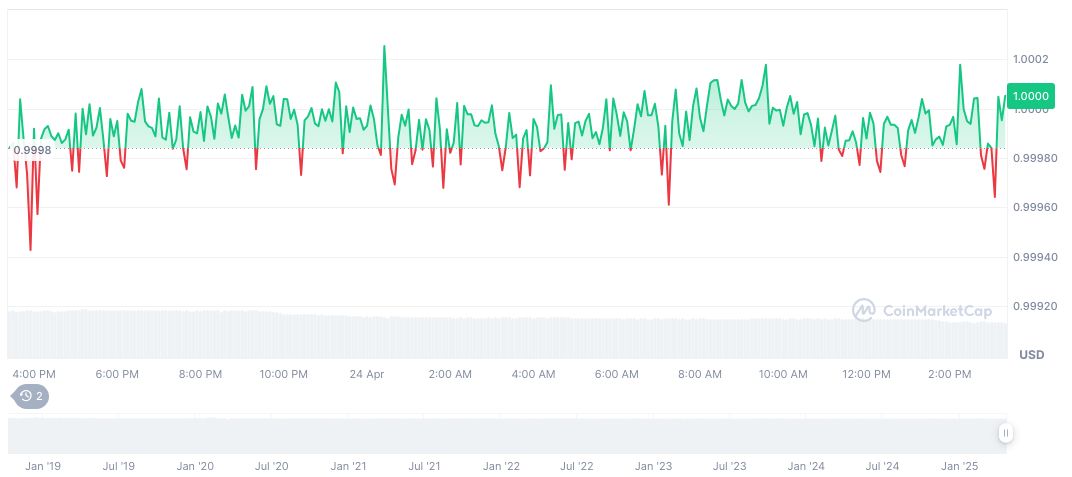

Stablecoin Trends Post-Fed Decision

Did you know? In 2020, significant regulatory easing resulted in the rapid adoption of digital banking solutions across financial institutions, reflecting the potential impact of the Fed’s current policy adjustments on crypto activities.

According to CoinMarketCap, USD Coin (USDC) remains stable, holding a market cap of $62.13 billion as of April 24, 2025, with negligible price fluctuation in the last 24 hours. USDC maintains a 2.11% market dominance with a 24-hour trading volume of $11.17 billion.

Coincu’s research indicates that the Fed’s policy recantation could lead to enhanced banking crypto collaborations and heighten market liquidity for USD-backed tokens. Historical trends suggest that regulatory clarity reinforces institutional confidence, potentially increasing adoption rates in the financial system.

Source: https://coincu.com/334172-fed-revokes-crypto-notification/