- Speculation on Fed rate cuts linked to tariff negotiations may impact crypto.

- Cryptocurrencies like Bitcoin and Ethereum may see price surges.

- Markets anticipate increased volatility across risk assets.

Major implications include a likely boost in cryptocurrency prices, with Bitcoin and Ethereum among beneficiaries as investors seek risk assets amid monetary policy changes. Historically, rate cut speculation has driven robust market enthusiasm in cryptocurrencies, reflecting broader macro trends. The backdrop of potential rate cuts has fervently engaged investor interest, with trading volumes and prices for major tokens expected to rise.

Market reactions have been robust, with increases in trading volumes and price movements. On May 8, 2025, Bitcoin saw a 2.3% rise, reaching $62,450 within 24 hours, while Ethereum mirrored the surge, indicating strong market confidence in imminent dovish Fed policy. As QCP Capital noted, “The growing disconnect between official Fed communication and market sentiment creates volatility,” underscoring the financial community’s focus on Fed signals.

Fed’s Tariff Deal Could Trigger Rate Cuts in 2025

The anticipation of Federal Reserve rate cuts linked to potential tariff deals has initiated widespread financial market speculation. Randal Quarles, a former vice chair at the Fed, highlighted that a deal over tariffs could open the door to rate cuts, a sentiment echoed by other officials like Christopher Waller and Raphael Bostic. Waller suggested that:

Bostic, however, emphasized a cautious approach, noting the economic impacts of tariff changes could take time to manifest, leading to possibly only one rate cut in 2025.

If tariffs decrease, rate cuts [are] expected in the second half of 2025.

Cryptocurrency Prices Surge Amid Rate Cut Expectations

Did you know? Historically, cryptocurrency markets have rallied during periods of expected Federal Reserve rate cuts, demonstrating a pronounced correlation between monetary policy shifts and digital asset strength.

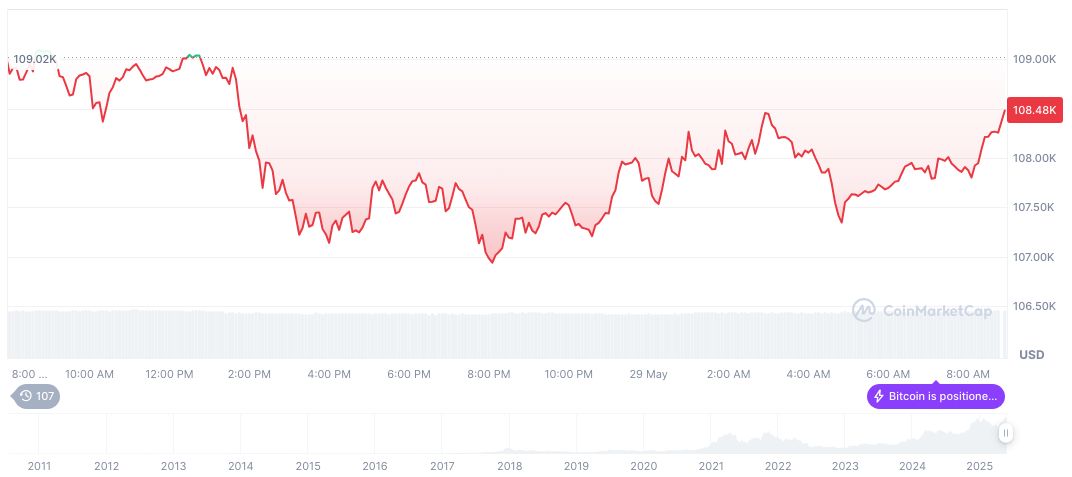

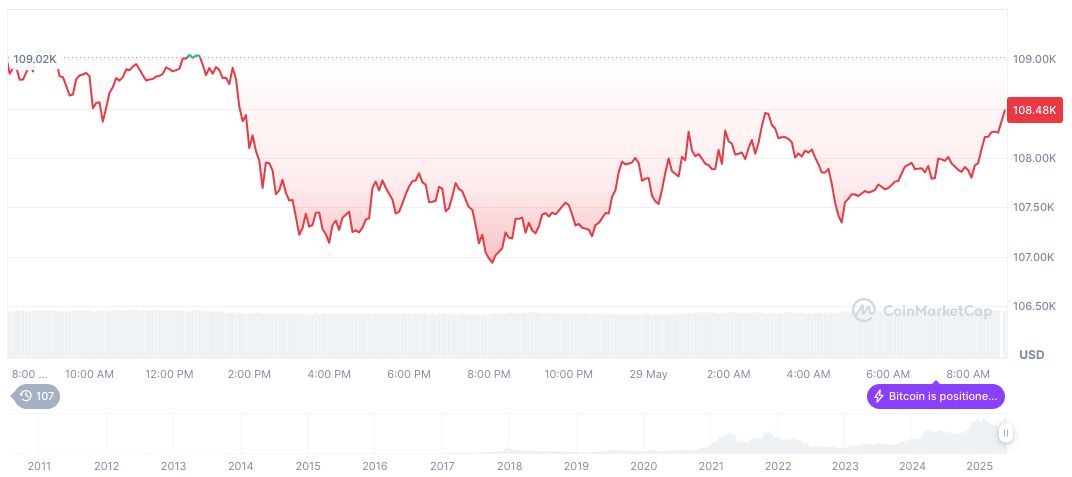

Bitcoin (BTC), according to latest data from CoinMarketCap, is valued at $107,532.74, reflecting a 13.41% increase over the last 30 days. The current market cap is approximately $2.14 trillion, indicating its dominance at 62.83% of the market. Despite minor fluctuations, this performance aligns with broader trends in anticipation of monetary easing.

Insight from the Coincu research team suggests that potential rate cuts could bolster financial interest in cryptocurrencies, supported by robust trading infrastructure improvements and regulatory changes. With historical rate cut precedents influencing crypto asset behavior, market participants may observe marked increases in institutional involvement and innovation.

Source: https://coincu.com/340513-fed-rate-cuts-crypto-impact-2/