- Federal Reserve rate cut speculation impacts Wall Street and cryptocurrencies.

- Nasdaq 100 and S&P 500 hit all-time highs.

- Cryptocurrencies benefit from lower yields and increased risk appetite.

On August 13, U.S. stock markets hit new highs following expectations of a Federal Reserve rate cut in September, spurred by recent inflation data.

A potential rate cut could ease financial conditions, impacting equities and cryptocurrency markets, as observed in past monetary easing cycles.

Fed Actions Propel S&P 500 and Nasdaq to New Heights

The possibility of rate cuts has been supported by Michelle W. Bowman, a Federal Reserve Governor, emphasizing recent labor market data as a factor for potential reductions. “The latest labor market data reinforce my view for three cuts this year,” Bowman stated in her speech.

Cryptocurrencies Strengthen Amid Policy Easing Signals

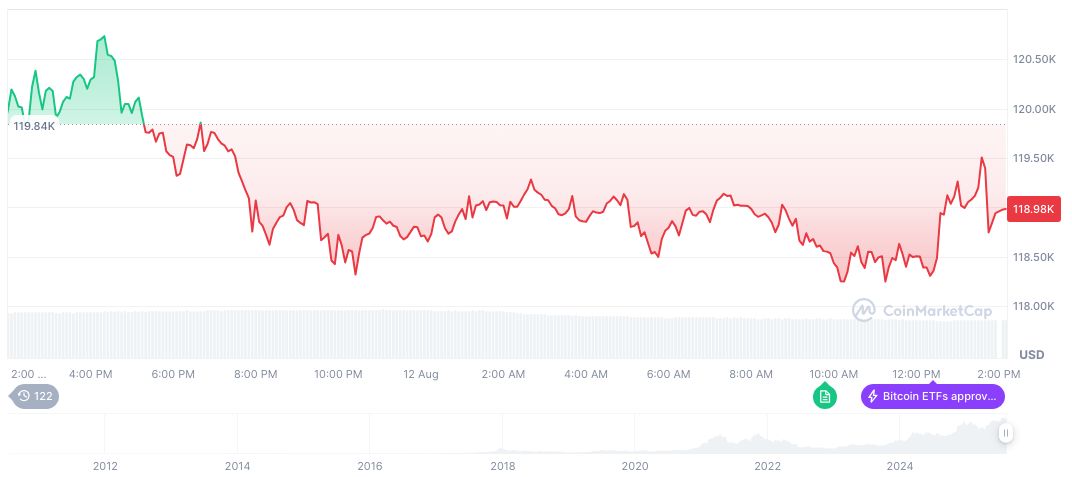

Bitcoin (BTC) commands a dominant position in the crypto market, reflecting a market cap of $2.39 trillion, supported by CoinMarketCap data. Gaining 1.1% over 24 hours, its 24-hour trading volume reached $72.85 billion. BTC’s circulating supply stands at 19.9 million against a maximum supply of 21 million. Coincu researchers indicate that the anticipated policy shift may drive liquidity and technological adoption, should BTC maintain its current path. Historical trends suggest a potential uptick in decentralized finance (DeFi) and blockchain usage patterns, echoing previous easing cycles.

Cryptocurrencies Strengthen Amid Policy Easing Signals

Did you know? In the 2019 rate-cut cycle, cryptocurrencies, led by Bitcoin, saw increased liquidity and investor engagement, illustrating potential parallels to current market dynamics.

Bitcoin (BTC) commands a dominant position in the crypto market, reflecting a market cap of $2.39 trillion, supported by CoinMarketCap data. Gaining 1.1% over 24 hours, its 24-hour trading volume reached $72.85 billion.

Coincu researchers indicate that the anticipated policy shift may drive liquidity and technological adoption, should BTC maintain its current path. Historical trends suggest a potential uptick in decentralized finance (DeFi) and blockchain usage patterns, echoing previous easing cycles.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-wall-street-crypto-impact/