- Traders now expect four Fed rate cuts this year.

- Changes in economic indicators influence global markets.

- Cryptocurrency markets are responsive to Fed policy signals.

Fed Rate Cut Projections Signal Crypto Market Volatility

Traders revised their expectations for U.S. Federal Reserve rate cuts amid shifting economic outlooks, now projecting approximately four reductions before year-end. These changes arise from evolving economic indicators affecting global market sentiments, alongside financial dynamics in the cryptocurrency space. Market participants previously predicted more aggressive rate cuts for 2025, reflecting a significant strategy adjustment.

Historical Market Reactions and Price Data Analysis

A reduction strategy in anticipated rate cuts potentially impacts liquidity and risk asset pricing. The report emphasizes a significant shift in market sentiment with traders now pricing in approximately four Fed rate cuts for the year, which represents a notable decrease from earlier expectations. Such policy shifts can alter the trading patterns within cryptocurrency markets, particularly affecting volumes and investor sentiment. Market participants typically respond to these expectations quickly, influencing related asset classes.

Both U.S. and international markets closely evaluate Federal Reserve decisions, including statements from prominent economic figures. While this event lacks direct commentary from influential leaders, market actions reveal underlying sentiments. Alignments between monetary policies and market behavior are crucial for future decision-making.

Market Data Analysis

Did you know? The last time traders significantly altered their Fed rate cut expectations, the crypto market experienced notable increases in trade volumes and asset volatility, underscoring the strong correlation between monetary policy signals and market dynamics.

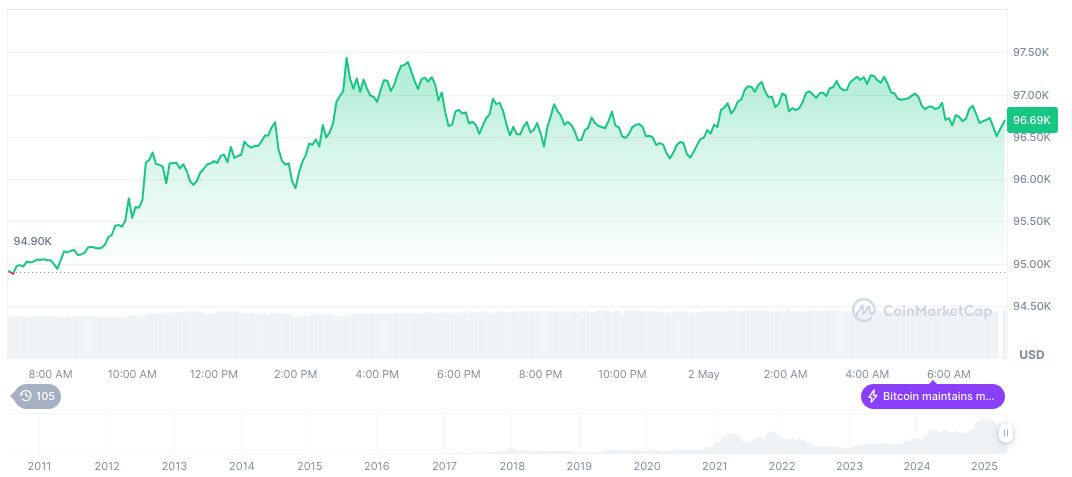

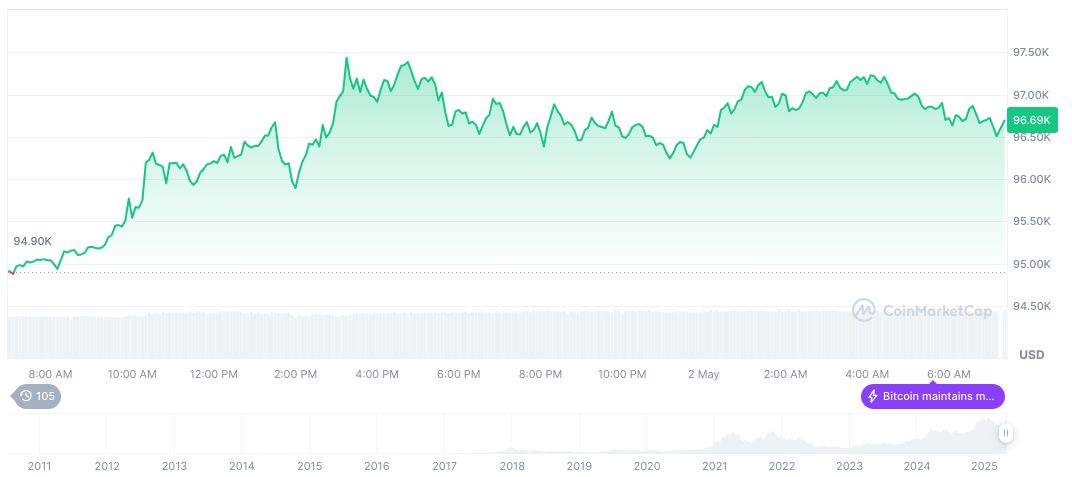

Bitcoin (BTC) stands at $96,770.86 with a market cap of $1.92 trillion and dominance at 63.76%, per CoinMarketCap. Current trends show minor price shifts over 24 hours (up 0.14%) but a noticeable 14.59% rise in the past 30 days. Adjustments in Federal Reserve policies could influence these metrics considerably in upcoming sessions.

According to Coincu research, potential economic shifts could drive long-term volatility in key crypto markets, prompting developer and investor scrutiny. These observations align with ongoing analyses of macroeconomic adjustments tied to U.S. Federal Reserve policies, suggesting heightened attention to applied economic strategies.

Source: https://coincu.com/335406-fed-rate-cuts-crypto-impact/