- Federal Reserve debates potential rate cuts for July impacting crypto sentiment.

- Speculation of easing policies fuels optimism in cryptocurrency sectors.

- Institutional interest grows, focusing on Layer 1 tokens like SOL and SUI.

Federal Reserve’s July rate cut speculation boosts crypto market sentiment amid strategic institutional shifts.

Federal Reserve officials debate potential rate cuts for July, impacting the crypto market’s sentiment towards strategic asset shifts. The discussions hint at possible easing policies, fueling optimism across cryptocurrency sectors and increasing institutional interest in Layer 1 tokens.

Crypto Markets Eye Fed’s July Rate Decision

Federal Reserve’s potential rate cut deliberations highlight a mixed consensus among officials. The minutes from the June meeting reveal diverse opinions on upcoming monetary policies, with a rate cut by September widely considered possible if data trends align.

Concerns over inflation and employment persist, shaping these monetary discussions. A potential shift towards easing policies could result in increased liquidity and market opportunities for cryptocurrencies, as past occurrences have shown.

“We’ve expanded our cryptocurrency reserves to approximately $7 million, focusing on next-generation Layer 1 tokens such as HYPE, SOL, and SUI.” – Lion Group Holding, CEO

Institutional Moves Amid Speculative Rate Cuts

Did you know? The possibility of a Federal Reserve rate cut has historically led to increased speculative interest and liquidity in the crypto market, often pushing major tokens like Bitcoin and Ethereum towards favorable price dynamics.

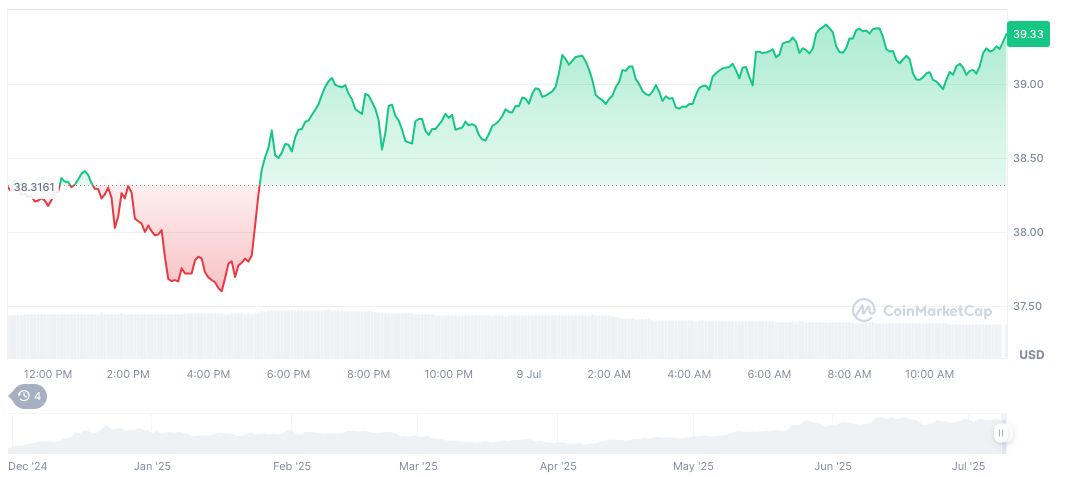

CoinMarketCap reports Hyperliquid (HYPE) with a current price of $39.32 and a market cap of $13.13 billion. Over the past 90 days, HYPE’s price surged by 178.37%, signaling strong market interest. Recent 24-hour trading saw a 2.94% increase despite a trading volume dip, emphasizing potential for continued growth.

Coincu analysts predict a cautiously optimistic stance for crypto investors, suggesting that possible rate cuts could maintain a favorable environment for risk assets. Regulatory and compliance factors remain crucial, as institutional participation intensifies in the cryptocurrency landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347671-fed-rate-cut-crypto-market/