- Fed maintains rates; crypto market impact anticipated.

- Market attentively awaits potential policy shifts.

- BTC, ETH volatility likely post-announcement.

Federal Reserve Chair Jerome Powell, alongside the FOMC, faces a pivotal interest rate meeting amid mounting political pressure and critical economic data releases scheduled for July 29-30, 2025.

Market anticipates no rate change, focusing on Powell’s guidance, impacting crypto volatility and traditional financial sectors.

Fed’s Rate Decision and Crypto Volatility Prospects

Jerome Powell and the FOMC are steering decisions in an environment of political pressure and crucial economic indicators. Data releases include GDP, employment reports, and the Fed’s preferred inflation measure. Economic forecasts anticipate a second-quarter GDP growth rate of 2.4%, marking an improvement due mainly to a reduced trade deficit.

“In a press briefing, Jerome Powell stated, ‘We are committed to making decisions based on the data we gather, which reflects the current economic landscape and inflation trajectories.’” — Kiplinger

“In a press briefing, Jerome Powell stated, ‘We are committed to making decisions based on the data we gather, which reflects the current economic landscape and inflation trajectories.’” — Kiplinger

Market Reactions: BTC and ETH in Focus

Did you know? The “higher-for-longer” rate policy seen since Powell’s tenure exemplifies data-oriented decision-making, frequently impacting altcoin volatility during Fed guidance announcements.

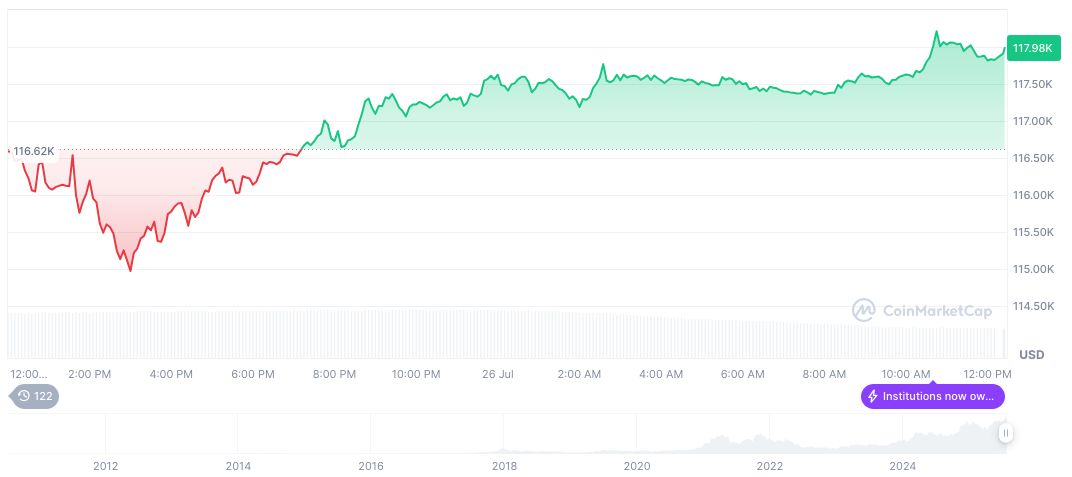

Bitcoin’s price stands at $118,221.41 with a large market cap nearing $2.35 trillion, according to CoinMarketCap. The cryptocurrency’s 24-hour trading volume remains robust at $47.51 billion, albeit down by 43.11%. Recent months reveal steady growth with a 25.55% increase over the past 90 days.

Insights from Coincu reveal that the FOMC’s decision may impact DeFi investments and token valuations, as market participants consider potential shifts in policy directions. Rate anticipation is highest for Ethereum and Bitcoin, given their macro-sensitive nature in current economic climates.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-holds-interest-rates-crypto-impact/