- Main event: UK FCA to permit retail crypto ETN access by 2025.

- Derivatives ban continues for retail investors.

- Approval applies to ETNs on select UK exchanges only.

The UK Financial Conduct Authority (FCA) will lift its ban on retail access to cryptocurrency exchange-traded notes (ETNs) on October 8, 2025, facilitating broader market participation.

This regulatory change marks a pivotal shift, aligning UK retail crypto policies with global standards, and could stimulate increased market activity while retaining restrictions on riskier derivatives.

FCA to Allow Retail Crypto ETNs by October 2025

The UK FCA is set to reverse its 2021 prohibition on retail cryptocurrency ETNs, effective October 8, 2025. Businesses will soon enable retail access to crypto ETNs through FCA-approved UK exchanges, such as the London Stock Exchange. The announcement indicates market maturity and enhanced regulatory frameworks guiding retail participation. Retail investors are to benefit from this regulatory change by legally accessing cryptocurrency ETNs, traditionally restricted to institutional investors. Enhanced risk controls and rigorous disclosures will accompany the new measures, maintaining investor protection standards.

Despite allowing ETNs, the FCA maintains its ban on crypto derivatives for retail clients, citing volatility concerns. Key statements and industry feedback emphasize continued caution.

“The market has matured beyond the need for blanket restrictions […] broader access must come with robust investor education and clear disclosures.” — Bivu Das, General Manager, Kraken UK

Crypto Market Implications and Historical Context

Did you know? The FCA’s 2021 ban on retail crypto ETNs came amidst global caution toward volatile digital assets, a common practice paralleled by three major regions—US, EU, and Asia—for similar high-risk investments.

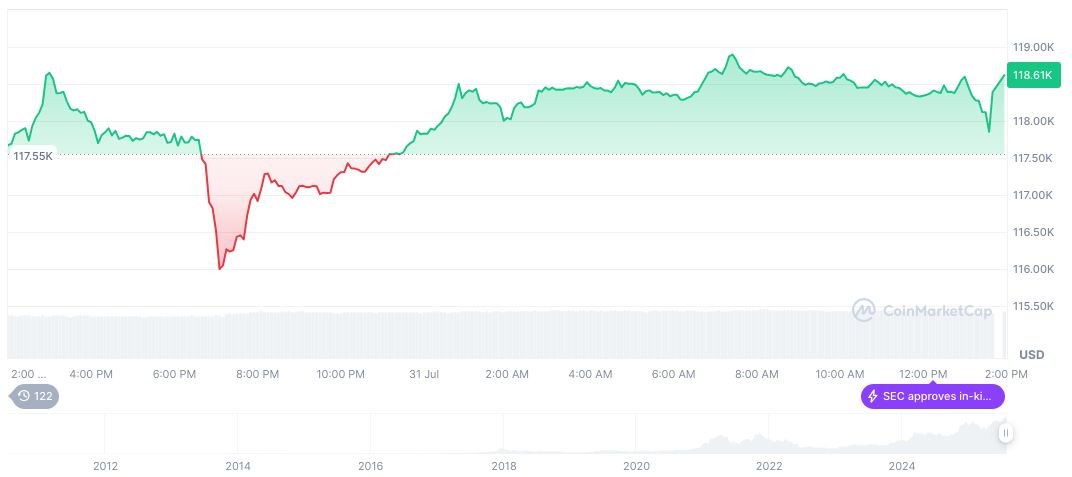

Bitcoin (BTC), valued at $115,232.71, has a market dominance of 61.13% and a market cap nearing $2.29 trillion, as per CoinMarketCap. Recent 30-day gains reach 7.19%, while a 20.08% rise is noted over 90-days despite a 2.63% dip in 24-hours. The current circulating supply is 19.90 million against a maximum of 21 million.

Coincu’s research team suggests significant evolution in financial regulation with the allowance of retail ETN access, predicting potential increased trading volumes on approved exchanges. Enhanced disclosure might stabilize retail markets, but governed access ensures controlled exposure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/fca-lifts-retail-crypto-etn-ban/