In crypto and finance in general, where things change fast, many investors face many challenges, but one of the biggest challenges is inflation.

As the Nobel laureate Milton Friedman once pointed out, this economic factor can quietly eat away the value of money – and it happens without anyone passing a law. This hits crypto HODLers hard, and usually, they don’t even realize it.

Now, in the crypto market, where digital currencies like Bitcoin and others are the stars, HODLers need ways to protect their money from losing value, and that’s where crypto savings accounts come into play.

In this article, we’re going to explore what these crypto savings accounts are, how they work, and reveal the top 5 ones that are catching our attention in 2024.

So, if you’re curious about how people beat inflation’s challenges in the crypto world, stick around – we’ve got some interesting insights for you.

What are Crypto Savings Accounts?

A crypto savings account is a financial service that allows you to deposit your cryptocurrency, letting you accrue or earn interest on it.

Basically, it’s a fusion of longstanding banking practices with the developing crypto industry. These savings accounts work similarly to a bank savings account, but they use cryptocurrency instead of fiat currency.

Typically, a crypto savings account earns interest on the deposited holdings on a daily basis (but not always, as some platforms offer monthly or even more rarely), delegation upon the terms and conditions stipulated by the exchange or platform providing this financial product.

Other terms associated with cryptocurrency savings accounts include crypto deposit accounts, crypto interest accounts, crypto yield accounts, or crypto earn accounts.

How Do Crypto Savings Accounts Work?

As we already said, crypto savings accounts work similarly to traditional savings accounts.

That means that users typically move their digital assets from their crypto wallets into a crypto savings account.

When they deposit the cryptocurrency into a crypto savings account, the depositor grants permission for their funds to be lent out in pursuit of yield.

From this point, the exchange or the platform you chose uses different methods to make money, such as:

- The platform lends it out to borrowers who need it to make purchases, trade other cryptocurrencies, or hedge their investments. The platform then keeps a portion of the interest payments made by borrowers and shares the rest with you, the depositor.

- The platform generates yield through blockchain-based staking. In this process, users’ funds contribute to the security of crypto networks using a proof-of-stake consensus mechanism, earning new coins as a reward, which are then shared with the depositor.

There are also more methods than that, but these two are the most well-known and widely used.

Also, regarding the interest earned by the depositor, this interest can be affected by market conditions, overall demand for loans on the platform, and the specific terms set by the platform or exchange.

Moreover, some crypto savings accounts offer fixed interest rates, while others provide variable rates that may change based on market dynamics.

The Most Important Benefits of Crypto Savings Accounts

High-Interest Rates

Crypto savings accounts typically offer interest rates significantly higher than traditional savings accounts. This is because cryptocurrency is still a relatively new and volatile asset class, and lenders are willing to pay higher rates to attract depositors.

For example, some crypto savings accounts offer crypto interest rates of up to 10% annual percentage yield (APY) or more.

Diversification

Cryptocurrencies are a relatively new asset class, and their value can be quite volatile. However, the value of cryptocurrency tends to move independently of the value of other asset classes, such as stocks and bonds. This makes cryptocurrency a good asset to include in a diversified investment portfolio.

By holding some of your assets in cryptocurrency, you can reduce your overall portfolio risk. This means that if the value of one of your asset classes goes down, the value of your cryptocurrency holdings may not be affected as much.

Passive Income

Crypto savings accounts can earn passive income on your crypto holdings. This means you can earn interest without actively managing your investments. This can be a great way to generate additional income, especially if you are uncomfortable with day trading or other active trading strategies.

All you need to do is deposit your cryptocurrency into a cryptocurrency savings account and let it sit there. You can earn interest on a daily, weekly, or monthly basis, and you can withdraw your funds at any time.

Accessibility

Crypto savings accounts are becoming increasingly accessible to investors. Many platforms now allow you to open an account and earn interest with just a few clicks. This makes it easy for anyone to get started with crypto savings accounts, even if you are not tech-savvy.

Compound Interest

Crypto savings accounts often offer compound interest, which means you earn interest not only on your initial deposit but also on the interest you have already earned. This compounding effect can significantly accelerate the growth of your asset holdings over time.

For example, consider an initial deposit of $1,000 with an annual interest rate of 5%. With simple interest, you would earn $50 per year. However, with compound interest, you would earn more like $51.26 in the first year and even more in subsequent years as the interest you earn is reinvested.

Risks to Consider When You Choose a Crypto Savings Account

Market Volatility

Cryptocurrencies are known for their unpredictable price swings, which can make them a risky investment. This volatility can affect your crypto savings account in two ways:

- Decline of interest earnings – If the price of your cryptocurrency declines, the value of your holdings will also decline. This means that the interest you earn on your crypto savings account may not keep pace with the depreciation of your holdings, and you could even lose money.

- Unrealized losses – If the price of your cryptocurrency falls sharply, you could face unrealized losses, which means that the value of your holdings is less than what you originally invested.

Lack of FDIC Insurance

Most traditional savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000. If your bank fails, you will be reimbursed for your losses up to the insured amount.

Crypto savings accounts, on the other hand, are usually not insured. If your platform goes bankrupt or is hacked, you could lose your entire investment.

Counterparty Risk

When you deposit your cryptocurrency into a crypto savings account, you essentially lend it to the platform. The platform then uses your cryptocurrency to generate returns by lending it to other borrowers. However, there is always a risk that the platform will not be able to repay you in full or at all.

Security Risks

Crypto savings platforms are attractive targets for hackers because they hold large amounts of cryptocurrency. If a platform’s security is compromised, your cryptocurrency could be stolen.

That’s why choosing a platform with strong security measures in place, such as multi-factor authentication and cold storage, is important.

Regulatory Risks

The cryptocurrency industry is still relatively new and unregulated. This means that there is a risk that governments could impose new regulations that negatively impact crypto savings platforms.

Crypto Savings Accounts vs. Traditional Savings Accounts vs. Crypto Wallets: In a Nutshell

Top 5 Crypto Savings Accounts You Should Give a Chance This Year

Now that you understand what these crypto savings accounts entail – their functions, advantages, and potential risks – let’s explore the cream of the crop in the realm of crypto savings.

Our expert team meticulously curated this list, factoring in key elements such as reputation, APY rates, user-friendliness, supported cryptocurrencies, security, and more.

Based on that, here’s the rundown of our top picks:

- Coinbase;

- Binance;

- YouHodler;

- Nexo;

- Uphold.

To gain a deeper insight into each of these platforms, read on for detailed explanations below:

Coinbase

Our top choice when it comes to selecting a crypto savings account that we trust and consider great is the one from Coinbase.

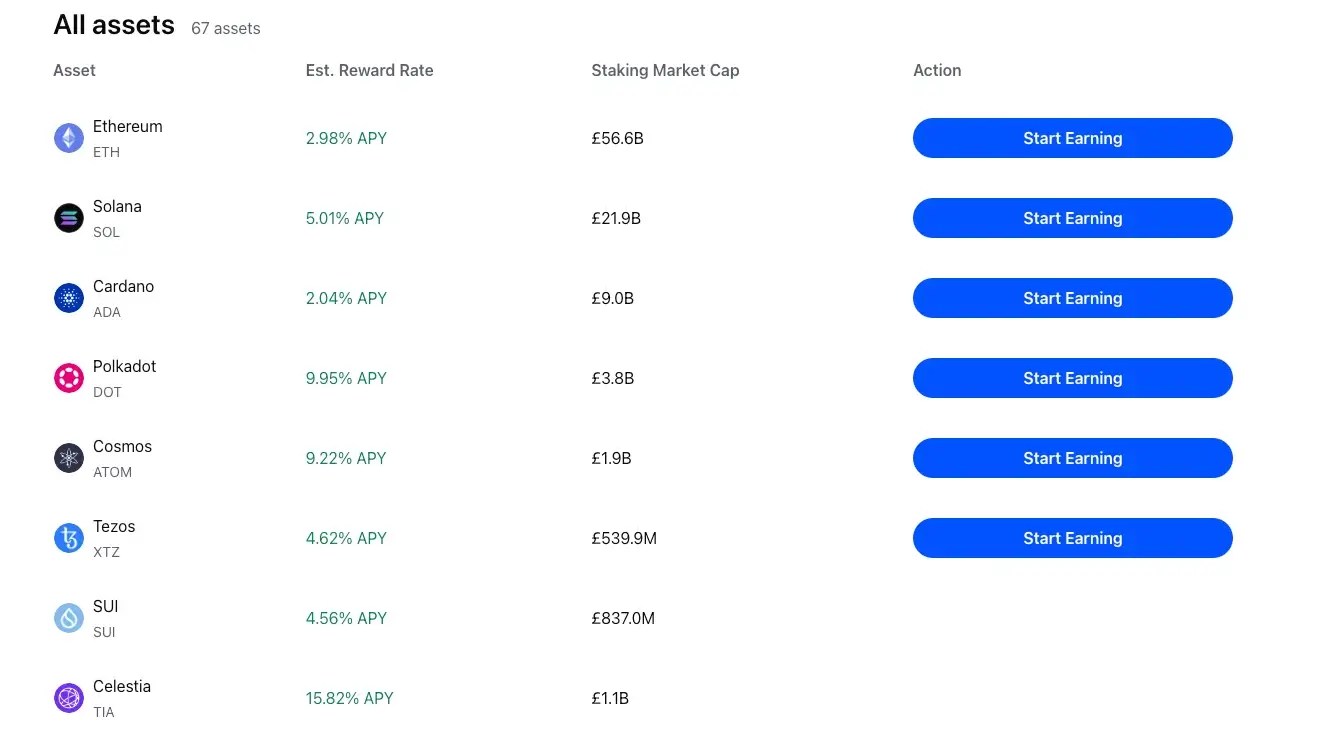

Coinbase is a major cryptocurrency exchange that provides a staking service called Coinbase Earn, enabling users to earn returns on their digital assets by contributing to the security of blockchain networks and receiving rewards.

Through Coinbase Earn, users can enjoy a 2.98% AP\Y on staked Ethereum, 5.01% on Solana, and potentially up to 10% on other widely staked assets. The availability of staking assets varies by region, and the rates are determined by the estimated protocol rate at the time, subject to possible changes.

In addition to staking services, Coinbase is directly collaborating with Circle, the issuer of the USDC stablecoin. Coinbase offers a loyalty program with a 5.10% yield for those holding USDC on their platform. Importantly, this yield is not generated through lending or staking but is funded by Coinbase’s own resources. While this rate can also change, it may present a more secure option for stablecoin investors seeking yield without the associated risks of lending.

Binance

Being the world’s largest crypto exchange, Binance provides various financial products, including a crypto savings account, and based on our research, we consider this savings account the second on our top.

Through Binance Earn, users have various ways to earn returns on their cryptocurrency holdings, including staking and lending. Additionally, users can participate in Binance’s Launchpool to receive rewards by locking their assets in decentralized finance (DeFi) liquidity pools.

Binance’s crypto savings account also features Dual Investment products, allowing users to lock their crypto and automatically execute “Buy Low” or “Sell High” actions if the asset’s price crosses a specific point on a pre-determined date. Users retain their assets and continue to earn yield if the price doesn’t reach the specified threshold.

For example, using a Binance crypto savings account with Ethereum (ETH) staking, you can earn between 0.84%-131.47% yield at the time of writing, based on what you opt for (Simple Earn, ETH Staking, or Dual Investment).

YouHodler

The only reason why we didn’t choose YouHodler as the best crypto savings account was related to the popularity and safety that Coinbase and Binance offer. If Coinbase and Binance didn’t exist, YouHodler would be our top choice.

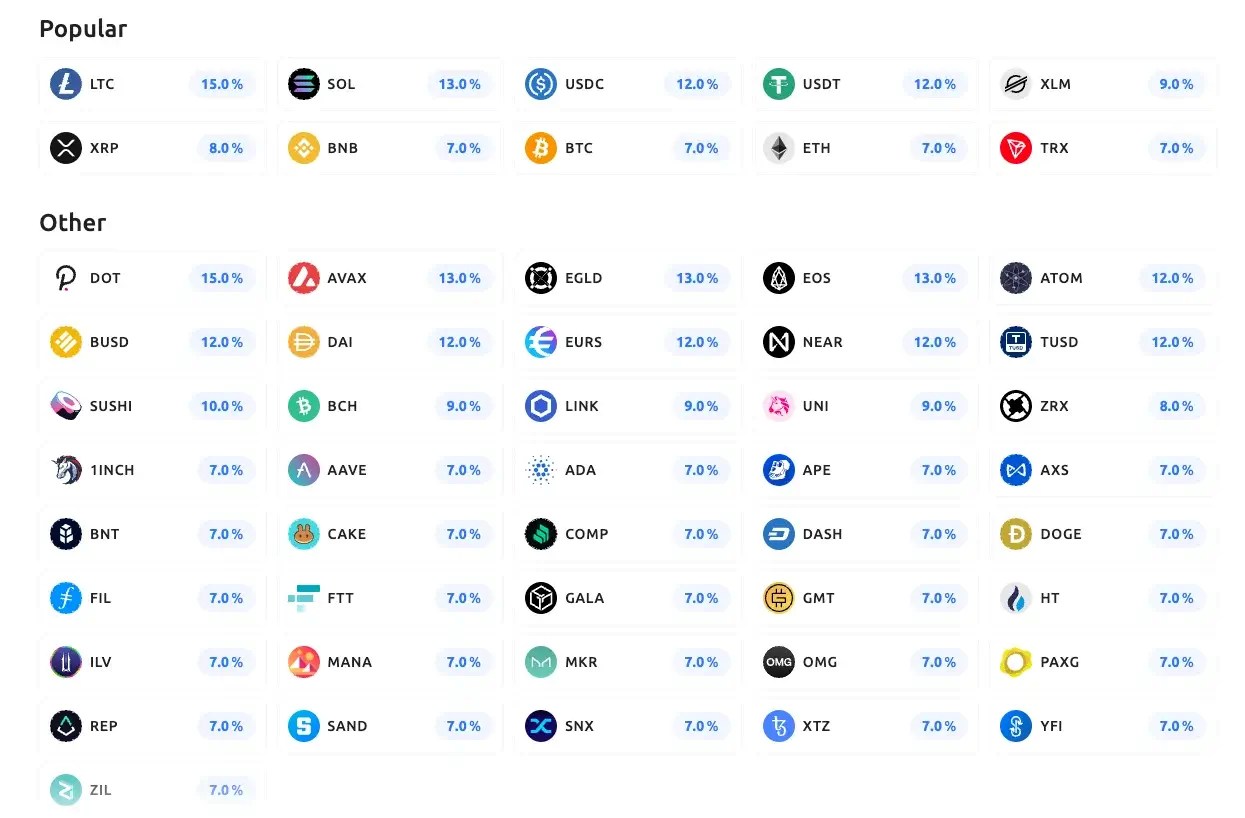

And that’s because YouHodler is not just a crypto exchange but also a high-interest rate crypto savings account. The platform supports over 55 top crypto assets for both saving and borrowing, including the most popular ones.

As you already understand, what makes YouHodler stand out is its competitive rates in the crypto savings market, offering up to 15% APY on different crypto and stablecoins.

To generate yield, YouHodler lends out user funds, requiring a minimum deposit of $100. The platform also facilitates crypto loans to customers, funded by depositors to its savings account.

The platform prioritizes security by partnering with reputable third parties. Elliptic, a blockchain security firm, conducts on-chain monitoring and risk assessment. Additionally, Ledger and Arch UK Lloyds of London syndicate safeguard customer funds and provide insurance against crime, enhancing the overall security measures of YouHodler.

Nexo

Nexo is another crypto savings account provider that gives you high interest on your crypto, but this time with short lockup periods, usually less than 24 hours.

With Nexo, you can save and earn interest on over 39 crypto assets, including popular ones like Bitcoin, Ethereum, USDT, USDC, Avalanche, Polygon, and Polkadot. For example, if you go with Ethereum, you can earn up to 8% interest, and if you keep USDC, you can earn up to 14%.

While Nexo pays out interest every day, there’s a limit on how often you can take money out. Users can make withdrawals 1-5 times each month.

Nexo lets users borrow crypto at lower rates compared to other platforms. The rates start from 0% as long as borrowers keep the loan-to-value ratio under 20%.

Nexo is our fourth choice because it had to pause its Earn product in the United States last year due to regulatory issues.

Uphold

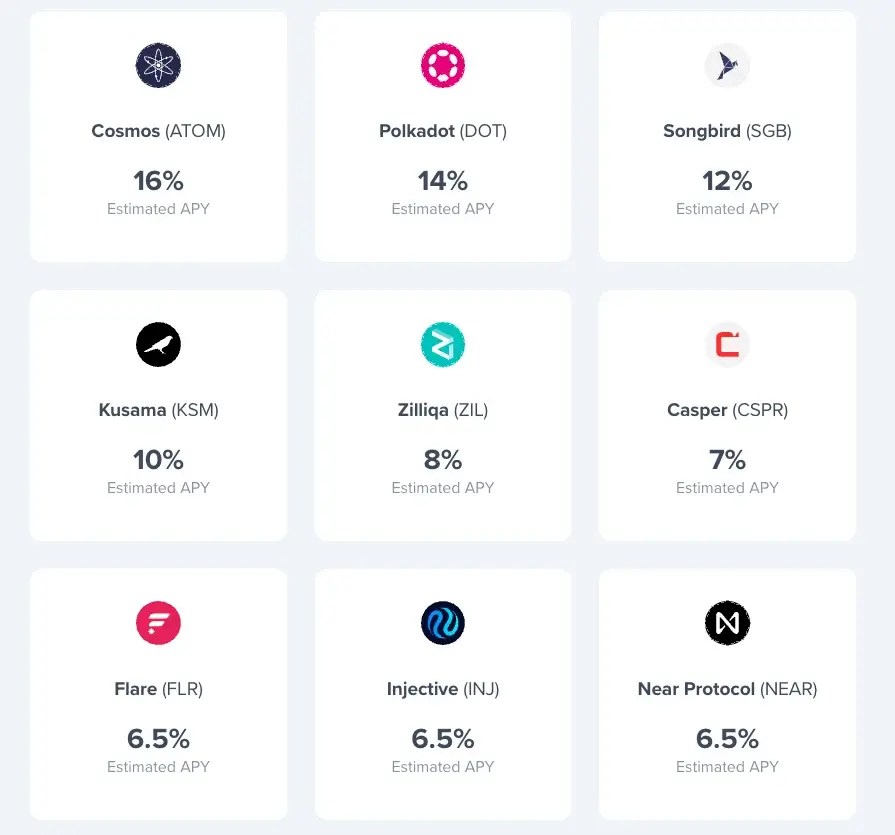

Uphold is an app that bundles crypto trading, forex trading, and crypto savings all in one place. On Uphold, you can stake over 15 cryptocurrencies in order to earn rewards.

Unlike traditional savings accounts, Uphold doesn’t make money by lending out your crypto. Instead, it stakes your crypto inside the relevant blockchains to earn token rewards. This method generally makes Uphold less risky but, at the same time, not as fruitful as the other platforms we already mentioned, as not all cryptos can be staked.

The rewards you earn from staking depend on the token. More stable cryptos like Ethereum might offer a 4.25% APY, while more volatile ones could go up to 16% APY.

FAQ

What are the Best Crypto Savings Accounts?

Based on our research, consider platforms like Coinbase, Binance, YouHodler, Nexo, and Uphold for reliable crypto savings accounts. These platforms offer features such as staking, competitive APY rates, and support for various cryptocurrencies, providing users with options to safeguard and potentially grow their holdings in the crypto market.

Is It a Good Idea to Keep Your Savings in Crypto?

While holding savings in well-established cryptocurrencies like Bitcoin, often referred to as “blue-chip,” can yield profits over the long term, it’s essential to note that crypto savings lack the backing of institutions like the FDIC, which secures cash deposits in banks. That’s why every potential investor must be mindful of the risks of keeping their savings in the crypto.

Conclusion

Navigating the complexities of the financial world presents challenges, but as an investor, safeguarding against potential risks is essential, and the most important, it’s possible. For that, you can use crypto savings accounts – a tool to fortify your financial position.

While they don’t promise extraordinary returns, one undeniable benefit is their ability to mitigate the impact of inflation.

Our article aims to provide insights and assistance in understanding these accounts, empowering you to make informed decisions in the ever-evolving finance landscape, so it should not be taken as financial advice. We trust that our information has proven valuable in your journey.

* The information in this article and the links provided are for general information purposes only

and should not constitute any financial or investment advice. We advise you to do your own research

or consult a professional before making financial decisions. Please acknowledge that we are not

responsible for any loss caused by any information present on this website.

Source: https://coindoo.com/crypto-savings-accounts/