In this article we will delve into everything you need to know about cryptocurrencies and blockchain technology.

Cryptocurrencies are digital currencies that rely on blockchain technology and are primarily used to transfer value between two users through peer-to-peer solutions that can maintain privacy between the parties involved.

When talking about cryptocurrencies, reference is made to the notion of financial freedom since in this fascinating world there are no central financial entities controlling the exchange of value.

Let’s look in more detail at what cryptocurrencies consist of

Everything there is to know about cryptocurrencies: what are they and what does blockchain have to do with them?

A cryptocurrency is a form of cryptographic digital cash which works through the blockchain, which is a distributed digital ledger accessible by all members of the network.

This ledger is immutable: every cryptocurrency transaction made by users is recorded on this database and can no longer be deleted.

Although the use of cryptocurrency may maintain the privacy of those who use it, the blockchain is instead generally public ( unless it is a private blockchain, such as Amazon‘s). This is why crypto assets are pseudo-anonymous (they are anonymous until the wallet address is made public)

The first cryptocurrency to be created, which is also the best known and most market-capitalized, is Bitcoin.

Bitcoin was born in 2008 from an invention of Satoshi Nakamoto, a pseudonym of an individual or group of people, who virtually spread the concept of Bitcoin in an online blog, publishing the famous document: “Bitcoin: A Peer-to-Peer Electronic Cash System.”

From there on, cryptocurrencies have become increasingly popular and increasingly used in every part of the planet, especially in those countries where there is no strong central currency that can meet the needs of citizens.

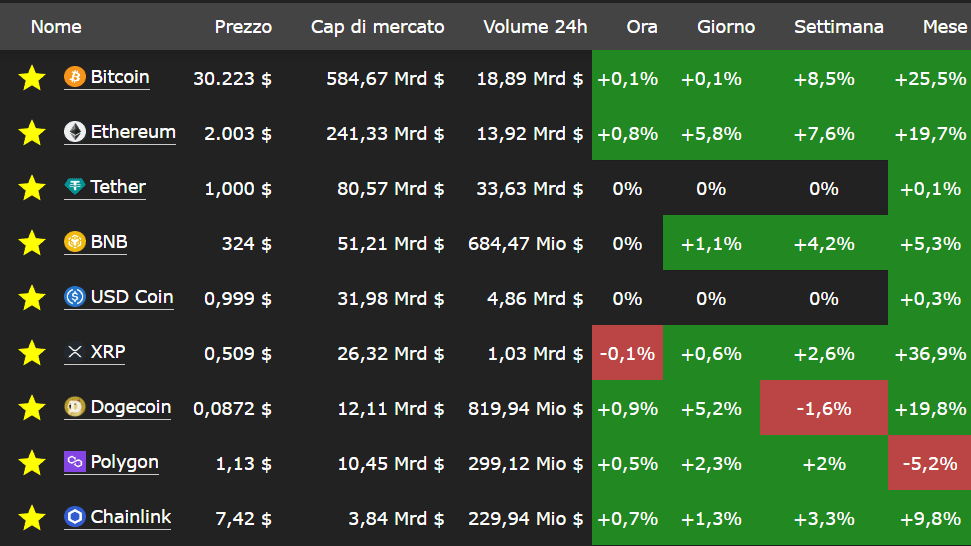

To date, there are more than 23 thousand cryptocurrencies, and the whole sector is worth about $1.2 trillion ($1,200 billion), though in the past it has reached as high as $3 trillion.

The most popular cryptocurrencies besides Bitcoin are Ethereum, Tether, BNB coin, USD Coin, Ripple, Polygon, Dogecoin, and Chainlink.

What makes cryptocurrencies really special?

The very fact that anyone is free to use them to transfer money anywhere in the world without having to account to a central bank (or more generally to a financial intermediary) that controls the currency we are using and the flows in and out of our account.

This is why when we talk about crypto we refer to the ideology of financial freedom: because cryptocurrencies are available to everyone and free those who use them from any kind of control.

Everything you need to know about cryptocurrencies: the difference between token and coin?

Cryptocurrencies are distinguished into tokens and coins.

We refer to a token when we are dealing with a cryptocurrency that does not have its own blockchain, but rather was created by harnessing another existing blockchain.

Instead, we refer to the term coin when a cryptocurrency uses its own digital database distributed among the various nodes in the network.

This detail does not preclude anything about the success or failure of a token, in fact there are tokens that have made history in crypto, such as Tether and Dogecoin, and coins that have fallen into ruin, such as Luna (as of today it is called LUNC)

For each token there is a “contract address,” or an address that users can use as reference data to “find” the cryptocurrency in any application that uses the blockchain on which the token itself runs.

For example, this is the Tether (USDT) contract on the Ethereum blockchain:

0xdac17f958d2ee523a2206206994597c13d831ec7

It is important to understand that for each cryptocurrency (including coins) there can be multiple smart contracts, as they can run on multiple blockchains.

To see which blockchain each cryptocurrency runs on, people can check CoinMarketCap by clicking on the “more” drop-down menu, like in the image below.

How do you buy cryptocurrencies? Centralized or decentralized exchanges?

To buy cryptocurrencies there are several more or less simple solutions depending on the needs of the individual.

The easiest way to buy crypto is to rely on centralized service providers such as Binance, Coinbase, Kraken or Bitget.

These are exchanges, i.e., trading desks where it is possible to buy digital currencies without having any expertise in the field.

Purchases and sales are governed by a mechanism called the “order book” in which all orders are executed according to certain conditions requested by users

These kinds of centralized solutions involve registration through procedures that undermine our privacy such as KYC.

In addition, when using a centralized exchange it is necessary to keep in mind that the user does not have pure financial freedom because he is relying on an intermediary.

There are many cases in the history of cryptocurrencies where exchanges have blocked users from withdrawing their virtual coins. The most recent are those of FTX and The Rock Trading.

If, on the other hand, you want to be in full possession of your crypto assets at all times, the best solution is to rely on DEXs, which are decentralized exchanges that allow you to buy and sell cryptocurrencies completely independently and without having to provide your personal information (there are also centralized versions that do not require KYC registration, such as Relai).

In this case, trades are governed by an “automated market maker” (AMM) that manages the free trading of cryptocurrencies through a simple equation: X*Y=K

Decentralized exchanges are generally more difficult to use than their centralized competitors: they require the user to have a good knowledge and familiarity with the use of cryptocurrencies, as well as to be in possession of a non-custodial wallet.

How are cryptocurrencies stored? The differences between various wallets: everything you need to know about them

Cryptocurrencies can be stored in wallets, i.e., crypto wallets that differ from each other based on certain characteristics.

First of all, it is important to understand that whatever method you want to use, there is a public key and a private key in each cryptocurrency wallet.

To simplify, the public key is used to receive money and hence can be shared without any particular problem (unless you want to maintain privacy), while the private key serves as a “secret password” to sign transactions on your wallet.

YOU SHOULD NEVER DISCLOSE THE PRIVATE KEYS OF YOUR WALLET!

Hence comes the famous saying, “Not your keys, not your coins.”

That said, the easiest way is to deposit digital currencies on custodial wallets owned by centralized exchanges. This way, each user will have a dashboard with all of his or her wallet information at his or her disposal.

The only thing that is not available in this case is the private key, because effectively those who custody crypto on centralized exchanges are not in possession of such assets but only have a claim against the platform (what happens in traditional banks).

There are, however, more complex but at the same time more secure methods of holding cryptocurrencies and being in possession of the relevant private key to sign transactions.

These are the non-custodial wallets, which are software or hardware that act as a digital safe for our crypto assets.

This kind of wallet is what is required to get in touch with decentralized exchanges and operate in total autonomy.

As mentioned in the previous paragraph, managing these devices is by no means simple, especially for novice users.

It is considered appropriate to begin one’s journey in the world of cryptocurrencies by initially leaning on centralized service providers, and then slowly experiencing the thrill of financial freedom on the blockchain.

Source: https://en.cryptonomist.ch/2023/04/15/everything-you-need-to-know-about-crypto/