- As of press time, dYdX was the second best performing coin by gains.

- Approximately $1 million worth of DYDX was liquidated at $1.18 on Binance.

dYdX [DYDX] has experienced a remarkable breakout, gaining over 38% in the last 24 hours. This strong surge has positioned it as second best performer among cryptos in the top 100 by market capon CoinMarketCap.

With its protocol’s fees being distributed mainly to stakers in USDC, dYdX continues to attract attention as a crypto to accumulate, especially as the market heads into what is anticipated to be a bullish final quarter of the year.

dYdX price action and prediction

Trading at $1.24 at press time, DYDX saw a trading volume surge of over 892%, reaching approximately $130 million in 24 hours. The volume-to-market cap ratio stands at 11%, indicating a high level of liquidity, reducing the risk of significant price fluctuations in the near term.

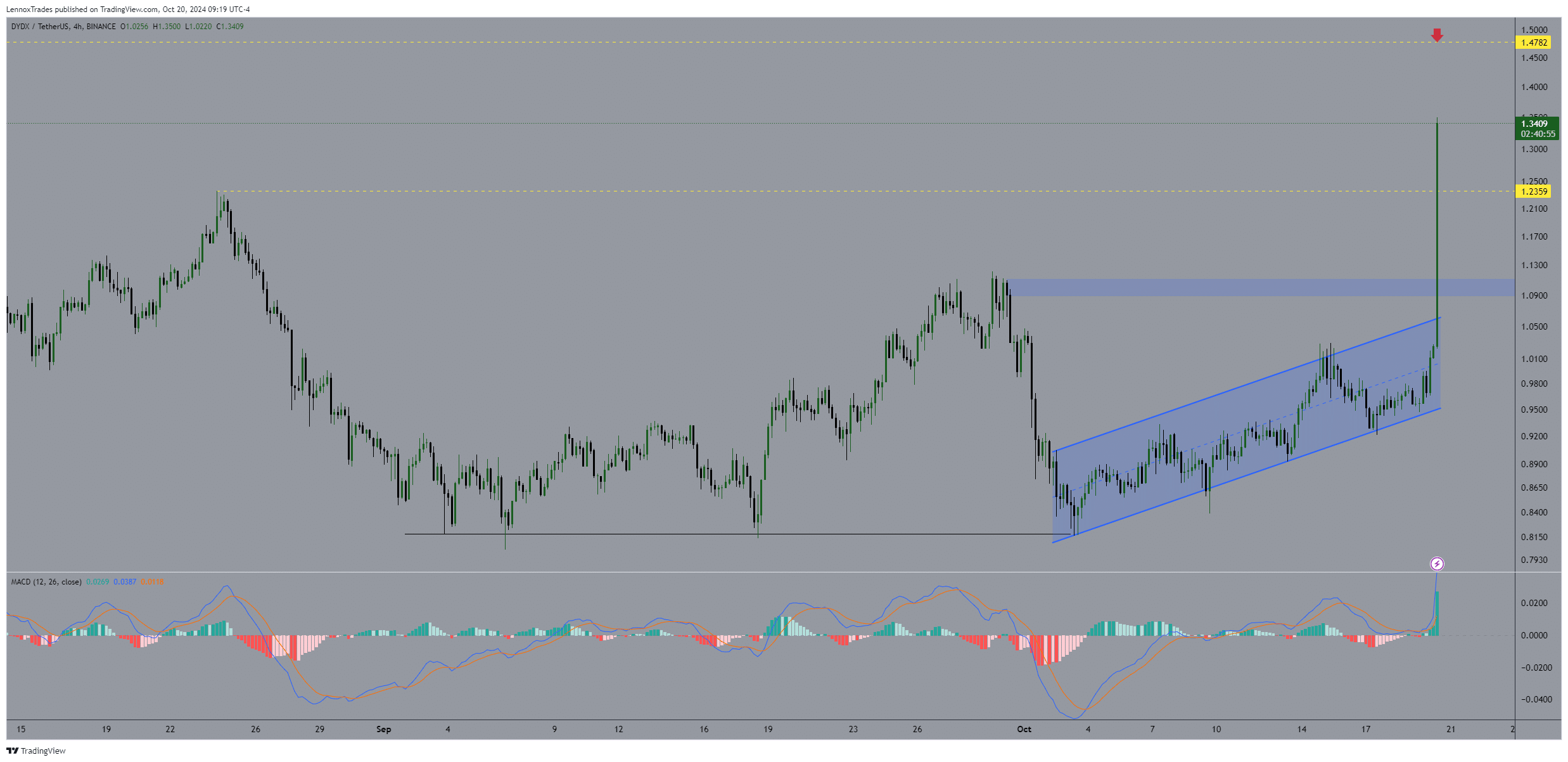

In terms of price action, it has broken out of an ascending triangle, leading to its impressive gains. The DYDX/USDT pair continues to break through resistance levels, potentially setting its sights on the $2 mark before the month ends.

While DYDX is still down 48% for the year, today’s breakout could signal a reversal if it can hold above the $1.4 level, paving the way for the $2 target to be hit.

Source: TradingView

The $0.83 support level, tested four times without breaking, has proven to be the bottom for this cycle, indicating a potential bullish trend leading into 2025. The MACD indicator has also flipped bullish, further supporting the case for higher prices.

Liquidation and open interests

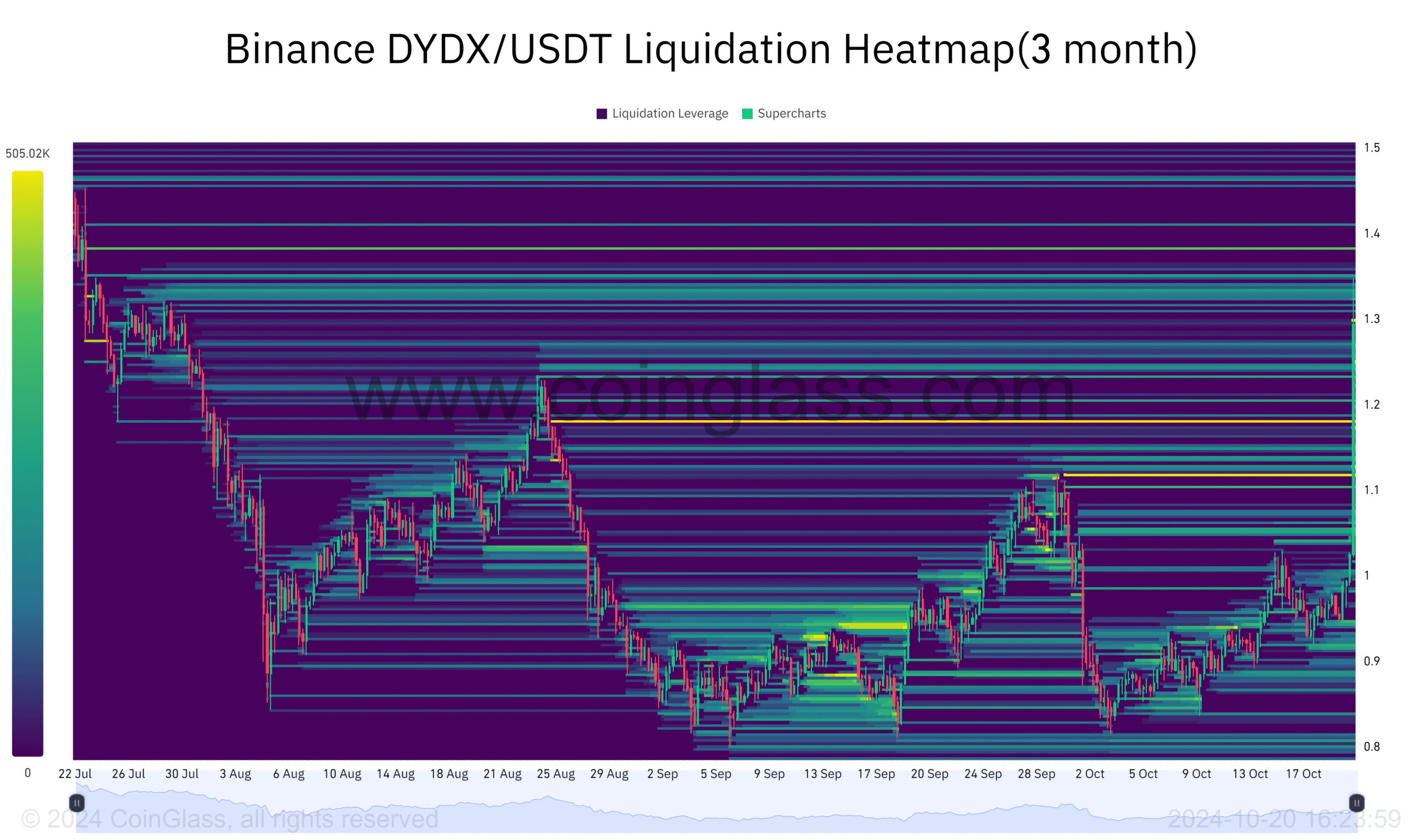

In addition, the liquidation heatmap shows DYDX’s price moving toward high liquidity zones, causing significant liquidations.

As of press time, traders liquidated around $1 million worth of DYDX at $1.18 on Binance. The price action of the L1 token is now targeting $1.3 zone for the next liquidation.

As liquidity increases above current levels, DYDX’s price will likely follow, reinforcing a bullish outlook for year-end. This makes the $2 target realistic.

Source: Coinglass

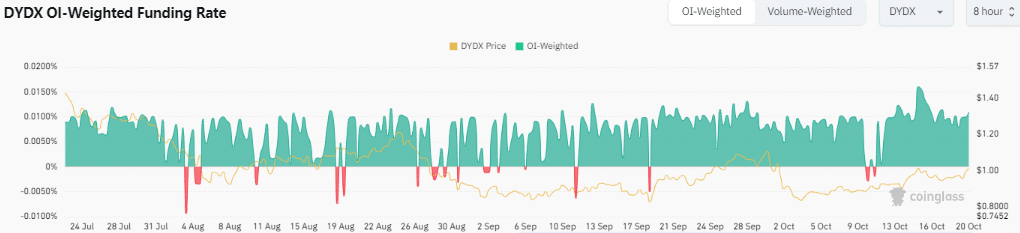

In terms of open interest, the OI-weighted funding rate stands at 0.0109%, indicating that long traders are paying shorts.

Realistic or not, here’s DYDX market cap in BTC’s terms

This positive rate suggests that holders are confident in the token’s future, with increased interest in buying and holding the chain’s token.

Source: Coinglass

DYDX shows strong market momentum, supported by favorable technical indicators and growing liquidity, positioning it for gains by year-end.

Source: https://ambcrypto.com/dydx-crypto-soars-38-in-24-hours-key-metrics-point-towards-2-target/