- DOJ seeks forfeiture of over $225.3M in crypto linked to fraud.

- Significant impact on Tether and the broader cryptocurrency market.

- Potential increase in regulatory scrutiny and compliance requirements.

The U.S. Department of Justice has filed a civil forfeiture suit to seize more than $225.3 million in cryptocurrencies linked to investment fraud, as reported on June 18 in Washington, D.C.

This action underscores the DOJ’s commitment to fighting crypto-related fraud, leveraging blockchain analysis to address illegal activities. The move is intended to reassure markets of regulatory interventions aimed at protecting investors.

Impact on Tether and Cryptocurrency Market

More than $225.3 million in cryptocurrencies has been targeted by the DOJ’s civil suit, which alleges these assets are associated with theft and laundering. Blockchain analysis revealed a complex network, resulting in the largest crypto seizure to date by the U.S. Secret Service. The DOJ, led by Matthew R. Galeotti, emphasizes public protection and fund recovery for victims.

In the short term, this action disrupts exchange liquidity, especially involving assets such as Tether (USDT) that have been identified as central to the fraud scheme. The civil forfeiture process aims to return these funds to victims, with over 400 investors noted as affected.

“Today, we have filed a civil forfeiture complaint to seize over $225 million in cryptocurrency linked to investment fraud scams. This action demonstrates our commitment to pursuing and recovering funds for victims of these complex fraudulent schemes,” said Matthew R. Galeotti, Head of Criminal Division, DOJ.

Outlook on Regulatory Framework and Market Response

Did you know? The $225 million crypto seizure by the U.S. Secret Service is a record-breaking operation, highlighting the escalating scale of regulatory actions against cryptocurrency fraud.

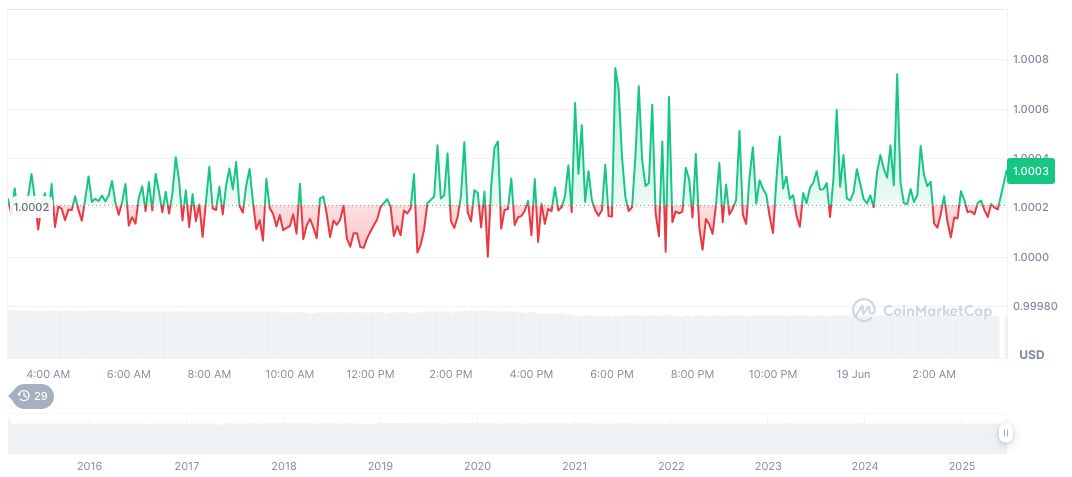

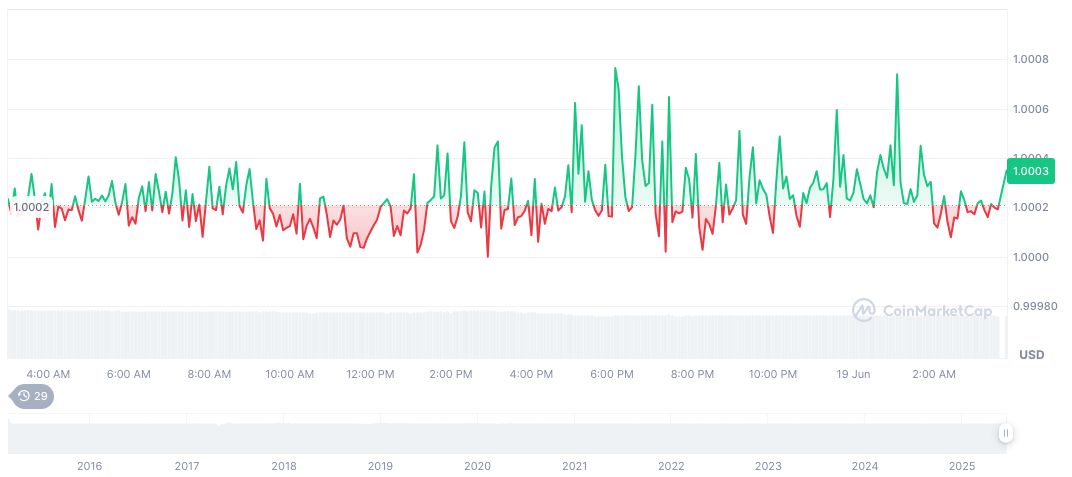

According to CoinMarketCap, Tether’s price remains constant at $1.00, with a market cap of $155.62 billion and a 24-hour trading volume of $73.15 billion. Notably, Tether’s price had a 24-hour increase of 1.65%, showing resilience amid these events.

The Coincu research team suggests potential shifts in regulatory frameworks following the scale of this civil forfeiture. Regulatory scrutiny might increase across digital asset markets, prompting exchanges to enhance compliance protocols. This could lead to tougher AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements for stablecoin transactions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344171-doj-seize-225m-crypto-fraud/