- The consolidation phase has officially ended.

- DIA is poised to multiply in value, and investors could examine opportunities to buy.

DIA [DIA] has had a strong performance in recent weeks. The $127 million market cap asset has persisted through the bear market since 2022 and has hugged the $0.35 support zone since May 2022.

The breakout past the $0.81 and the $1 levels was a notable development. This breakout past the highs from March signaled that the token has ended its consolidation phase of the bear market.

Chances of a northward price expansion look good

Source: DIA/USDT on TradingView

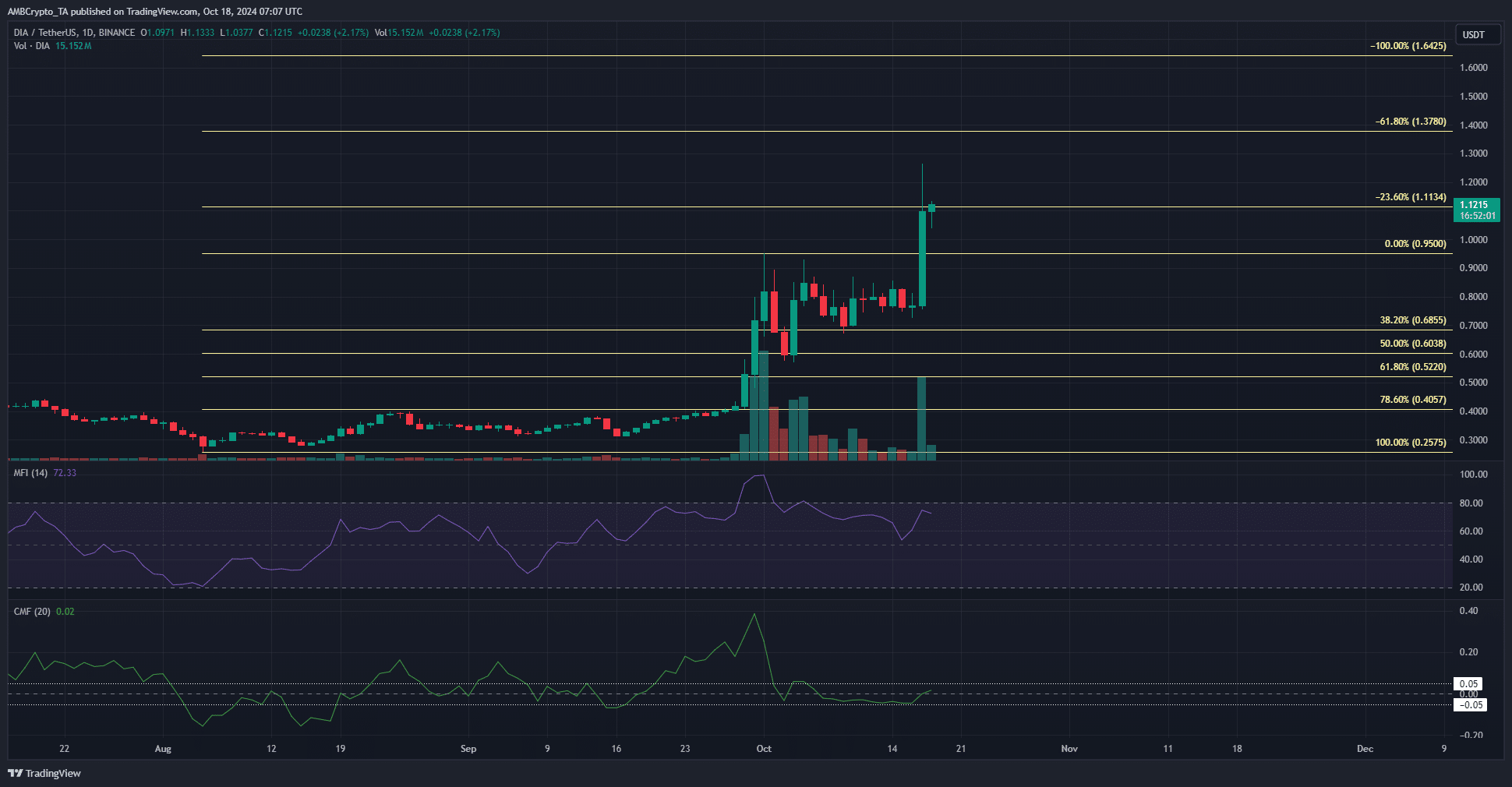

The Fibonacci extension levels were plotted based on the rally DIA crypto saw since August. This rally rapidly gained momentum toward the end of September, when the token 134% in three days before falling lower.

At press time, the 23.6% extension level at $1.11 was under siege. It is possible that DIA bulls would drive prices higher. In the event of a rejection, a price dip to $0.95-$1 could offer a buying opportunity.

The RSI signaled strong bullish momentum but the CMF was only at +0.02, showing buying pressure was positive but not high. Further north, the $1.37 and $1.64 levels could serve as the next resistances.

Short-term bullish sentiment goes bonkers

Source: Coinalyze

On the morning of 17th of October, the Open Interest was at $3.4 million while DIA traded at $0.79. Six hours later, the price was at $1.12 and the OI at $24 million. This influx of OI underlined a speculative frenzy.

Realistic or not, here’s DIA’s market cap in BTC’s terms

The spot market saw a strong move higher, but the vast OI increase in 24 hours could see high volatility for the token. Investors and traders should exercise caution and be more stringent with risk management.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Source: https://ambcrypto.com/dia-crypto-rises-42-5-in-a-day-smashes-past-1-what-now/