| Key Points: – DeFi TVL drops by $48.9 billion, marking a 27.5% decline in Q1/2025. – Ethereum leads the downturn, losing $40B in TVL as ETH price plunges. – Memecoin hype collapses after rug pulls, shaking investor confidence. – Bitcoin gains market dominance despite underperforming traditional assets. |

DeFi TVL drops sharply in Q1/2025 as altcoins plunge, memecoin mania fades, and market optimism under President Trump gives way to macroeconomic stress.

DeFi TVL Drops as Market Optimism Quickly Fades

Q1/2025 began with high expectations following Donald Trump’s re-election and promises of crypto-friendly policy. Yet, those hopes were quickly overshadowed by global trade tensions and fading investor confidence.

According to CoinGecko, DeFi TVL dropped by $48.9 billion, plunging from $177.4 billion at the end of 2024 to just $128.6 billion by March – a staggering 27.5% decline. This steep fall was primarily driven by a broad correction in altcoin prices rather than mass withdrawals.

The broader crypto market also felt the pain, with total capitalization slipping 18.6%, losing $1 trillion in value from a high of $3.8 trillion. This was the lowest market cap recorded in the last three years.

Ethereum and Altcoin Ecosystems Take a Major Hit

The DeFi TVL drop was most pronounced on Ethereum, the leading smart contract network. ETH fell from $3,336 to $1,805, wiping out all of its 2024 gains. As a result, Ethereum’s DeFi TVL contracted 35.4%, or around $40 billion, shrinking its market share from 63.5% to 56.6%. Other major ecosystems, such as Solana and Base, also saw TVL drops of 23.5% and 15.3%, respectively.

However, one notable exception was Berachain, a newcomer that surged to $5.2 billion in TVL, becoming the sixth-largest DeFi chain by the end of March. Still, this outlier did little to offset the broader downturn in DeFi.

Memecoin Craze Crashes After LIBRA Rug Pull

The collapse in altcoins was mirrored in the memecoin segment. Platforms like Pump.fun saw daily token creation drop by 56.3%, following the spectacular implosion of LIBRA, a politically themed memecoin inspired by Argentina’s president, Javier Milei. LIBRA investors reportedly lost $251 million in a rug pull, triggering a broader sentiment collapse in the meme sector.

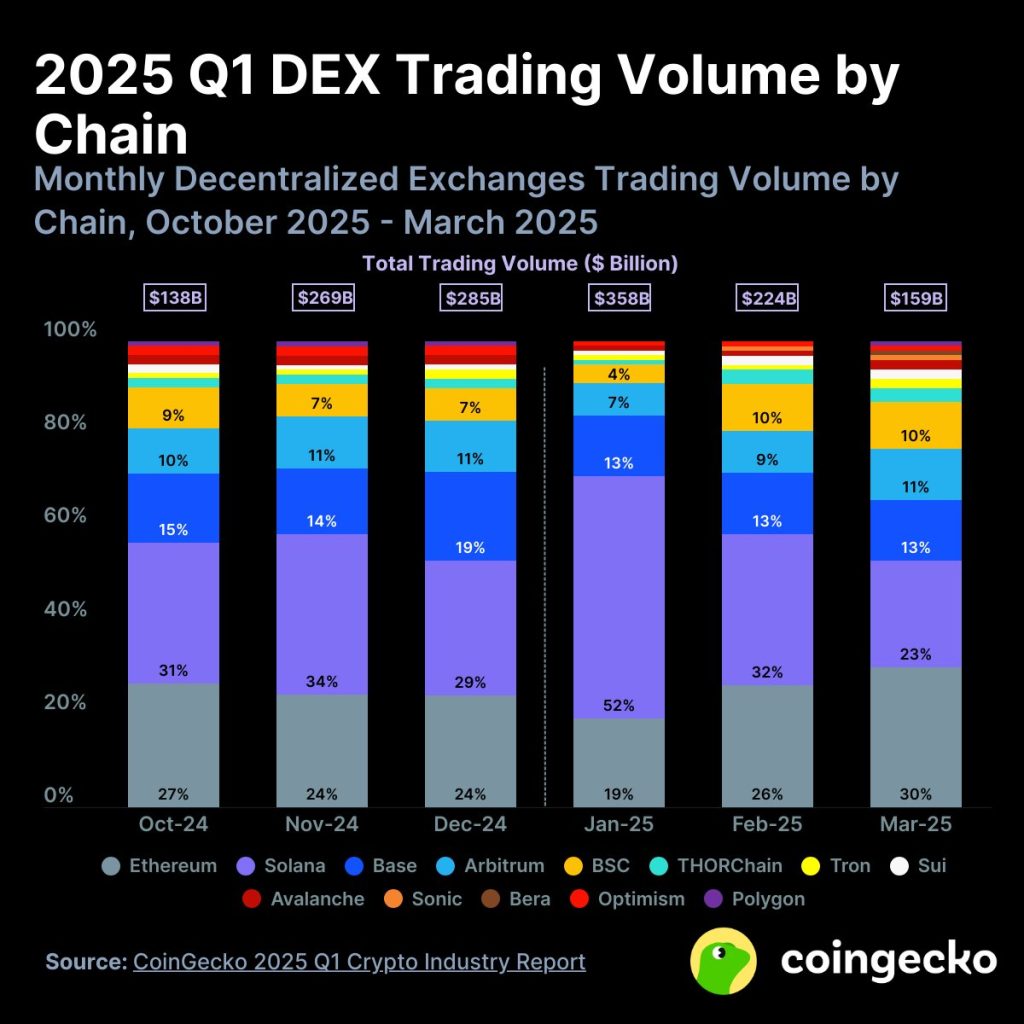

Despite the chaos, Solana-based DEXes managed to retain leadership, accounting for 39.6% of total decentralized exchange volume in Q1/2025, according to CoinGecko.

Bitcoin Becomes a Safe Haven as Risk Appetite Shrinks

While DeFi TVL dropped and altcoins suffered, Bitcoin emerged as a relative safe haven. Although BTC underperformed traditional assets like gold and U.S. Treasuries, making Q1 its worst in seven years, its dominance surged to 59.1%. This reflected investors rotating out of volatile tokens and back into the top digital asset during uncertain times.

Spot trading volumes on centralized exchanges also tumbled by 27.3% quarter-over-quarter, with total CEX volumes shrinking from $200 billion to $146 billion.

The crypto industry’s Q1 served as a harsh reminder: real value, not political slogans or speculative hype, is what sustains long-term growth.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/332876-defi-tvl-drops-48b-in-q1-amid-altcoin-crash/