On 11 November 2022, the bankruptcy “chapter 11” filing of crypto exchange FTX was submitted to the Federal District of Delaware.

The fall of one of the largest and most respected entities within the cryptocurrency landscape was a terrible event for the entire industry.

A few months later, the first report from affiliated debtors was announced, in which the focal points that caused the failure of FTX and crypto FTT are discussed and identified.

The fall of crypto exchange FTX

It all started when Changpeng Zhao, CEO of Binance, the world’s largest cryptocurrency exchange, made a tweet regarding his concerns about the future of FTT and the FTX company.

According to CZ, Binance had decided to liquidate its $500 million FTT position given the “recent revelations that have come to light.”

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

The tweet caused a wave of sales on the FTT market and bank-runs of withdrawals on the FTX crypto exchange, until the latter, on 8 November 2022 decided to halt all activity on the platform until the situation stabilized.

Situation that, as we know, did not normalize and indeed precipitated until, 3 days later, the company decided to declare bankruptcy and file for bankruptcy in the US federal courts.

This affair came as a shock to the entire community, which saw one of the largest crypto exchanges in terms of volume disappear within a week.

A great many users lost their digital assets, which were stuck in the proceedings of FTX’s bankruptcy.

A process is currently underway to liquidate the remaining assets within Sam Bankman Fried’s former company, so that what remains can be returned to the debtors, in proportion to what was on the exchange and its subsidiaries before the escalation of the events.

It is worth mentioning once again how important it is to be aware of self-custodial crypto practices, in order to always be the true owners of cryptocurrencies and always have private keys in hand to sign transactions.

However, it is imperative to have a good knowledge base to avoid making technical mistakes and losing all of your funds. Studying and knowing always prove to be the most useful skills in this sensitive financial sector.

Debtors’ report on the FTX bankruptcy

FTX Trading Ltd. and its affiliated debtors recently announced the release of their first report that identifies and makes clear the fallacy with which the previous FTX Group management team handled some critical areas.

These include problems with management and governance, finance and accounting, digital asset management, and information security and cybersecurity.

John J. Ray III, current chief executive officer of FTX as well as the person in charge of the crypto exchange’s bankruptcy proceedings, said:

“We are releasing the first report in the spirit of transparency that we promised since the beginning of the Chapter 11 process. In this report, we provide details on our findings that FTX Group failed to implement appropriate controls in areas that were critical for safeguarding cash and crypto assets.”

According to John J. Ray III, the previous individuals in charge of crypto exchange FTX and hedge fund Alameda Research, which include the names of Sam Bankman Fried, Gary Wang, and Nishad Singh, have failed to responsibly and adequately manage the company, showing little interest in establishing a way to oversee its accounting.

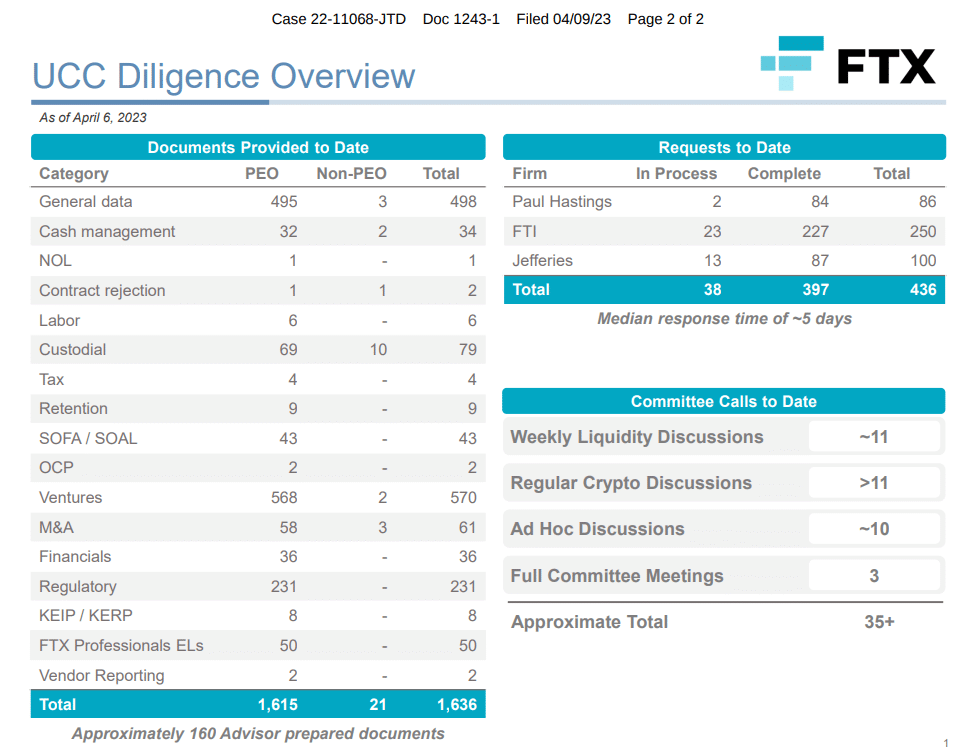

In the report that was carried out by the affiliated debtors, it is interesting to note the amount of data (over 1 million documents) that was taken into consideration to determine in which areas the former management failed and to quantify the amount of cash left within the company.

The report was compiled through the combined work of a team of legal, restructuring, forensic accounting, cybersecurity, computer engineering and cryptography experts.

Arguably, the case of the FTX crypto exchange bankruptcy is one of the situations in which bankruptcy trustees have the hardest time framing and recovering the assets available, given the inherent complexity of the crypto world and the anonymity that crypto is the master of, and given the large number of companies and subsidiaries that FTX set up over time, precisely to avoid the mess that was there coming to light.

Those who wish to delve deeper into what transpired within the report can find the information within the FTX Debtors Krool website, in the quick links section.

Source: https://en.cryptonomist.ch/2023/04/11/debtors-crypto-exchange-ftx/