- Crypto whale incurs $8.26 million unrealized loss, impacting top assets.

- Analyst Ai Yi reports asset decline.

- Potential volatility trigger in highly leveraged markets.

On-chain analyst Ai Yi reports that the ‘100% win rate whale’ now faces an unrealized loss of $8.26 million, marking its lowest asset level since October 14.

This marks the first major loss for a trader previously noted for consecutive profits, raising concerns about leveraged positions in BTC, ETH, SOL, and HYPE.

Whale’s $8.26 Million Loss Alters Market Sentiment

Renowned on-chain analyst Ai Yi has disclosed that the so-called “100% win rate whale” experienced a major setback. Known for large, leveraged trading, the whale’s asset value has hit its lowest point since October 14. The significant unrealized loss of $8.26 million follows 12 consecutive trades that wiped out previous gains. With a longstanding history of successful trades, the whale’s current situation marks a pivotal turn in market sentiment.

The asset downturn potential involves considerable positions in BTC, ETH, SOL, and HYPE. The whale’s leveraged long positions total approximately $370 million, with substantial investment in BTC at $113 million and SOL at $105 million. Market participants are now reassessing their risk exposure in light of this unexpected loss.

“The whale’s leveraged trading represents a bellwether for short-term sentiment; a painful unwind at this scale often triggers market discussion around risk, margin management, and systemic liquidity risk.” — Ai Yi, On-Chain Analyst (Binance Square)

On-Chain Analysis Underscores High-Leverage Trading Risks

Did you know? The largest recorded whale loss since October 11 has shifted market perspectives on the sustainability of high-leverage trading strategies.

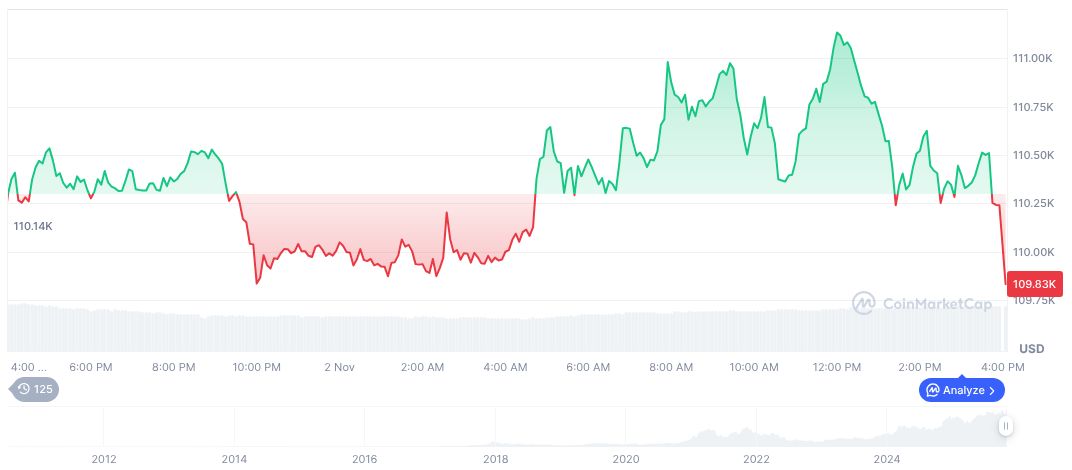

According to CoinMarketCap data, Bitcoin’s price stands at $107,979.10 with a market cap of $2.15 trillion and a circulating supply nearing 20 million. The 24-hour trading volume is $47.35 billion, down by 46.21%. Bitcoin’s price dropped by 2.26% in the past 24 hours, illustrating the broader market’s volatility on November 3, 2025.

The research team at Coincu indicates that market perceptions may change significantly, with a focus on smarter leverage use and risk management becoming more prevalent. Such events usually prompt discussions about systemic liquidity risks, necessitating adjustments in hedging strategies across cryptocurrency markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-whale-unrealized-loss-impact/