In recent crypto news, India secured the top spot in Chainalysis’ 2025 Global Crypto Adoption Index as the Asia-Pacific region cemented its position as the world’s primary hub for grassroots cryptocurrency activity.

The annual index preview revealed shifts in global crypto patterns between 2024 and 2025. APAC emerged as the fastest-growing region with 69% year-over-year growth in transaction volume, rising from $1.4 Trillion to $2.36 Trillion.

Latin America followed with 63% growth, while Sub-Saharan Africa posted 52% expansion.

APAC Maintains Dominance

In more crypto news, Chainalysis modified its methodology for 2025, removing retail DeFi as a standalone category after determining it represented niche behavior that skewed results.

The firm added institutional activity tracking for transactions exceeding $1 Million to reflect growing professional participation.

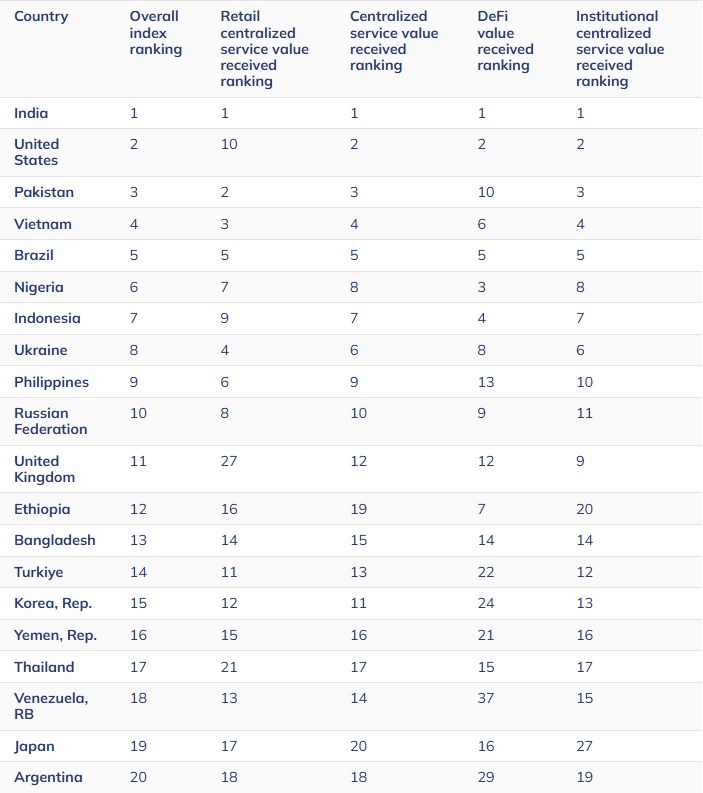

India topped all four sub-indices in the ranking system, which weighs cryptocurrency usage across centralized services, retail activity, DeFi protocols, and institutional flows.

The United States ranked second overall, followed by Pakistan in third position. Vietnam and Brazil rounded out the top five positions.

The index tracks 151 countries using web traffic patterns to estimate transaction volumes across different cryptocurrency services. Rankings factor in population size and purchasing power to create weighted scores from zero to one.

Crypto News: Eastern Europe Leads in Population-Adjusted Rankings

Population-adjusted metrics revealed different adoption leaders. Ukraine claimed the top position when crypto activity was measured per capita, followed by Moldova and Georgia. Jordan and Hong Kong completed the top five in population-adjusted rankings.

Eastern European countries showed high crypto engagement relative to population size.

Economic uncertainty, banking system distrust, and technical literacy drove adoption patterns across the region.

Cryptocurrency served as an alternative for wealth preservation and cross-border transactions in countries facing inflation or banking restrictions.

Vietnam ranked sixth in population-adjusted metrics after holding fourth place in absolute terms. The country’s position highlighted how different measurement approaches reveal varying adoption patterns across global markets.

Stablecoin Growth Accelerates Across Regions

Stablecoin transaction volume remained dominated by USDT and USDC between June 2024 and June 2025. USDT processed over $1 Trillion monthly, peaking at $1.14 Trillion in January 2025. USDC ranged from $1.24 Trillion to $3.29 Trillion in monthly volume.

Smaller stablecoins posted explosive growth rates. EURC expanded nearly 89% month-over-month on average, rising from $47 Million to $7.5 Billion in monthly volume. PYUSD grew from $783 million to $3.95 Billion during the same period.

Traditional financial institutions launched stablecoin integration products. Stripe, Mastercard, and Visa introduced spending mechanisms for stablecoins through conventional payment rails.

Platforms such as MetaMask, Kraken, and Crypto.com have added card-linked stablecoin payment options.

Bitcoin Remains Primary Fiat Gateway

Fiat on-ramping analysis showed Bitcoin’s continued dominance as an entry point. The cryptocurrency accounted for $4.6 Trillion in fiat inflows between July 2024 and June 2025, exceeding twice the volume of Layer 1 tokens at $3.8 Trillion.

Stablecoins ranked third with $1.3 Trillion in fiat purchases, while altcoins generated $540 Billion in volume. Other categories, including DeFi and memecoins, each attracted less than $300 Billion in fiat inflows.

The United States maintained its position as the largest fiat on-ramp with $4.2 Trillion in total volume. South Korea followed with $1 Trillion, while the European Union registered $500 billion in fiat cryptocurrency purchases.

Global Adoption Spans Income Brackets

Quarterly analysis across World Bank income brackets showed synchronized growth among high-, upper-middle-, and lower-middle-income country cohorts. The pattern suggested broad-based adoption rather than concentration in specific economic segments.

Low-income countries displayed more volatility with episodic surges followed by retracement. Policy changes, connectivity constraints, and conflict-related disruptions affected adoption patterns in these markets.

North America climbed to the second-highest regional position behind APAC. Regulatory developments, including the approval of spot bitcoin ETFs and clarity on the institutional framework, contributed to a 49% growth in the region.