- Stellar, Hedera, and Tezos were the biggest gainers in the past week.

- Popcat, dogwifhat, and Bonk ended the week as the biggest losers.

This week has been eventful for the cryptocurrency market, with significant price movements shaping the dynamics of the top 100 digital assets by market capitalization.

While some tokens soared to new heights, others struggled under market pressures.

Biggest winners

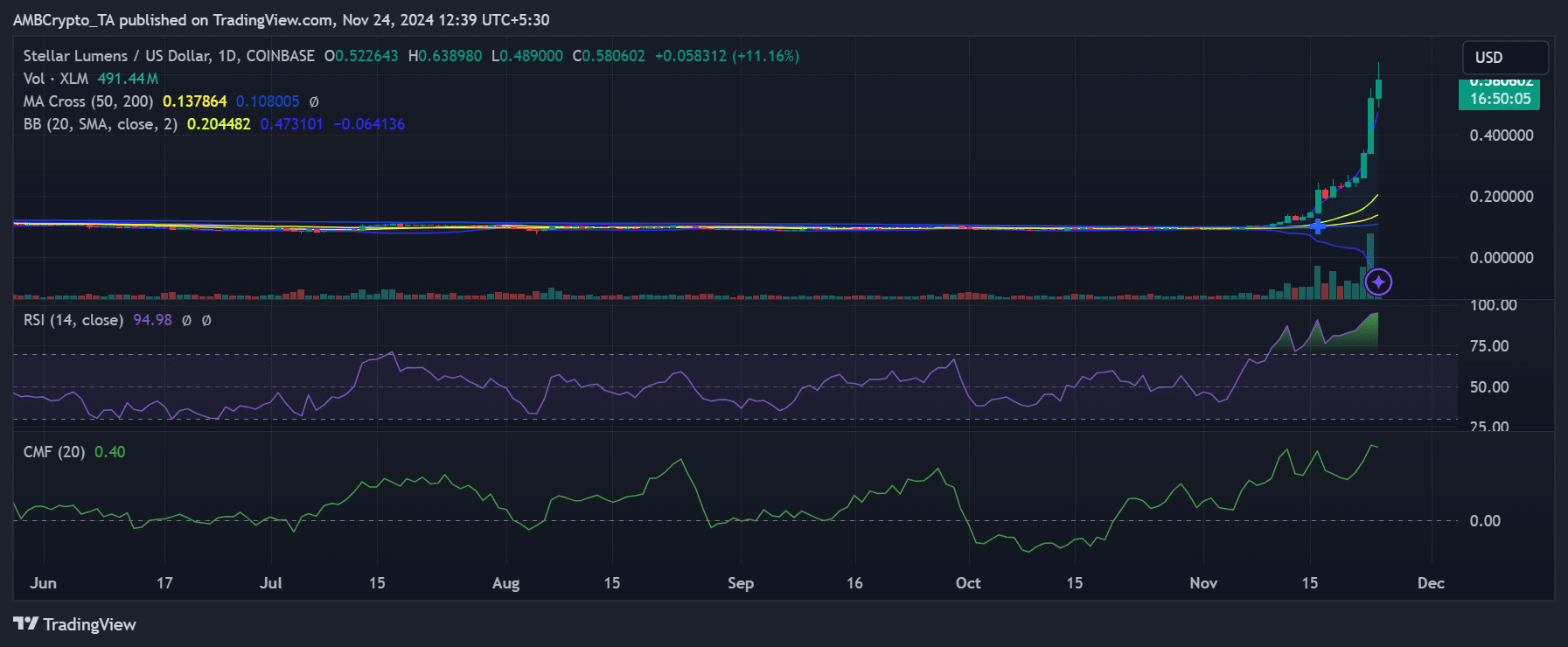

Stellar [XLM]

Stellar Lumens [XLM] has dominated the market this past week, emerging as the top-performing cryptocurrency with an incredible 190% surge.

Over the last seven days, XLM’s price action was marked by steady gains followed by rapid acceleration, particularly after crossing the psychological $0.30 mark.

However, it started the week at around $0.19 before gaining momentum. At the end of the week, it saw a 53.40% spike, which took its price to around $0.52.

Trading at $0.58 at press time, XLM has shown remarkable bullish momentum, driven by strong market sentiment and sustained buying activity.

Source: TradingView

The daily chart reveals a parabolic move, with XLM breaking multiple resistance levels. The 50-day and 200-day SMAs at $0.14 and $0.10 were decisively breached earlier this week, triggering a golden cross.

The RSI stands at 94.98, deep into overbought territory, suggesting the possibility of a short-term correction as traders lock in profits.

Meanwhile, the Chaikin Money Flow (CMF) indicator remained positive at 0.40, reflecting robust inflows of capital into XLM, which could sustain its bullish trajectory in the near term.

Hedera [HBAR]

Hedera Hashgraph [HBAR] has had a stellar performance over the past week, marking a remarkable 76% price increase, positioning it as the second-highest gainer in the crypto market.

A look at its price trend showed it started the week at around $0.08, but a 60.19% spike on 18th November took its price to around $0.14.

It witnessed uptrends and downtrends during the week but ended the week at around $0.15. HBAR was trading at $0.152 at press time, reflecting sustained bullish momentum.

However, its volume has declined by over 26% in the last 24 hours, with data showing it at $1.5 billion as of this writing. Its market capitalization was almost $5.8 billion as of this writing.

Tezos [XTZ]

Rounding up the top gainers in this category is Tezos [XTZ], making it its second week as a top gainer. According to data from CoinGecko, XTZ gained over 69% in the past week.

Its price trend showed it started the week with an over 8% decline at around $0.79. However, a spike of over 47% took its value to around $1.17 the next day.

Like HBAR, its price fluctuated subsequently but ended the week at around $1.15, after an over 2% increase.

As of this writing, it has seen another massive increase with an over 22% spike, and its price was at $1.4.

Its trading volume has spiked by over 63% in the last 24 hours and is now over $380 million. Its market capitalization is around $1.4 billion.

Top 1,000 gainers

Outside the top 100, this week’s top gainer, Big Dog Fink [BINK], surged by over 690%.

The second and third-largest gainers were Dolos The Bully [BULLY] and We Love T*ts [TITS], with over 401% and over 258% increases, respectively.

Biggest losers

Popcat [POPCAT]

Popcat [POPCAT] has faced significant selling pressure over the past seven days, emerging as the biggest loser in the market with an over 18% drop in value.

AMBCrypto’s analysis of its price trend showed it started the week positively with an over 9% increase, taking its price to around $1.9.

However, POPCAT saw sharp declines subsequently, ending the week at around $1.4. The price was trading at around $1.48 with a weak uptrend attempt, but it remained below critical price zones.

Its volume was around $128 million, with an over 26% decline in the last 24 hours. Also, its market capitalization was around $1.46 billion as of this writing.

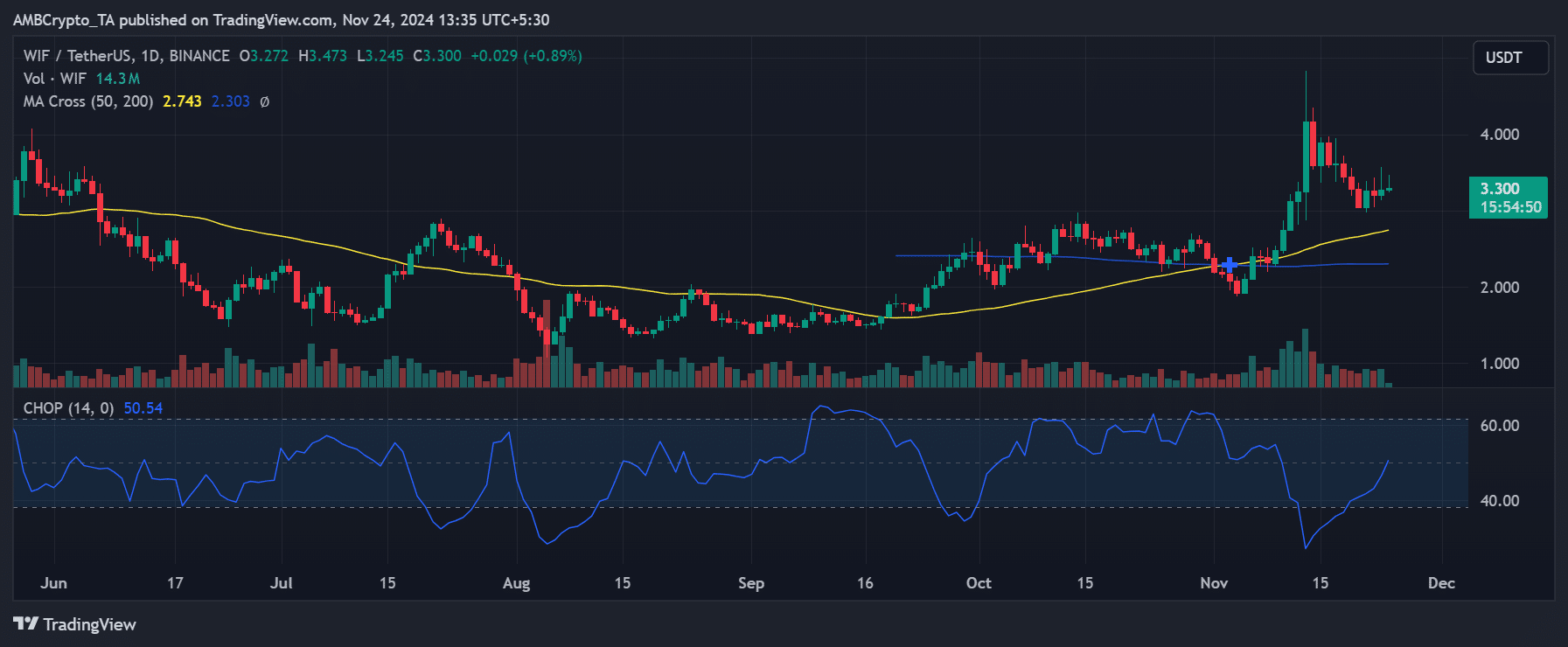

dogwifhat [WIF]

Dogwifhat [WIF] has encountered a turbulent week, recording a significant 14% decline over the past seven days, making it the second-largest loser in the market.

In the last seven days, WIF has failed to sustain above its critical psychological level of $3.50, triggering increased selling activity.

AMBCrypto’s look at its chart showed that its price was around $3.6 at the beginning of the week but had declined to around $3.2 by the week’s end.

Source: TradingView

Trading at $3.30, at the time of writing, the token struggled to maintain its foothold after a sharp correction from the recent high of $4.00 earlier in the month.

Also, The Choppiness Index [CHOP] reading of 50.54 highlighted consolidation, signaling that the token might remain range-bound in the short term.

If bearish sentiment persists, the price might test support at $3.00, with a potential slide toward the 50-day moving average. Conversely, a recovery above $3.50 could reignite bullish momentum.

As of this writing, its market capitalization is almost $3.3 billion, with an over 2% decline in the last 24 hours.

Bonk [BONK]

Bonk [BONK] rounded up the top losers, making it a memecoin affair. Data from CoinGecko showed that BONK declined by over 10% in the last seven days.

It started the week strong after an over 8% increase, which took its price to around $0.00005 — the highest in over six months.

However, it could not hold as it ended the week at around $0.00004 after significant fluctuations were observed.

As of this writing, it was trading around the $0.00004 price level. Its market cap has declined by over 5% in the last 24 hours and is around $3.56 billion as of this writing.

Top 1,000 losers

Outside the top 100, this week’s top loser was Shrub [SHRUB], with an over 61% decline.

The second and third-biggest losers were Shoggoth [SHOGGOTH] and Hasbulla’s Cat [BARSIK], with over 59% decline, respectively.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research (DYOR) before making investment decisions is best.

Source: https://ambcrypto.com/crypto-market-weekly-review-24-november/