- Top Gainers: MANTRA (+16%), Hyperliquid (+3%), Tether Gold (+2%).

- Top Losers: dogwifhat (-30%), Kaspa (-28.3%), VIRTUAL (-27%).

The crypto market displayed contrasting dynamics this week, with established tokens showing resilience while meme-themed assets faced significant selling pressure.

This week’s movements highlight the growing disparity between different market segments and the continued evolution of investor sentiment.

Biggest winners

MANTRA [OM]

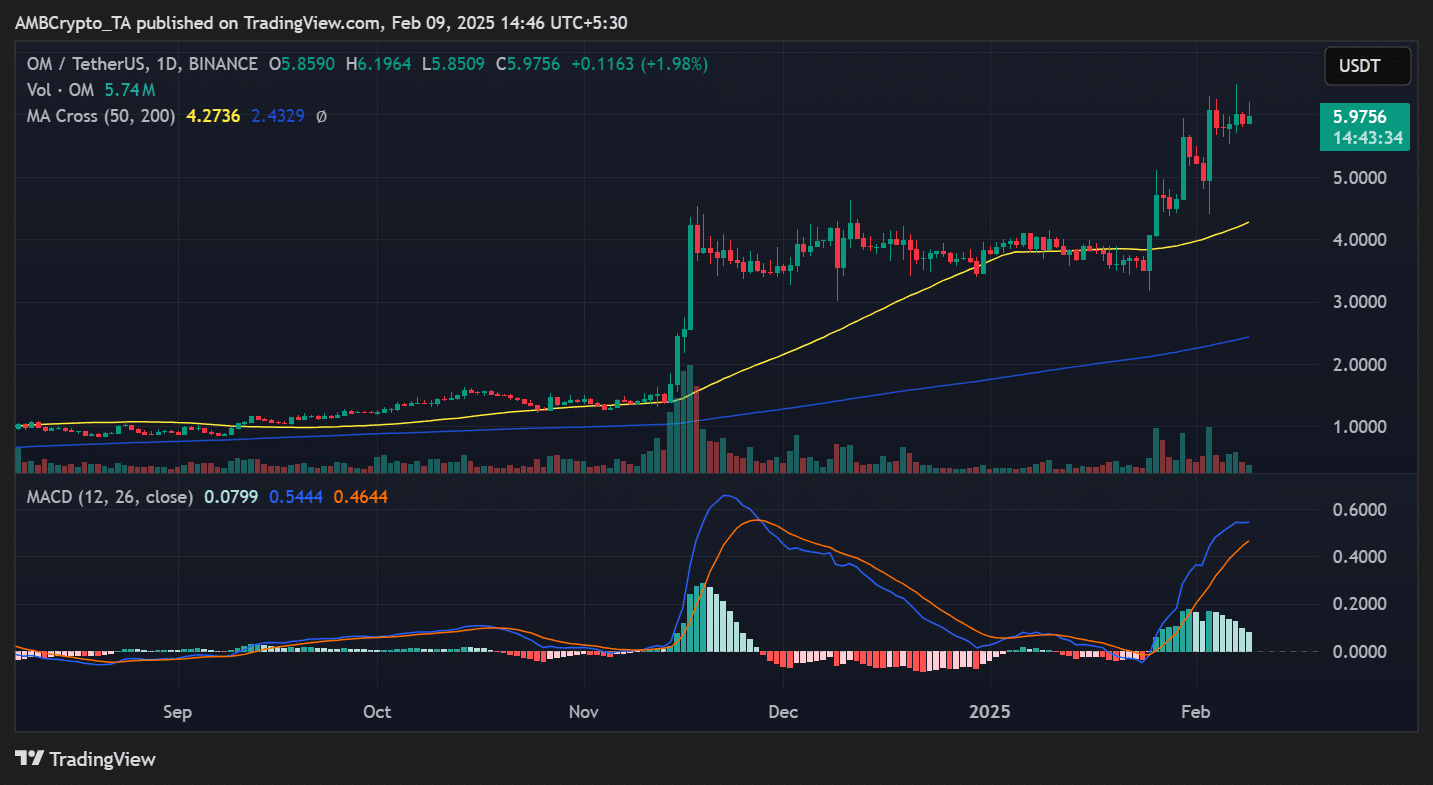

MANTRA [OM] continued its impressive run, securing the top spot for the second consecutive week with a 16% gain as prices climbed from $5.10 to $5.97.

The token’s sustained momentum demonstrated remarkable strength in a typically volatile market.

The week opened with OM finding support at $5.10 before staging a decisive breakout on the 4th of February that pushed prices above $5.75.

Following a brief consolidation phase, buyers remained in control, maintaining the token’s upward trajectory.

Trading volume has been particularly noteworthy, reaching 5.74M OM, suggesting strong institutional interest in the rally.

Source: TradingView

From a technical perspective, MANTRA continued to trade well above both its 50-day (4.2736) and 200-day (2.4329) moving averages, confirming the robust bullish trend.

The MACD indicator showed positive momentum with readings at 0.0799, while the divergence between the signal and MACD lines suggests the potential for further upside.

Today’s trading shows continued strength, with a 1.98% gain as the token consolidates near $5.97.

What’s particularly impressive is the token’s ability to maintain its upward momentum for two consecutive weeks, a rare feat in the crypto market.

The price action displays a series of higher lows and higher highs, indicating sustained buyer conviction.

While some consolidation might be expected after such an extended run, the strong volume profile and technical indicators suggest this rally could have further room to run.

The key support level to watch is $5.75, which should provide a foundation for any retracements.

Hyperliquid [HYPE]

Hyperliquid [HYPE] has secured its position as this week’s second-best performer, climbing from $22.50 to $23.75 for a modest 3% gain. The token’s price action showcases a measured recovery following early-week volatility.

The week’s trading began with HYPE finding its footing at $22.50 before initiating a steady climb that pushed prices toward $27.00.

The 5th of February saw particularly active trading, with the token testing higher levels before encountering selling pressure. While profit-taking pulled prices back from these highs, the overall trend remained constructive.

Recent price action shows HYPE consolidating above $23.50, with buyers emerging during dips to support the token’s upward trajectory.

The methodical nature of the recovery, characterized by higher lows and sustained buying interest during pullbacks, suggests the potential for further gains. However, the $24.00 level remains a key resistance zone to watch.

Tether Gold [XAUt]

Tether Gold (XAUT) has posted a steady performance this week, rising from $2,800 to $2,865, securing a 2% gain amid increasing interest in digital gold tokens.

The token’s price action mirrors physical gold’s stability while offering blockchain efficiency. Though a commodity-backed stablecoin, it saw a better price movement than most of the other digital assets.

The week opened with XAUT finding support at $2,775 before initiating a methodical climb through the $2,800 level.

A notable surge on the 5th of February pushed prices above $2,850, establishing a new support zone.

The advance demonstrated particular strength on the 7th of February, briefly touching $2,900 before settling at current levels.

Recent trading showsed XAUT consolidating around $2,865, with remarkably tight price action suggesting strong market equilibrium.

The measured pace of the advance, coupled with consistent trading volumes, indicated genuine institutional interest rather than speculative activity.

While the token maintained its upward bias, the $2,900 level represented immediate resistance for further gains.

Top 1,000 gainers

Beyond the top performers, the broader crypto market showed significant activity, with Fartboy [FARTBOY] leading the top 1,000 tokens with a 386% surge.

Following closely, SwarmNode.ai [SNAI] and ANDY BSC [ANDY] posted impressive gains of 249% and 159%, respectively.

Biggest losers

dogwifhat [WIF]

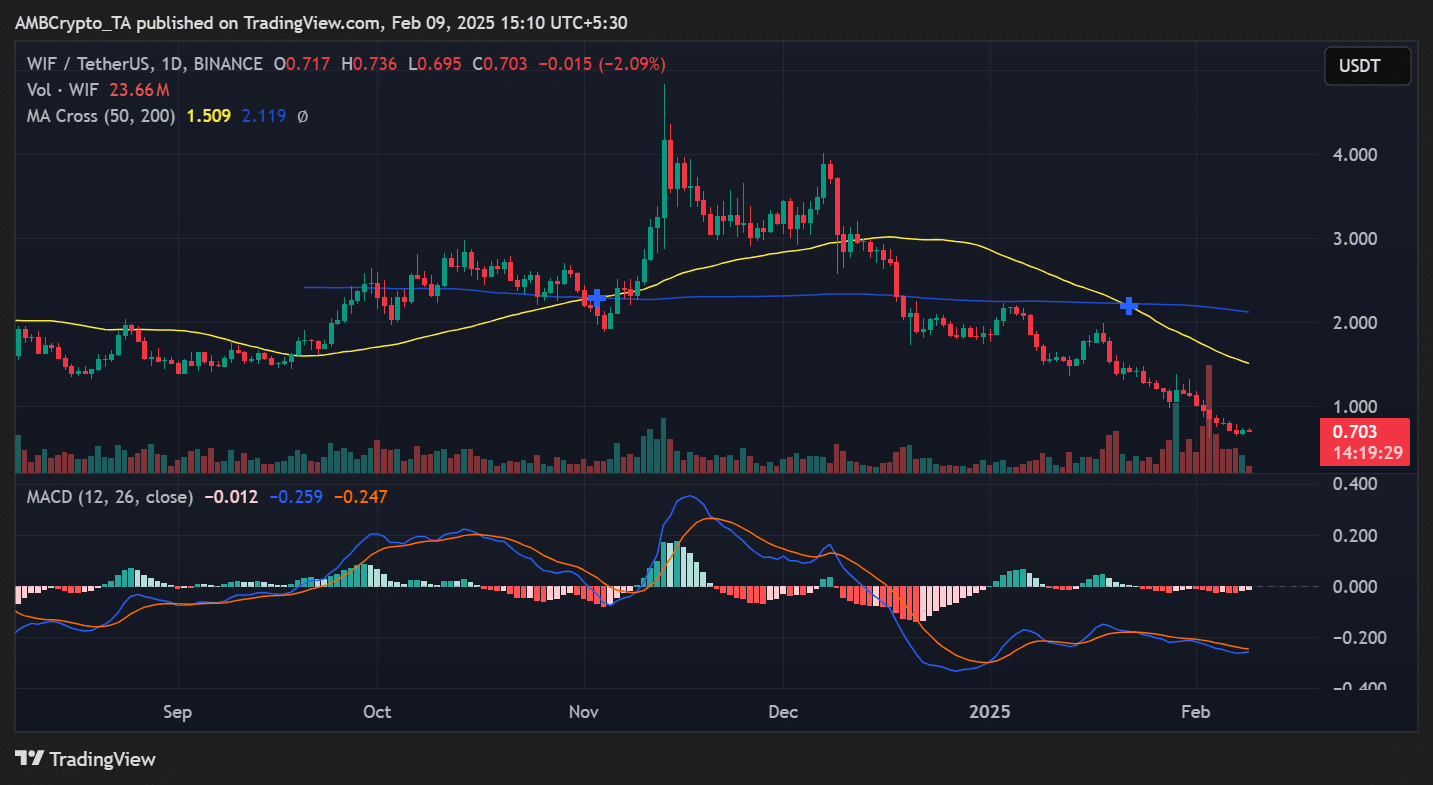

On the opposite end of the spectrum, dogwifhat faced significant headwinds, emerging as this week’s biggest loser. Its value declined from $1.05 to $0.703, recording a steep 30% decline.

The token’s descent marks the second consecutive week that a memecoin has led the market’s losses, following Pudgy Penguins’ [PENGU] dramatic fall last week.

Trading metrics painted a concerning picture, with volume surging to 23.66M WIF amid accelerated selling pressure.

The token traded well below both its 50-day (1.509) and 200-day (2.119) moving averages at press time, indicating significant technical damage.

The MACD remained in negative territory at -0.012, with diverging signal lines suggesting continued downward momentum.

Source: TradingView

The week began with immediate selling pressure as WIF broke below its crucial support at $1.00.

Each attempted recovery throughout the week met fresh waves of selling, creating a pattern of lower highs and lower lows.

A brief consolidation around $0.80 midweek proved temporary, as sellers pushed prices to current levels near $0.70.

Today’s trading shows WIF down another 2.09%, struggling to find support even at these depressed levels.

The technical picture appears particularly concerning, with the death cross formation (50-day MA crossing below 200-day MA) suggesting potential for further weakness.

While oversold conditions might typically spark a technical bounce, the deteriorating market structure and increasing volume on down moves suggest caution.

The token needs to reclaim and hold above $0.80 to begin repairing its technical damage, though the immediate outlook remains challenging without a significant shift in market sentiment.

Kaspa [KAS]

Kaspa [KAS] has endured a punishing week, dropping from $0.122 to $0.087, recording a substantial 28.3% decline. The token’s downward trajectory reflected increasing selling pressure and deteriorating market confidence.

The week opened with immediate weakness as KAS plunged from $0.122, briefly finding support near $0.110 before another wave of selling pushed prices lower.

A series of failed recovery attempts around the $0.100 level preceded further declines, with each bounce meeting renewed selling pressure.

Recent trading showed the token struggling to maintain ground above $0.087, with diminishing volume during relief rallies suggesting waning buyer interest.

While the current price level might typically attract bargain hunters, the persistent selling pressure and lack of meaningful support zones paint a concerning picture.

The succession of lower highs and lower lows indicates the downward momentum could continue unless a significant catalyst emerges.

Virtuals Protocol [VIRTUAL]

Virtuals Protocol [VIRTUAL] has extended its losses for a second consecutive week, falling from $1.60 to $1.20, marking another sharp 27% decline.

The token’s continued weakness suggested deepening market concerns following last week’s significant drop.

The week opened with immediate selling pressure as VIRTUAL struggled to hold $1.60, quickly giving way to a cascade of selling that drove prices toward $1.40.

A brief consolidation phase around $1.50 on the 4th of February proved temporary, as sellers remained firmly in control of the market direction.

Recent trading showed the token attempting to stabilize around $1.20, though each recovery attempt faces fresh selling pressure.

The consecutive weekly declines have significantly damaged crypto market confidence, with declining volume during bounce attempts suggesting limited buyer interest.

While oversold conditions likely sparked a technical recovery, the persistent weakness across two weeks indicated potential for further downside unless substantial buying interest emerges.

Top 1,000 losers

In the broader market context, Elon4AfD [ELON4AFD] led the declines among the top 1,000 tokens with a 66% drop, followed by FLAY [FLAY] and AkumaInu [AKUMA], which recorded 65% and 60% losses, respectively.

Conclusion

Here’s the weekly recap of the crypto market’s biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research (DYOR) before making investment decisions is best.

Source: https://ambcrypto.com/crypto-market-weekly-review-9-february/