- Fed discussions and $19.1 billion liquidations affect crypto markets.

- BTC drops from $117,000 to $102,000 in one day.

- Community debates leverage policies, no official proposals yet.

On October 11, the cryptocurrency market experienced severe liquidations affecting major assets like BTC and ETH, triggered by macroeconomic uncertainties and significant policy shifts impacting over $19.1 billion.

This financial shock underscores the fragility of leveraged positions and raises concerns about future volatility in digital asset markets amid upcoming macroeconomic data and policy decisions.

Crypto Liquidations Surge to $19.1 Billion Amid Fed Talks

The sudden liquidation event on October 11, 2025, marks an unprecedented level of historic liquidations in the crypto market, totaling $19.1 billion and affecting 1.6 million accounts. Federal Reserve announcements and discussions around economic policies sparked uncertainty, resulting in cascading sell-offs across major cryptocurrencies like BTC and ETH.

As the market digests these unforeseen financial shocks, notable assets, including Bitcoin, experienced drastic price reductions, prompting reevaluation among traders and investors regarding economic outlooks. The landscape of digital assets now faces potential further volatility, influenced by macroeconomic data releases scheduled for the week.

While key figures from the Federal Reserve and other institutions have not directly commented on the digital asset impact, their focus on inflation and orderly markets remains central in navigating upcoming economic challenges. The community has increased dialogue over leverage management, trailing the news without any formalized proposals emerging yet.

Bitcoin’s Price Decline and Market Analysis

Did you know? The crypto market liquidation on October 11, 2025, exceeded those witnessed during the “5/19 crash” in 2021, setting a new record in both the number and value of liquidated positions.

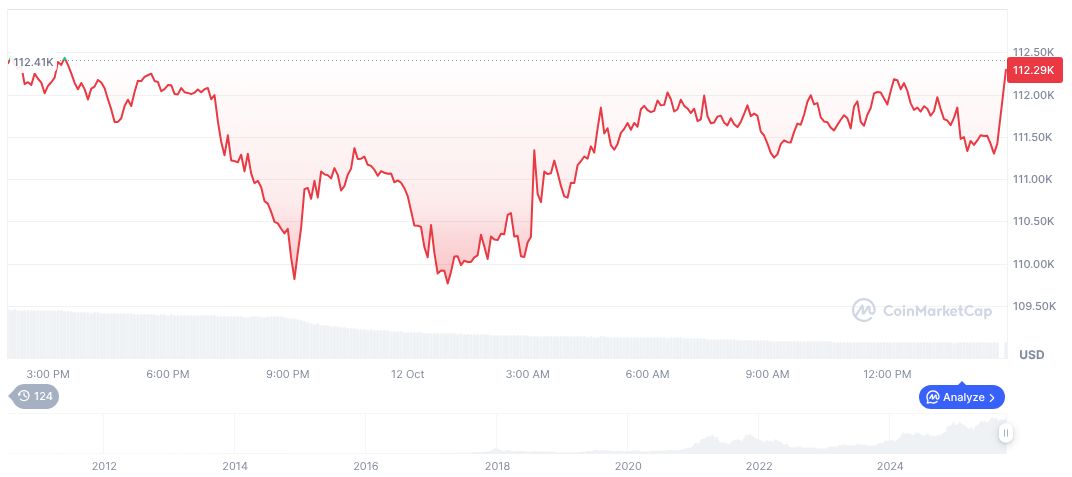

Bitcoin (BTC) is seeing a current price of $112,940.79 with a market dominance of 59.68%. Its market cap amounts to formatNumber(2251.23 billion) while recent figures show a 24-hour trading volume at $70.48 billion. Over the past week, BTC’s price has declined by 8.17%, according to CoinMarketCap data.

Insights from Coincu research suggest that the confluence of macroeconomic pressures and leveraged derivative positions contributed to the historic scale of crypto liquidations. Monitoring Fed communications and potential regulatory responses provides crucial insights into managing market stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-market-liquidations-fed-policy/