- QCP Capital reports on crypto market’s stability amid U.S. economic shifts.

- BTC holds above $111,000 despite ETF outflows.

- Strong demand for ETH options indicates resilience.

QCP Capital released its latest report on September 8, highlighting the continuing sideways action in cryptocurrencies despite recent stock and gold rallies following weaker U.S. payroll data.

This highlights the crypto market’s cautious stance amid economic uncertainties, with independent movements reflecting divergent sentiment from traditional equities and precious metals.

Crypto Market Stability Amid Fed Rate-Cut Expectations

Investors’ confidence in Bitcoin and Ethereum appears intact as both assets continue their sideways trajectory. QCP’s analysis notes a trend towards stability, with no sharp reactions expected until the next batch of inflation data surfaces. Elevated demand for downside protection through put options emphasizes the nervousness within the market awaiting the potential of an unexpected rise in inflation.

While observations highlight a mature response within the crypto market, concerns linger about economic data and monetary policy’s influence. QCP Capital suggests that a richer understanding of the market’s stabilization and risks remains pivotal for guiding future strategies in the sector.

“The lack of reaction to bullish headlines and strong institutional flows may reflect a maturing rally and potential late-cycle market behavior.”

Bitcoin and Ethereum Defy Volatility With Market Maturity

Did you know? Past Federal Reserve actions have often resulted in volatile market cycles, yet this time, cryptocurrencies exhibit a unique detachment from traditional asset movements, hinting at broader market maturation.

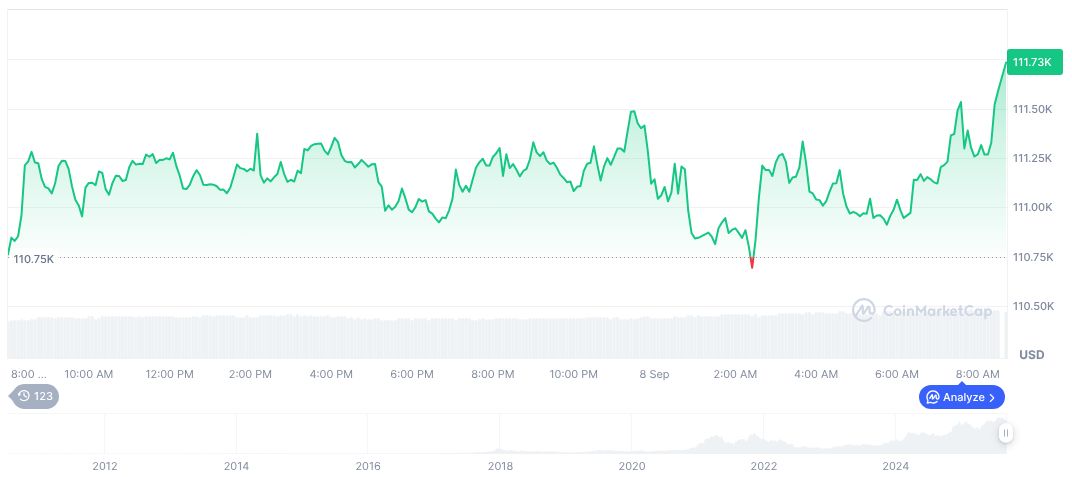

Bitcoin (BTC) trades near $111,794.56 with a market cap of $2.23 trillion, representing 57.65% market dominance with $31.11 billion 24-hour trading volume. Despite recent inactivity, BTC has held steady, recovering modestly with a 2.93% weekly gain. Down 4.55% monthly, Bitcoin maintains crowded support amid market fluctuations, as reported by CoinMarketCap.

According to Coincu research, cryptocurrencies are likely to remain calm unless upcoming inflation data significantly alters market expectations. While there are no imminent threats of trade policy escalation from the U.S., sentiment relies heavily on overcoming institutional hesitance, allowing regulatory clarity to drive the next growth phase.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-stability-fed-rate-cut/