The cryptocurrency market has endured an aggressive early-2026 sell-off, wiping out approximately $720 billion in just over five weeks.

From January 1 to Friday, February 6, the total crypto market capitalization slid from $2.97 trillion to $2.25 trillion, implying $20 billion average daily losses as selling pressure remained relentless across major digital assets.

By February 6, the crypto market had shed $1 trillion from its valuation since the January 14 annual peak, for an even greater average daily loss of almost $44 billion, per data calculated by Finbold from TradingView.

Specifically, after beginning the year with a market capitalization of $2.97 trillion, digital assets climbed to $3.25 trillion within two weeks and then plummeted to the Friday press time level at $2.25 trillion.

The losses were even larger in the night between February 5 and February 6, as the total valuation of cryptocurrencies hit $2.14 trillion before entering an upward correction that may or may not prove a ‘dead cat bounce.’

Bitcoin leads the 2026 crypto market bloodbath

As could be expected from the biggest asset in its class, Bitcoin (BTC) accounts for the largest part of the downturn. BTC’s own market cap crashed by $610 billion within 23 days, from $1.94 trillion to $1.33 trillion, for an average daily fall of $26.5 billion.

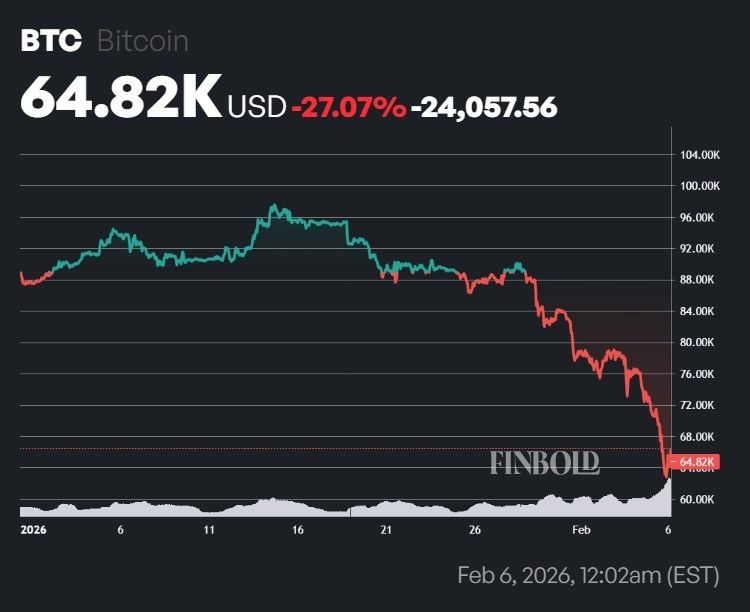

Bitcoin’s price is down 27.07% year-to-date (YTD) and, at press time, the world’s premier cryptocurrency is changing hands at $64,844.

Examining performance since BTC – and the cryptocurrency market by extension – hit a new all-time high (ATH) in October 2025 revealed an even greater, though slower-paced fall.

Indeed, in approximately four months, the valuation of digital assets plummeted by approximately $2 trillion from $4.23 trillion. Bitcoin’s market cap fell more than $1.1 trillion from $2.5 trillion.

Why the crypto market is capitulating in 2026

At press time on February 6, the bloodbath appears – as strange as it may sound – like ‘business as usual’ for the cryptocurrency market. Since gaining prominence more than a decade ago, digital assets have been moving between bullish and bearish cycles, with each boom bringing in new ATHs and each downturn leading to higher lows.

For Bitcoin in particular, some analysts, such as the on-chain expert Ali Martinez, believe investors are now facing a standard part of BTC’s price journey – the 364-day path to cycle lows – and that the digital asset will bottom in October no lower than $38,000.

Though the cause appears to be intrinsically tied to the standard workings of the market, the trigger was, based on the available information, mostly external.

In early 2026, various systemic risks have been mounting.

Traders are slowly losing confidence that the artificial intelligence (AI) bubble will avoid bursting, commodities like Gold and Silver have risen so rapidly that a correction was all but inevitable, cryptocurrencies have been deflating for months, and geopolitical tensions remain sky-high.

Featured image via Shutterstock

Source: https://finbold.com/crypto-market-sheds-20-billion-per-day-on-average-since-start-of-2026/