- The total financing decrease by 23.5% from July signals a cautious approach from investors amid market uncertainty.

- Large investments in key players like Galaxy Digital and Bullish Exchange demonstrate sustained confidence in regulated digital assets.

- These financings included $1.4 billion in project financing and a $1.11 billion IPO respectively, underscoring ongoing institutional interest.

In August 2025, the crypto market experienced a downturn in venture funding, with 79 financing events totaling $898 million, a 23.5% decrease from the previous month, according to RootData.

This contraction could signal a shift in investment strategy, highlighting increased focus on infrastructure and compliance as key market priorities.

Key Developments, Impact, and Reactions

The crypto market’s funding landscape in August saw IVIX, a compliance platform, lead with a $60 million Series B round. Rain, a crypto card issuer, followed with $58 million in Series B, while Portal To Bitcoin secured $50 million for Bitcoin protocol advancements. These figures signify shifts in investor focus toward compliance and infrastructure projects, even as overall funding levels decreased.

These financings included $1.4 billion in project financing and a $1.11 billion IPO respectively, underscoring ongoing institutional interest.

“Institutional adoption is pivotal, and our strategic mergers are designed to meet that sustained appetite.” — Mike Novogratz, CEO, Galaxy Digital

Bitcoin Stabilizes While Investors Eye Regulatory Compliance

Did you know? The 23.5% drop in funding during August 2025 mirrors similar periods in 2022 and 2023, typically followed by innovation cycles in blockchain infrastructure and compliance.

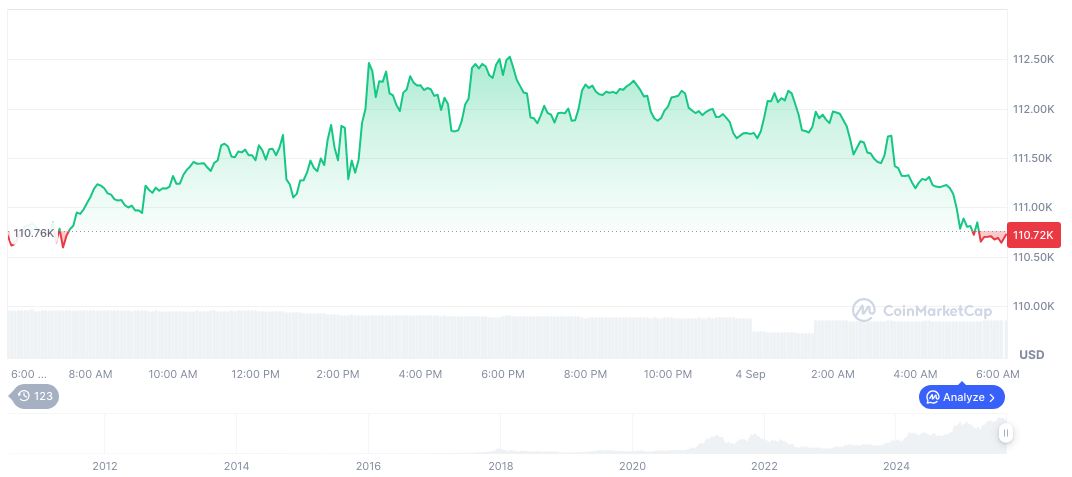

Bitcoin (BTC) trades at $109,433.25, with a market cap of $2.18 trillion and a 24-hour volume of $57.34 billion as reported by CoinMarketCap. Over the past 90 days, its price increased by 4.20%, demonstrating relative stability in a volatile market. Its circulating supply stands at 19.92 million, nearing its max supply of 21 million.

Insights from the Coincu research team suggest that while short-term contractions reflect investor caution, historically, these periods often catalyze advancements in compliant and technological solutions within the sector. Focus on regulated projects indicates a strategic reallocation toward sustainability and resilience in cryptocurrency investments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-market-funding-drop-august-2025/